Benchmark lost £7.1m during 'stepping-stone' quarter

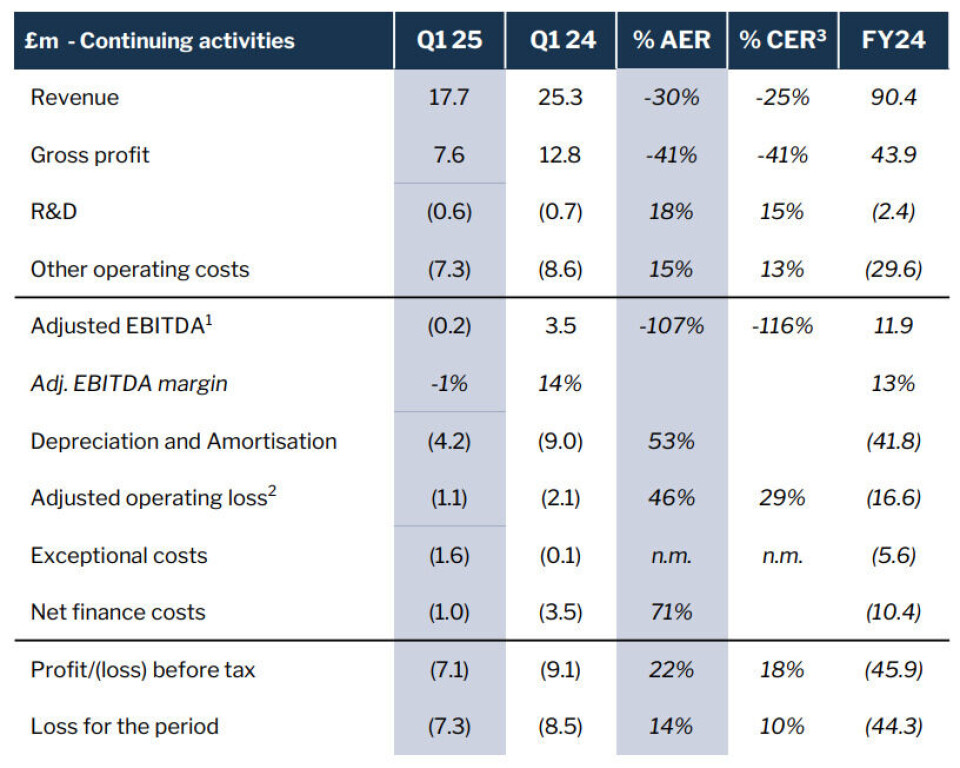

Aquaculture biotechnology company Benchmark Holdings made a pre-tax loss of £7.1 million in the first quarter of its 2025 financial year, which runs from October 2024.

The loss was for continuing operations – its Advanced Nutrition and Health divisions – and doesn’t include its Genetics division, which is in the process of being sold to Denmark-headquartered life sciences investor Novo Holdings.

Advanced Nutrition had a soft start to the new financial year, Benchmark said in its Q1 2025 report. Revenues were £16.1m, 16% below the prior year. Performance was strong in Europe driven by sales to the marine fish market where Benchmark is expanding into the nursery segment, and in the Americas, while Asia was most affected by soft conditions in the shrimp markets.

Land-based CleanTreat

Revenues in the Health division in Q1 were £1.6m (Q1 FY24: £6.1m) primarily reflecting the pause in sales of the wellboat salmon lice treatment Ectosan Vet and the CleanTreat filtration that must be used with it. Benchmark originally installed two CleanTreat systems on vessels that moored next to wellboats using Ectosan, but they proved too expensive to run, and the company is now developing a new business model for the medicine that includes a land-based CleanTreat system.

“We are working in partnership with a specialist solutions provider, Water AS, and have significant expression of interest from potential customers who have previously used Ectosan Vet and CleanTreat and who remain interested in incorporating the solution into their sea lice toolkit with a simplified infrastructure and cost-efficient business model,” wrote Benchmark.

Sales of Benchmark’s other lice medicine, Salmosan Vet (azamethiphos) totalled £1.6m (Q1 FY24: £2.1m) and were driven by sales in Norway and Chile which experienced high sea lice levels, offset primarily by lower sales in the Faroe Islands compared to last year.

Transition period

“Q1 FY25 has been a stepping-stone quarter for us representing a period of transition for Benchmark ahead of completion of the Genetics disposal and streamlining of the continuing business,” wrote Benchmark chief executive Trond Williksen.

“Our reported performance reflects ongoing weakness in the global shrimp markets for Advanced Nutrition coupled with a temporary change in product mix and a solid performance in Health.

“Looking forward we expect an improvement in trading conditions and margins, and we have two well positioned businesses capable of delivering attractive shareholder returns. Our restructured Health business performs well as a cash generative business and is advancing towards a relaunch of a new land-based business model for Ectosan Vet and CleanTreat.”

Benchmark said progress towards the completion of the sale of the Genetics business is well advanced. The company has obtained most of the regulatory clearances and has well-developed plans in place to deliver on the transaction services agreement.

Proceeds will be used to return capital to shareholders and to reduce Benchmark’s leverage by repaying the group’s unsecured listed green bond and drawn amounts under its revolving credit facility.