Scottish Sea Farms’ earnings take hit in Q4

Scottish Sea Farms’ operating profit in the last quarter of 2019 fell by more than two thirds compared to the same period in 2018, co-owner Lerøy said in its Q4 2019 report today.

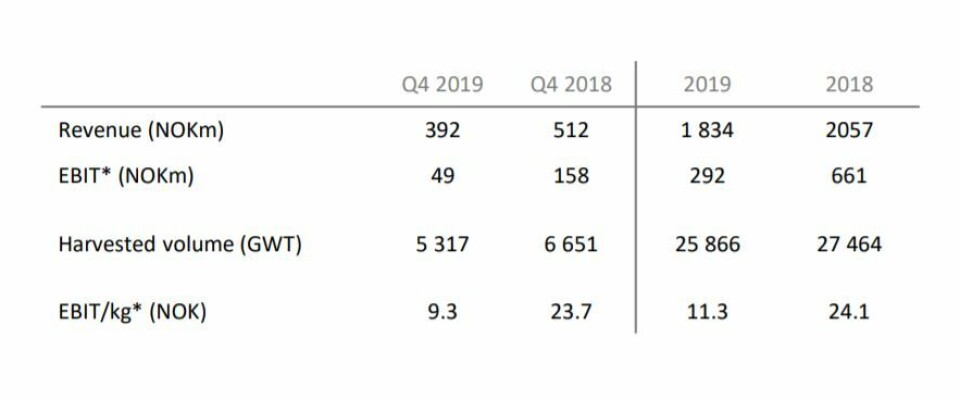

EBIT dropped from NOK 158 million in Q4 2018 to NOK 49m (£4.035m) on revenue of NOK 392m (Q4 2018: 512m).

Scottish Sea Farms harvested 5,317 gutted weight tonnes of salmon in Q4 2019, (6,651 gwt) and EBIT/kg was NOK 9.3 (NOK 23.7).

Gill disease

According to Lerøy, which jointly owns SSF with fellow Norwegian salmon farmer SalMar, SSF’s harvest volume and ex-cage costs in the quarter were impacted by challenges earlier in the year in Shetland and the mainland.

SSF has previously reported that it encountered problems with gill disease in the second half of 2019 which forced it to cut its harvest guidance by 3,000 tonnes.

Costs are expected to decline quarter on quarter into Q1 2020, and improvements are expected now that SSF’s new recirculating aquaculture system facility at Barcaldine, near Oban has begun delivering larger, more robust smolts to sea sites.

Growth potential

SSF harvest guidance for 2020 is 26,000 gwt, but there is potential for significant growth in 2021, said Lerøy.

The Scottish operation’s contribution to Lerøy’s coffers in Q4 2019 was NOK 72.6m, down from NOK 82.7m in Q4 2018. For the whole of last year, Lerøy earned NOK 106.5m from SSF, less than half of the NOK 265m it received in 2018.

EBIT for the whole of Lerøy Seafood Group (LSG) also decreased both for the year and the fourth quarter compared with the same periods in 2018.

‘Not satisfied’

“The board is not satisfied with the achievements in aquaculture in 2019, but is strengthened in the belief that the measures implemented and the investments made will give a positive development through increased volume and improved competitiveness in the years to come,” the company said in its Q4 report.

“As of today, the board expects earnings in the first quarter of 2020 to be significantly better than the group achieved in the first quarter of 2019.”

Lerøy Seafood Group had sales (including wild fish) in 2019 for NOK 20.4 billion, compared with 19.8bn in 2018.

EBIT was NOK 2.7bn, compared with NOK 3.6bn. The company harvested 158,000 gwt in Norway (2018: 162,000 gwt).

In the fourth quarter, revenue was NOK 5.2bn, compared with NOK 5.3bn in the same period in 2018.

EBIT was at NOK 769m against NOK 948m in Q4 2018.

In the quarter, 43,000 gwt of salmon, salmon and trout were harvested, compared to 49,000 tonnes in Q4 2018.

‘Volatile prices’

“The fourth quarter saw extremely volatile prices for Atlantic salmon, but the underlying development during the quarter and the profit figures have in the main been as expected,” said chief executive Henning Beltestad.

“Looking back on 2019 as a whole, we experienced several unforeseen incidents in the Farming segment that had a negative impact on the harvest volume and, as a result, our cost levels.

“The onshore industry for whitefish has experienced challenges, while we can report a good development in downstream operations.

“At the start of 2020, we are confident that Lerøy has a sound position for profitable growth in the years to come.”

Lower volumes

The Farming segment achieved operating profit before value adjustments related to biological assets of NOK 597m in the fourth quarter of 2019, compared with 786m in the same period in 2018.

Compared to the same quarter in 2018, price attainment is somewhat higher, but ex-cage costs increased mainly as a result of lower harvest volumes.

In total, EBIT / kg in the segment is down from NOK 15.9 in the fourth quarter of 2018 to NOK 14.0 in the fourth quarter of 2019.

The results for the company’s three Norwegian regions are:

Lerøy Aurora: SEK 25.4 / kg (24.5)

Lerøy Middle: NOK 10.7 / kg (16.3)

Lerøy Sjøtroll: SEK 7.0 / kg (7.9)

Bigger smolts

“The Farming segment was affected by some unforeseen events in 2019, which negatively affected the harvested volume and thus also the cost level per kilo,” said Beltestad.

“For 2020 and the years to come, we expect the group’s investments in smolt to gradually increase in volume, and this volume will also contribute to a reduction in the group’s costs per kilogram of redfish.”

In Lerøy Aurora and Lerøy Sjøtroll, the average size for smolts put to sea will be about 300 grams in 2020

The expected harvest volume this year, including the share in associated companies, is currently between 183,000 and 188,000 gwt of salmon and trout. LSG’s ambition is that the corresponding figures for 2021 will be between 200,000 - 210,000 tonnes.

LSG’s contract share for the first quarter of 2020 is in the region of 40%.