SalMar made £167.5m operating profit in Q3

Norwegian salmon heavyweight plans 9% volume increase next year

SalMar, the world’s second largest Atlantic salmon farmer, has announced strong results for the third quarter of 2023, driven by operations in Norway.

The group made an operating profit of NOK 2.3 billion (£167.5 million), which is almost NOK 1 bn more than it made in the same period last year before its acquisition of NTS, Norway Royal Salmon (NRS), and SalmoNor gave it increased farming capacity.

Nearly all its operating profit in Q3 – NOK 2.274bn – was made in Norway.

Total harvest was 78,100 gutted weight tonnes, of which 74,000 gwt was harvested in Norway. SalMar owns 50% of Scottish Sea Farms (SSF), which harvested 8,800 gwt in Q3, but does not consolidate SSF’s volumes in its quarterly figures because it is a joint venture, not a subsidiary.

SalMar has kept its 2023 volume guidance for Norway unchanged at 243,000 gwt and has increased guidance for its subsidiary Icelandic Salmon by 1,000 gwt to 17,000 gwt.

Significant growth

The company is expecting significant volume growth next year, and is guiding for 257,000 gwt in Norway, 7,000 gwt from semi-offshore subsidiary SalMar Aker Ocean, and 15,000 gwt in Iceland. It also expects SFF to produce 37,000 gwt. Including relative share from SSF, this gives a total of 298,000 gwt and represent a growth of 9% from volume in 2023.

“We have put behind us another good quarter, especially in our Norwegian operations,” said SalMar chief executive Frode Arntsen. “This has given strong results. Our fish farmers in Central and Northern Norway have achieved good biological results which leads to good financial results. On land our staff and operators in Sales and Industry has handled large volumes well.”

Arnsten added that the integration of operations from NRS, NTS and SalmoNor is progressing as planned. “We are in fact able to extract greater synergies than we originally planned and expect that all this will be in place by the end of the year. The sale of Frøy (NTS’ wellboats and marine services company) in the third quarter has further contributed to strengthening our financial position.”

SalMar estimates that yearly recurring synergies from the integration amount to NOK 844m.

Fully offshore farm on hold

In September, site approval for one open ocean unit was granted to SalMar Aker Ocean’s Smart Fish Farm, approximately 50 nautical miles west of Frøya in Central Norway. But due to regulatory uncertainty, it has decided that further work on offshore aquaculture in Norway is currently on hold.

“The company will now fully focus on growth semi-offshore and utilise the capacity of its existing two semi-offshore units for the production of sustainable Norwegian salmon,” wrote SalMar in its Q3 2023 report. “It will also continue to explore opportunities outside of Norway.”

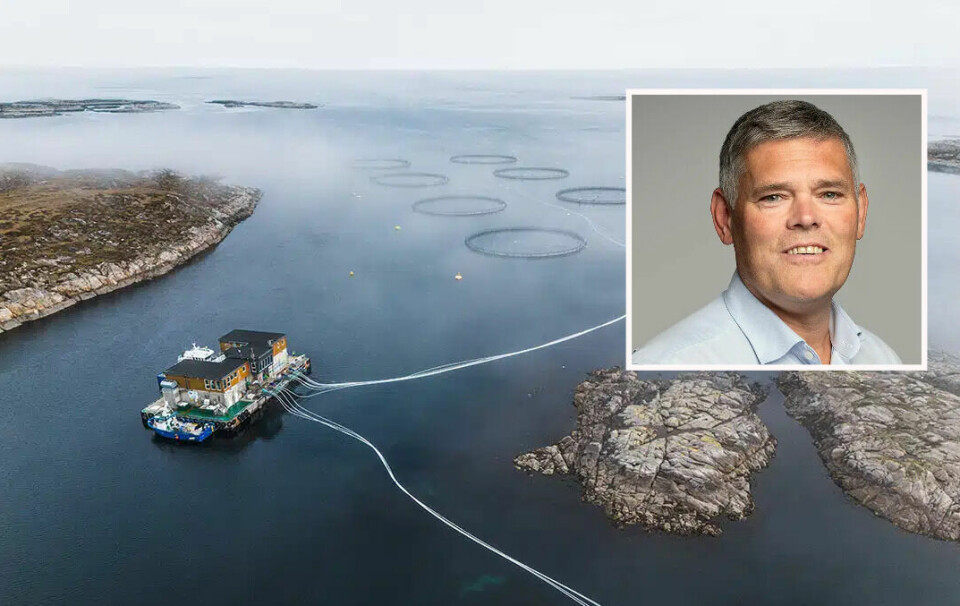

SalMar Aker Ocean’s two semi-offshore units are Ocean Farm 1, developed by SalMar, and Arctic Offshore Farming, acquired when SalMar bought NRS.

The third production cycle at Ocean Farm 1 commenced early May, and planned harvest remains on track for early 2024, reported SalMar.

SalMar Aker Ocean aims to harvest 4,000 tonnes in the current quarter from the Arctic Offshore Farming project.