Salmar improves for fourth consecutive quarter

Salmar - co-owner of Scottish Sea Farms - has delivered improvement in underlying operations and reduced costs for the fourth quarter in a row. However, high levels of treatment in central Norway and rising pressure in northern Norway will affect the cost side ahead, the company says in its report for the fourth quarter of 2017.

Salmar's operational EBIT (operating profit) in the period came to NOK 707.2 million (£64.9m), up from NOK 557m (£51.1m) in Q4 2016. The improvement is largely attributable to a higher harvested volume, combined with improved underlying operations and enhanced biological control, says Salmar.

According to the report, results for Scottish Sea Farms were "satisfactory". Salmar owns 50% of SSF, with the other half being owned by another large Norwegian salmon farmer, Lerøy.

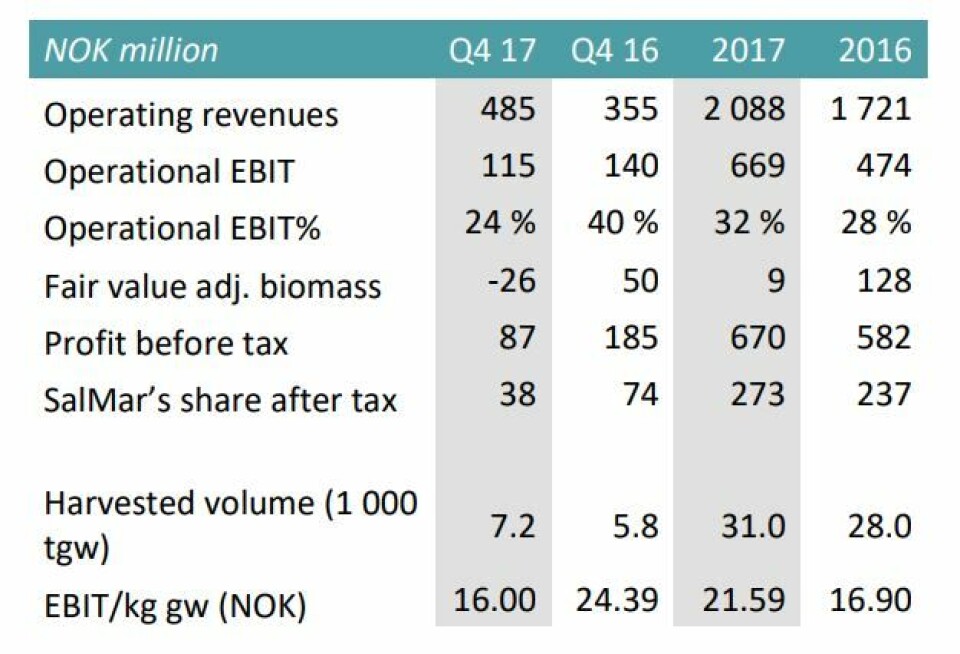

Salmar says SSF generated gross operating revenues of NOK 485 million (£44.5m) in the fourth quarter 2017, down from NOK 631.9m (£58m) in the third quarter, but up from NOK 354.6m (£32.5m) in the fourth quarter 2016.

'Satisfactory results'

Overall, SSF harvested around 7,200 tonnes of fish in the quarter, 2,200 tonnes less than in the previous quarter, but 1,400 tonnes more than in the corresponding period the year before. SalMar’s share of the harvested volume came to 3,600 tonnes.

"The company posted satisfactory results in the fourth quarter 2017," says the report. "Although underlying operations were good in the quarter, Scottish Sea Farms was once again obliged to deal with biological challenges relating to gill health at certain sites in mainland Scotland and Shetland.

"These gill health issues had a negative impact on the quarterly results, since it was necessary to harvest fish prematurely at a low weight. All the fish affected by these issues were harvested out during the quarter.

26,000 tonnes in 2018

"The company had a contract rate of 44 per cent in the quarter. EBIT per kg gutted weight came to NOK 16.00 (£1.47) in the fourth quarter 2017, compared with NOK 19.46 per kg (£1.79) in the previous quarter and NOK 24.39 per kg (£2.24)in the fourth quarter 2016. The company expects to harvest around 26,000 tonnes in 2018."

SSF recently revealed that it's spending with Scottish suppliers topped £100m last year. It is also investing in a new hatchery at Barcaldine, Oban.

Overall, Salmar reports:

- Total operating income was NOK 2.8 billion (£257m) in the quarter, up from NOK 2.5 billion in the corresponding period the year before. Harvest volume was 39,900 tonnes, against 26,500 tonnes in the fourth quarter of 2016.

- Operating profit per kilo was NOK 17.70 (£1.62), down from NOK 20.98 per kilo in the fourth quarter of 2016.

- The average spot price has fallen by NOK 17.74 per kilo over the same period.

In the report, chief executive Trond Williksen says: "High harvest volumes, biological recovery and efficient operations have helped SalMar deliver a strong financial result again. The improvement in underlying operations for the fourth quarter in a row is a result of investments in competence and capacity over time. This will be continued."

Growth in production volumes

He further states that Salmar wishes to continue the growth in its production volumes, and says the company is actively work along several axes to realise this.

In Salmar's Central Norway region, positive biological developments continued.

"Still lower lice levels contributed to reduced costs, a development expected to continue in the first quarter of 2018. The good development is the result of targeted efforts to strengthen preparedness, capacity and knowledge related to the management of biological challenges. Despite the positive development, the company will continue to maintain high levels of treatment. This will affect the level of costs also in the coming quarters," the company writes.

In Northern Norway, increased lice numbers in certain areas of the region had a negative impact on the region’s costs. This applies particularly to fish transferred to sea farms in the autumn of 2016, where increased delousing activity has increased costs and will continue to do so in coming quarters.

"Salmar is well equipped to handle the situation in the segment in the future," they said.