Good growth and fish health for Scottish Sea Farms

Scottish Sea Farms had good growth and biological performance in the first quarter of this year, co-owner Lerøy said in its Q1 2020 report today.

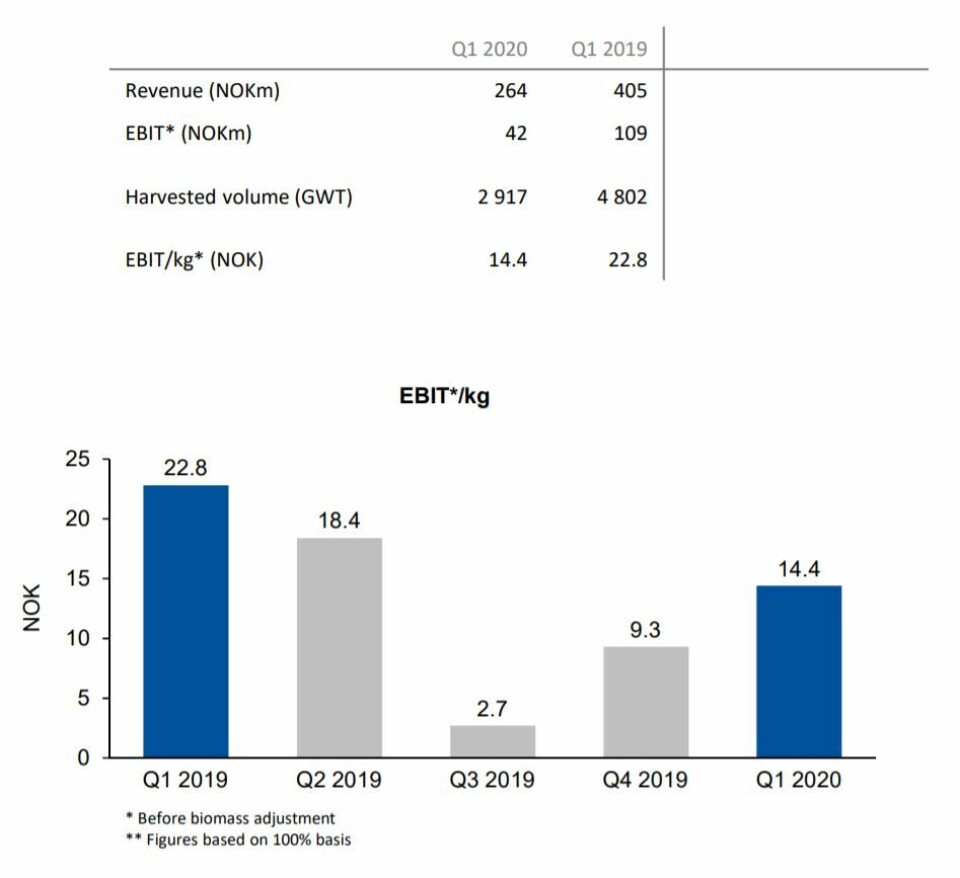

SSF, Scotland’s third-largest salmon farmer by volume, had a lower harvest than in Q1 2019 due to biological challenges in the second half of last year. This led to lower revenue and operating profit.

The company, owned equally by Lerøy and fellow Norwegian salmon farmer SalMar, harvested 14,400 gutted weight tonnes in Q1 compared to 22,800 gwt in Q1 2019.

Bigger smolts

Revenue was NOK 264 million (Q1 2019: 405) and EBIT was NOK 42m (109). EBIT per kilo was NOK 14.4 (22.8).

SSF transferred 3.8 million smolts with an average weight of 156 grams to sea. These are larger, more robust smolts than previously set out.

Harvest guidance for 2020 remains at 26,000 gwt, with growth potential in 2021.

Lerøy earnings up

Overall, Lerøy was able to benefit from high spot prices in the beginning of the first quarter. It said the second quarter is likely to be more affected by the impacts of Covid-19 on sales, but at the same time the company sees signs that the food service market is probably gently improving.

Lerøy Seafood Group (LSG), which includes wild-caught fish as well as farmed salmon and trout, achieved group-level sales of NOK 5.31 billion in the first quarter of 2020, compared with NOK 4.75bn in the same period in 2019.

Operating profit (EBIT) before value adjustments related to biological assets at group level was NOK 816m (Q1 2019: NOK 691m).

Bigger harvest

The aquaculture segment had revenues of NOK 2.42bn (1.98 bn) and EBIT before value adjustments related to biological assets for the aquaculture segment was NOK 562 million (510m).

Lerøy harvested 39,000 gwt of salmon and trout (32,000). The contract share was 38%.

Lerøy Aurora (north Norway) delivered an EBIT / kg of NOK 16.6, Lerøy Midt (central Norway) NOK 18.4 and Lerøy Sjøtroll (southern Norway) NOK 9.4 / kg.

In total, EBIT / kg in the segment is down from NOK 15.8 in the first quarter of 2019 to NOK 14.3 Q1 2020.

Earnings in both the aquaculture and wild-catch segments were higher than in the same period last year, while earnings in value-added products and sales were lower.

Winter wounds

“Gradually through the first quarter of 2020 and into the second quarter, operations were significantly affected by the Covid-19 pandemic,” said chief executive Henning Beltestad.

At the beginning of the quarter spot prices for salmon were high, but weakened throughout the quarter, partly as a result of reduced demand related to the restrictions imposed in connection with the Covid-19 pandemic.

“In addition, price attainment was also negatively affected by more winter wounds than normal on the fish,” said Beltestad.

The Group had higher ex-cage costs in Q1 compared to the same period last year, but Beltestad says falling costs are expected in the second half of 2020.

Proud of employees

“I am very proud of the Group’s employees, who have found constructive solutions and displayed a wonderful determination, working extremely hard to keep the Group’s value chain open and ensure deliveries to our customers,” said Beltestad.

In the Q1 report, the company’s directors said they still expect good underlying demand growth in the years to come.

“The management and the board do not have the competence to assess how long the Covid-19 situation will be but believe there is reason to assume that demand will eventually return to historical level and grow from there.

Q2 warning

“It's early to say, but it seems the HoReCa (Hotels, Restaurants, Catering) market is gradually reopening. The Board emphasises that the uncertainty associated with the assessment of future developments is considerably greater than normal, but the expectation today is that earnings in the second quarter of 2020 will be sharply reduced from what one would normally expect.

“The Board points out that the total result for the year will depend on the duration of the Covid-19 restrictions.”