Scottish salmon exports to Asia doubled in value and volume in Q1

The value of Scottish salmon exports to Asia more than doubled to £24 million in the first quarter of this year, new figures from His Majesty’s Customs and Revenue (HMRC) show.

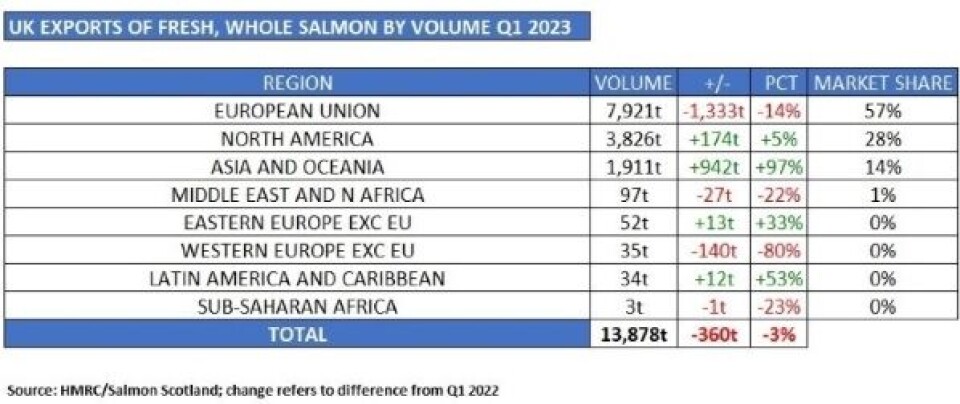

European destinations remain the primary international markets, but North America (29%) and Asia (18%) accounted for nearly half of all sales in Q1, driven by strong demand from China, Taiwan, Singapore, and South Korea.

The value of exports to Asia was up by £12m, and the volume of fish exported to the region rose by 97%.

In total, exports of Scottish salmon in Q1 were worth £134m, an increase of £20m, or 18%, compared to Q1 2022, despite the export volume in the period falling marginally by 360 gutted weight tonnes (3%) to 13,878 gwt. Prices have been pushed up by low global supply.

In its Economic Quarterly report for Q1 2023, sector trade body Salmon Scotland said harvest volumes in the period had reportedly increased compared to the same period last year despite a challenging final quarter of 2022. “A combination of holding on to stock from the end 2022 and increased capacity utilisation have contributed to this,” said Salmon Scotland.

Trade agreement

Salmon Scotland said the opportunity to develop increased trade with global markets has been aided by the UK reaching agreement with other countries to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

The CPTPP is a free-trade agreement between 11 countries around the Pacific Rim: Canada, Mexico, Peru, Chile, New Zealand, Australia, Brunei, Singapore, Malaysia, Vietnam, and Japan.

Although potentially increasing trade, the CPTPP has been criticised by the RSPCA as “another nail in the coffin for animal welfare”. The charity said many members of the CPTPP use methods of animal production that would be illegal in the UK.

Beyond the CPTPP, Salmon Scotland said discussions for a free trade agreement with the GCC (Gulf Cooperation Council) as well as India were ongoing and talks were opening with Switzerland, “providing increased revenues and incomes for employees across our producing regions and supply chain”.

Malcolm Offord, the UK minister for Scotland and exports, said today that the Conservative government wanted to maximise the potential for Scottish salmon exports and was “working tirelessly to reduce trade barriers internationally so that these exports figures can continue to grow”.

Demographic shift

However, the impact of the UK’s exit from the European Union has helped drive inflation and pushed down sales of fish, including salmon, in the UK, said Salmon Scotland in its Economic Quarterly report.

“Inflationary pressure across the UK looks to be more prolonged and severe than in other parts of the world. Contributing factors of people leaving the workforce during the [Covid] pandemic combined with a smaller pool of available workers following Brexit look to have exacerbated the situation,” said Salmon Scotland.

“The demographic shift has been notable across our rural and coastal communities as remote-working jobs and the uptake of second homes or holiday lets has grown.

“With continued increased cost of living pressures domestically, it is little surprise that there has been an impact on retail volumes. In the 12 months to the end of March, salmon remained the most in-demand fresh fish at UK retail worth over £1.2 billion accounting for 30% of value sales and 16% of volumes although this was accompanied by a sector-common drop in volumes and values.”