Smaller harvest but good performance for SSF

Scottish Sea Farms made less money in the first three months of 2019 than in the corresponding period last year, according to a quarterly report published by its Norwegian joint owner, SalMar, today.

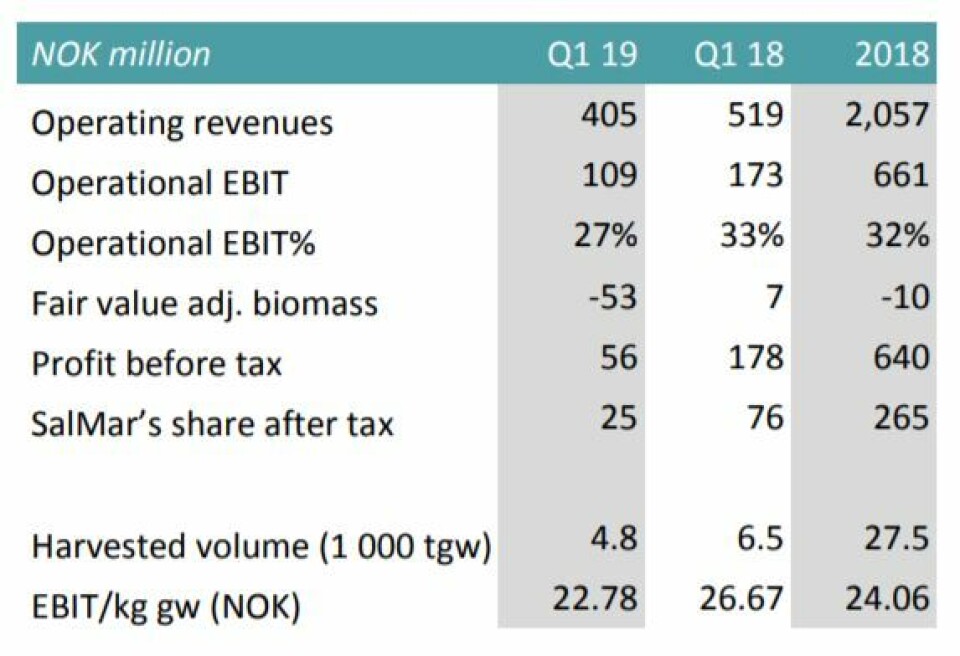

SSF generated gross operating revenues of NOK 405.2 million (£36.5m), compared with NOK 518.7m in Q1 2018.

SalMar said the decrease in revenues is attributable to a lower volume harvested. SSF harvested 4,800 tonnes of fish in the quarter, which is 1,700 tonnes fewer than in Q1 2018.

Orkney

The bulk of the volume harvested came from Orkney, with good operational performance and average weights.

The remaining volume harvested came from mainland Scotland.

SalMar said the financial result has been negatively affected by costs relating to high mortality at certain sites. Half of the quarter’s volume was sold under contract.

Operational EBIT per kg gutted weight came to NOK 22.78, compared with NOK 26.67 per kg in the same period in 2018. SSF expects to harvest 30,000 tonnes in 2019 as a whole, unchanged from the estimate published at the close of the previous quarter.

Highest-ever Q1 harvest

Overall SalMar recorded its highest ever first-quarter operational EBIT and harvest volume, thanks in part to including the earnings and fish of Icelandic salmon farmer Arnarlax – in which it now has a controlling interest - in its figures for the first time.

Previously it was treated an as associate company, like SSF, and its figures were kept separate.

Operational EBIT was NOK 806.2m in the first quarter 2019, compared with NOK 708.1m in the same period last year, on a harvest of 35,500 tonnes, up from 31,900 tonnes in Q1 2019.

EBIT per kg was NOK 22.71, a year-on-year increase of NOK 0.50 per kg.

Higher costs in Central Norway

SalMar said that after several quarters of strong biological performance and a significant drop in production costs, its Central Norway segment had a rise in production costs. Outbreaks of disease at certain sites led to premature harvesting and, consequently, higher production costs. The company expects the segment to have a higher volume and lower costs in Q2.

The Northern Norway segment harvested a large volume of fish, although results were affected by biological challenges, including the harvesting of fish from the ISA zone where additional infection-prevention measures increased costs.

SalMar’s sales and processing segment posted a profit of NOK 14.3m, a big turnaround on the NOK 15.3m loss made in Q1 2018. The company said the improvement was driven by fixed price contracts having a higher price point than for Q1. Seasonally lower volumes had influenced the profit contribution from the harvesting and secondary processing activities.

Great faith in Arnarlax

The company said operational improvements at Arnarlax contributed to a positive financial result in Q1, despite costs associated with high mortality caused by winter wounds.

The company said: “SalMar has great faith in the future of Arnarlax and salmon farming in Iceland, but it will take time before the segment is able to perform at the same level as the Group's operations in Norway.”

SalMar maintains its expectations to harvest 155,000 tonnes in 2019, with 145,000 tonnes coming from the Norwegian segments and 10,000 tonnes from Iceland.