Profits plunged for SalMar in Q3

Salmon heavyweight impacted by biological problems

The operating profit of the world’s second largest Atlantic salmon farmer, SalMar, was more than halved in the third quarter of 2024 compared to the same period the previous year.

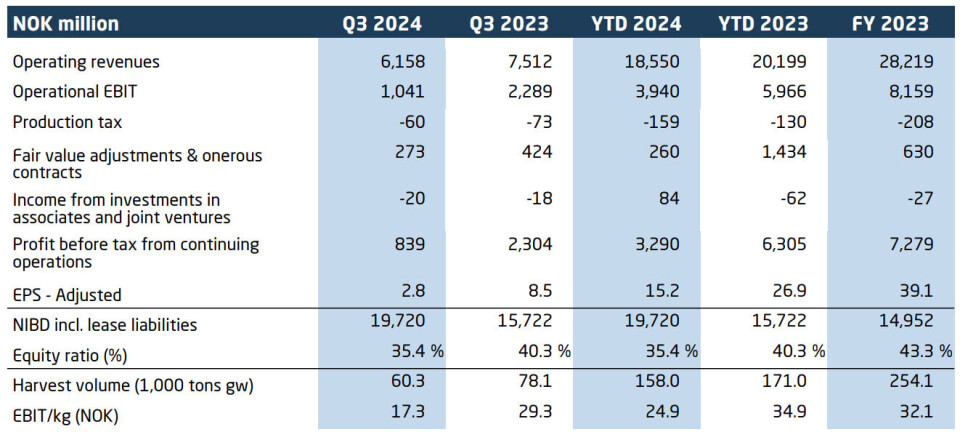

The company today reported operational EBIT for the group of NOK 1.041 billion (£74.2 million) for Q3 2024, compared to NOK 2.3bn in the same quarter last year.

SalMar harvested 60,300 gutted weight tonnes in Norway and Iceland (Q3 20023: 78,100 gwt) and made EBIT per kilogram of NOK 17.3 in the quarter (NOK 29.3). It paid NOK 347m in ground rent tax – a 25% extra profit tax imposed on salmonid farmers - in the quarter.

Jellyfish and lice

The fish farmer wrote in its Q3 2024 report that the farming operation in Norway had been characterised by biological challenges in the quarter, caused by ripple effects from string jellyfish last winter, record high sea temperatures, and high sea lice pressure. These impacted the biological performance and have led to a reduction in volume expectations for 2024.

At the same time, the company writes that its Sales and Industry segment delivered a historically strong result, supported by an efficient operational setup and a high proportion of contracts.

Offshore farming division SalMar Aker Ocean has completed harvesting for the year, and production cycles at Ocean Farm 1 and Arctic Offshore Farming are under way with planned harvesting in 2025. Icelandic Salmon is still affected by low volumes and high costs, while Scottish Sea Farms – which SalMar owns 50-50 with another Norwegian salmon heavyweight, Lerøy Seafood Group - reported a good quarter with increased harvest volume, higher average harvest weight and good biological status at sea.

Designed to cope

“Although the results are affected by challenges at sea, the results also show that the structure we have at SalMar is solid and rigged to handle challenging periods, which makes the financial results acceptable during the period,” said SalMar chief executive Frode Arntsen.

“Going forward, we are fully focused on improving performance and realising the potential we see in the value chain.”

In November, SalMar entered into an agreement to purchase a controlling stake in salmon farmer Knutshaugfisk. The company has permits for a maximum allowed biomass of 3,464 tonnes and four farming locations in production area 6 in central Norway.

“Knutshaugfisk is a well-run family company with which we have developed a close and value-creating collaboration over many years. SalMar’s purchase of a significant stake in the company is a natural continuation of this collaboration,” said Arntsen.

The transaction is subject to regulatory approvals and is expected to be completed in January 2025.

Targets NOK 1.2bn in savings

After realising synergies following the acquisition of NRS, NTS, and SalmoNor in 2023, SalMar analysed the entire value chain in 2024 to optimise the new company further. This work has identified NOK 1.2bn in potential savings in the value chain. Through improved operational structure and increased efficiency, this is expected to be realised by 2029.

The volume guidance for 2024 is now 257,000 tonnes in total for the group, including an expected contribution of 20,000 gwt from Scottish Sea Farms. For 2025, a volume of 294,000 gwt is expected, a growth of 14% compared to 2024. The acquisition of Knutshaugfisk and the purchase of volume from Norway’s “traffic light system” earlier this year increases the volume potential to 370,000 tonnes in total, including the share in Scottish Sea Farms.

“Although we have experienced challenges in 2024 that have affected slaughter volumes, we are adapting to the challenges through measures throughout the value chain,” concluded Arntsen.