Is a stock market listing on the menu for BioMar?

Schouw calculates whether it's still the best fit for aquafeed heavyweight

The owner of aquafeed manufacturer BioMar may list the company separately, it has announced.

Industrial conglomerate Schouw & Co., which is listed on the Copenhagen Stock Exchange, has owned BioMar for 19 years and would continue to hold a majority stake.

““Schouw & Co. has initiated an evaluation of a possible separate listing of BioMar. Since BioMar became part of the Schouw & Co. Group in 2005, we have grown to become a leading global producer of sustainable aquaculture feeds and have increased our revenue by almost six-fold. A potential separate listing of BioMar could provide the right platform for BioMar to continue our growth trajectory,” said BioMar chief executive Carlos Diaz in a press release.

“If Schouw & Co. eventually decides to pursue a separate listing of BioMar, they intend to remain the majority shareholder of BioMar and will continue to support our development through both organic and acquisitive growth.”

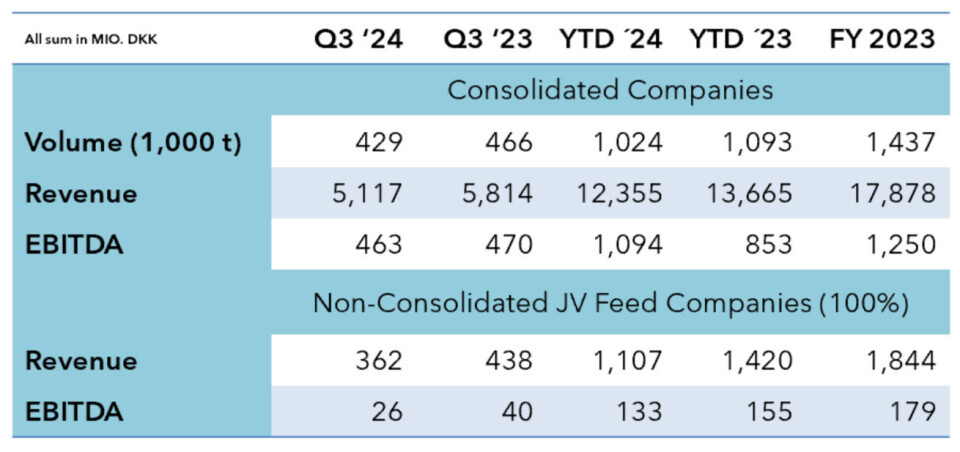

News of the potential listing accompanied BioMar’s results for the third quarter of this year. Sales volumes and revenue were both lower than in Q3 2023, and EBITDA – a form of operating profit – was also reduced.

BioMar said the results still indicate that the company will reach expected earnings for the year. However, full-year revenue expectations are slightly lowered due to decreasing raw material prices combined with lower volumes because of biological conditions in Norway, energy crisis in Ecuador and a focus on receivable risks in the Mediterranean area.

“In general, we are performing well across divisions despite challenges related to biological conditions in Norway and the Ecuadorian energy crisis, which has impacted our production of shrimp feed,” said Diaz.

“Our focus on functional feed solutions combined with shared value creation with our customers is providing tailwind. Given our strong momentum and solid outlook, we will slightly narrow the full-year EBITDA expectations for 2024 to the level of DKK 1,410-1,460 million (£157m-£162.5m).”