Camanchaca reins in coho production as fish stay in the freezer

Market concerns outweigh biological advantages for Chilean producer

Chilean fish farmer Salmones Camanchaca is cutting back on production of coho salmon next year due to a drop in price and demand and a currency devaluation in Japan, which buys around two thirds of Chilean coho.

Camancha has been increasing its output of coho due to the biological advantages of the species compared to Atlantic salmon. Coho is naturally resistant to sea lice and reaches harvest size before the worst time for harmful algal blooms (HABs).

But other Chilean farmers have also been increasing coho production and Camanchaca, which harvested 3,700 tonnes of coho in the third quarter of 2023, has been left with an unsold inventory of more than 1,000 tonnes (whole fish equivalent). That inventory has lost value due to the weaker Japanese yen, which has lost 30% in value over the last two years, and is calculated to have cost Camanchaca US $3.1 million because the cost to produce the fish is higher than the estimated sale price.

During a presentation of Q3 results, chief financial officer Daniel Bortnik said the company would reduce the number of sites stocked with coho from three to one next year and would produce only half of the 6-8,000 tonnes produced in the current season.

Bruising quarter

It was a financially bruising Q3 for Camanchaca, which was also hit by a combination of lower price achievement due to low demand and higher ex-cage costs for Atlantic salmon caused by 70% of the Atlantic harvest coming from two sites accounting that were affected by SRS (salmon rickettsial septicaemia) outbreaks and sea lice presence which increased treatment costs.

Prices for trout, grown in a joint venture, were also impacted by the weak yen and higher production costs, resulting in a loss of $2m.

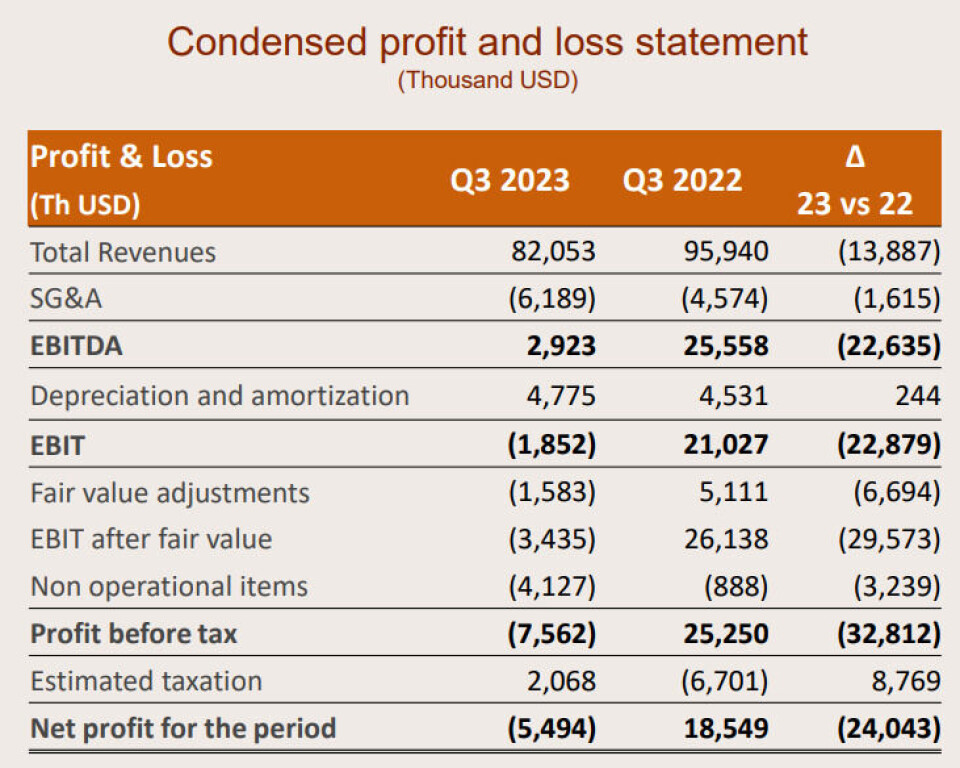

Salmones Camanchaca’s revenues for Q3 amounted to $82.1m, a decrease of 1.4.5% on the $95.9m made in Q3 2022, despite the company’s Atlantic salmon harvest increasing by 24% year-on-year to 17,700 tonnes WFE. A drop in demand meant that 9,000 tonnes remained unsold.

Operating loss

Earning before interest and tax (EBIT), a measure of operating profit, plunged from $25.6m in Q3 2022 to $-1.8m in Q3 2023, and the net profit of $18.5m made in Q3 last year became a net loss of $5.5m in the same period this year.

Atlantic salmon EBIT/kg WFE was $0.05 in Q3 2023, down from 1.78/kg WFE in Q3 2022. Coho salmon EBIT/kg WFE was $ -0.54, down from $1.16 in Q3 2022.

Camanchaca’s total 2023 harvest is expected at 54-58,000 tonnes WFE for all species, with 80% being Atlantic salmon. For 2024 the Atlantic salmon harvest is expected to grow 10% to around 50,000 tonnes.

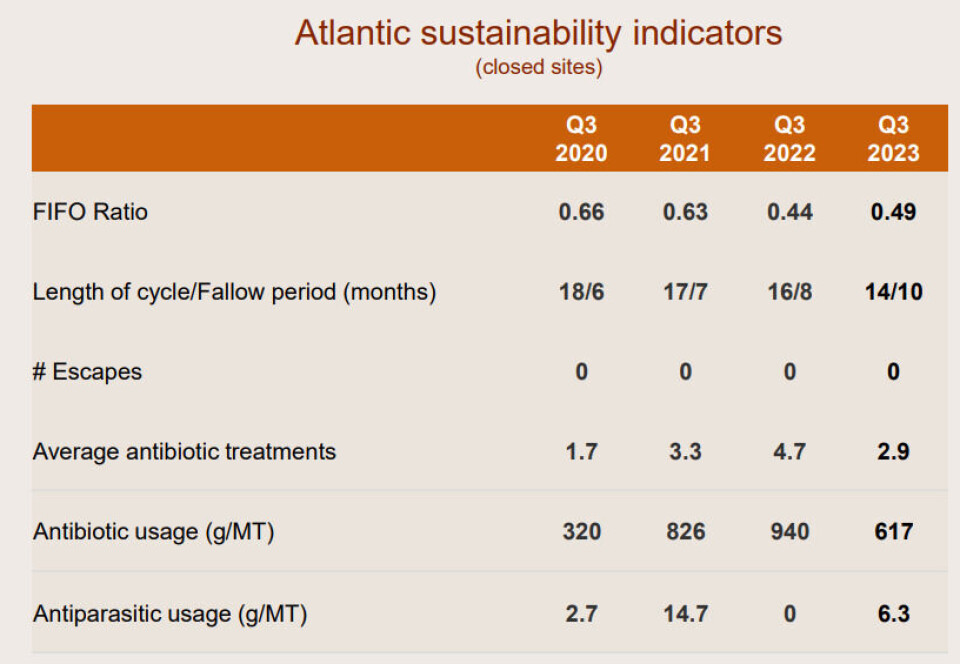

Chief executive Manuel Arrigada pointed out that Camanchaca had performed better than the industry average on several performance indicators except antibiotic use, which was higher because of the SRS outbreak.

The company has reduced the time of its in-sea farming cycle for Atlantic salmon to 14.1 months (industry average 15.2) and had an average harvest weight of 5.2 kg (5kg).

But ex-cage cost has increased by around $1 per kilo compared to pre-Covid levels, due to higher feed costs, mitigation measures for harmful algal blooms and low oxygen levels, and inflation on other expenses. Processing costs, on the other down, had been reduced by 5.3% to 0.98 per kilo due to increased volume.