Benchmark completes sale of genetics division for up to £260m

Biotech company will have £107.5m from initial £230m payment left after paying down debt

Aquaculture biotechnology company Benchmark Holdings plc has announced the completion of the sale of its genetics business to Starfish Bidco AS, a wholly owned subsidiary of international life sciences investor Novo Holdings A/S.

The sale is worth up to £260 million, comprising an initial consideration of £230m and contingent consideration of up to £30m.

Benchmark said that after completion of accounts adjustments based on the cash, debt and working capital position of the genetics business, as well as certain other specified liabilities agreed between Starfish Bidco and Benchmark, the transaction is expected to realise gross cash proceeds of approximately £194m, excluding any earn-out consideration.

Debt repayments

Benchmark will use some of the money to repay its unsecured floating rate listed green bond which currently amounts to approximately £63m.

It will also pay back the £23.75m drawn under its revolving credit facility provided by DNB Bank ASA by the middle of April, leaving it with net cash proceeds of approximately £107.5m.

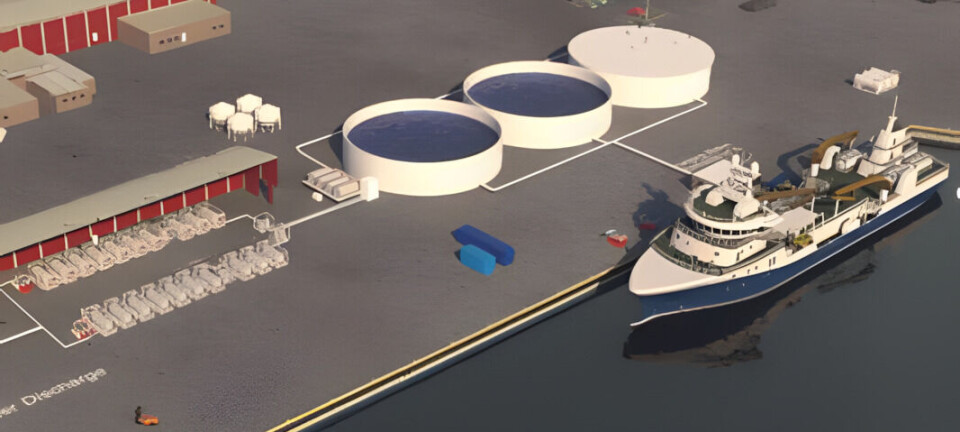

Benchmark’s genetics division is one of the world’s biggest suppliers of eyed salmon eggs, with broodstock facilities in Norway, Iceland, and Chile. It also develops, produces and globally distributes genetically improved, high performing shrimp strains, and offers a variety of genetics and genotyping services.

New owner Novo Holdings is responsible for managing the assets and the wealth of the Novo Nordisk Foundation, one of the world’s largest enterprise foundations.

Denmark-headquartered Novo Nordisk is a global healthcare company with more than 100 years of innovation and leadership in diabetes care. It also has leading positions within haemophilia care, growth hormone therapy, and hormone replacement therapy.