SSF 'producing well' says joint owner SalMar

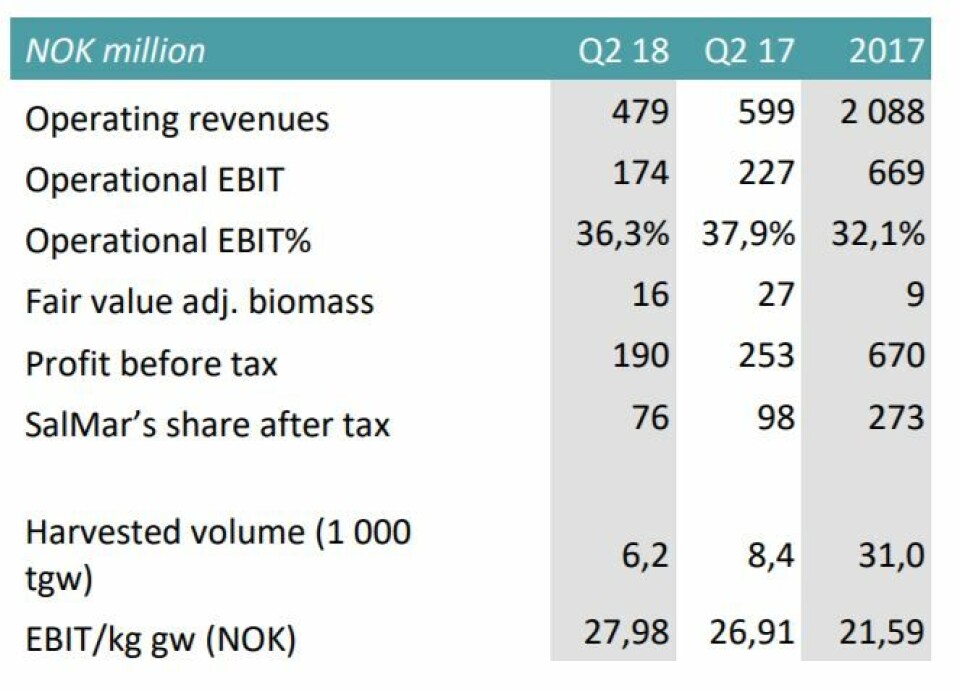

Scottish Sea Farms (SSF) generated gross operating revenues of NOK479.3 million (£44.5m) in the second quarter 2018, according to a financial report published by co-owner SalMar today.

The figure is lower than the NOK518.7m (£48m) in the first quarter this year and NOK598.7m (£55.6m) in the second quarter 2017, something that is largely attributable to a lower harvested volume, SalMar said.

SSF harvested 6,200 tonnes of fish in the quarter, 300 tonnes less than in the previous quarter and 2,200 tonnes less than in the corresponding period last year.

Good performance

In SalMar’s report for the second quarter and first half of 2018, SSF was described as having a good underlying operative performance. “The company is producing well and the biological status in all its operational areas is good,” says SalMar, which shares ownership of the company with fellow Norwegian salmon farmer Lerøy.

“As a result, the fish harvested in the quarter have had a favourable average weight. The contract rate for the quarter was 45%. EBIT per kg gutted weight came to NOK27.98 (£2.60) in the period, compared with NOK26.67 (£2.50) per kg in the previous quarter and NOK26.91 per kg in the second quarter 2017. The company expects to harvest around 26,000 tonnes in 2018 as a whole.”

In its report, SalMar said “associates” contributed NOK78.8m (£7.3m) to the period’s result, with NOK76m coming from SSF. “The contribution derives primarily from SalMar’s share of the profit/loss in Scottish Sea Farms and [Icelandic fish farmer] Arnarlax. Associates contributed NOK74.9m in the second quarter 2017”, stated the report.

For SalMar overall, operational EBIT in Q2 2018 came to NOK878.6m (£81.6m) compared with NOK983m (£91m) in the same period last year.

Weaker contract rate

Year-on-year harvests were similar, with SalMar harvesting 34,049 tonnes in Q2 2018, compared with 35,000 tonnes in Q2 2017, but earnings were dented because a high proportion of sales were on contract, and prices failed to match spot prices. The contract rate for the third quarter 2018 has been reduced to 35% .

“SalMar’s good biological performance continued in the second quarter,” said chief executive Olav-Andreas Ervik. “Our results were driven by cost improvements and yet another quarter with high salmon prices.

“However, the market operates so that a portion of the salmon is sold on long-term contracts at a fixed price. In this quarter about 45% of the volume has been sold with a price achievement that has been below the record high spot prices. Such results are normal and part of our business.”

Offshore farming

Ervik said SalMar constantly sought new methods and solutions that can help develop and ensure continued sustainable growth within the aquaculture industry. “We have already invested above NOK700m (£65m) in Ocean Farm 1, and have recently entered into a strategic collaboration with regard to the ‘Smart Fish Farm’, a development project that could bring offshore fish farming another step forward," said Ervik.

SalMar expects to harvest around 143,000 tonnes in Norway in 2018: 100,000 tonnes in Central Norway and 43,000 tonnes in Northern Norway.