Salmon Evolution closes in on North America site

Land-based fish farmer in talks over location that ‘ticks all the boxes’

Norwegian land-based fish farmer Salmon Evolution is in advanced negotiations on a high-potential site in North America that “ticks all the boxes”, it said in a report published today.

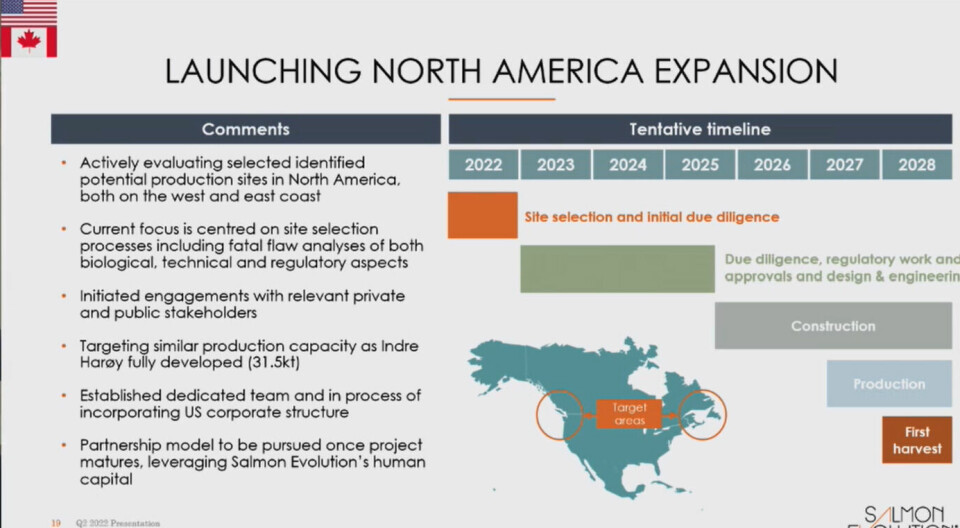

Salmon Evolution is developing a hybrid flowthrough / recirculating aquaculture system (RAS) farm with a capacity of 32,000 tonnes HOG (head on gutted) annually at Indre Harøy, Norway, and plans a facility of the same size across the Atlantic.

“The initial site verification processes, including fatal flaws analyses of both water, biological, technical, and regulatory aspects, points to this being an ideal site for a hybrid flowthrough system,” the company said in its report for the fourth quarter of 2023.

“As previously communicated the focus with respect to sites is centred around areas with an established salmon farming industry, mirroring the Group’s approach for Indre Harøy. Salmon Evolution sees a significant value in leveraging existing aquaculture infrastructure and value chains, enabling both scale and cost leadership, as well as reducing operational and biological risk.”

Dedicated team

The company said it has established a dedicated team of both in-house and external resources to further the North American project and is in the process of ramping this team up.

Salmon Evolution has been looking at sites on the east and west coasts of the northern US and southern Canada, which are regions where net pen salmonid farming is or has until recently been practised. Unlike a full RAS facility, Salmon Evolution’s hybrid farm requires seawater that is drawn from considerable depth, and which has a narrow temperature variation to eliminate and substantially reduce heating and cooling costs.

Salmon Evolution is also expanding to South Korea with K Smart Farming, a joint venture with seafood heavyweight Dongwon Industries, and is finding costs an issue.

“The Company currently sees the overall project economics as challenging, primarily driven by site specific circumstances at the Yangyang grow-out site, in particular related to the intake and discharge water solution due to a relatively long and shallow shoreline at the grow-out site,” it said.

It added that K Smart is currently engaging with relevant authorities in South Korea to shore up government financial support to improve project economics. Clarification around this is expected during the second quarter of this year.

EBITDA 'break-even'

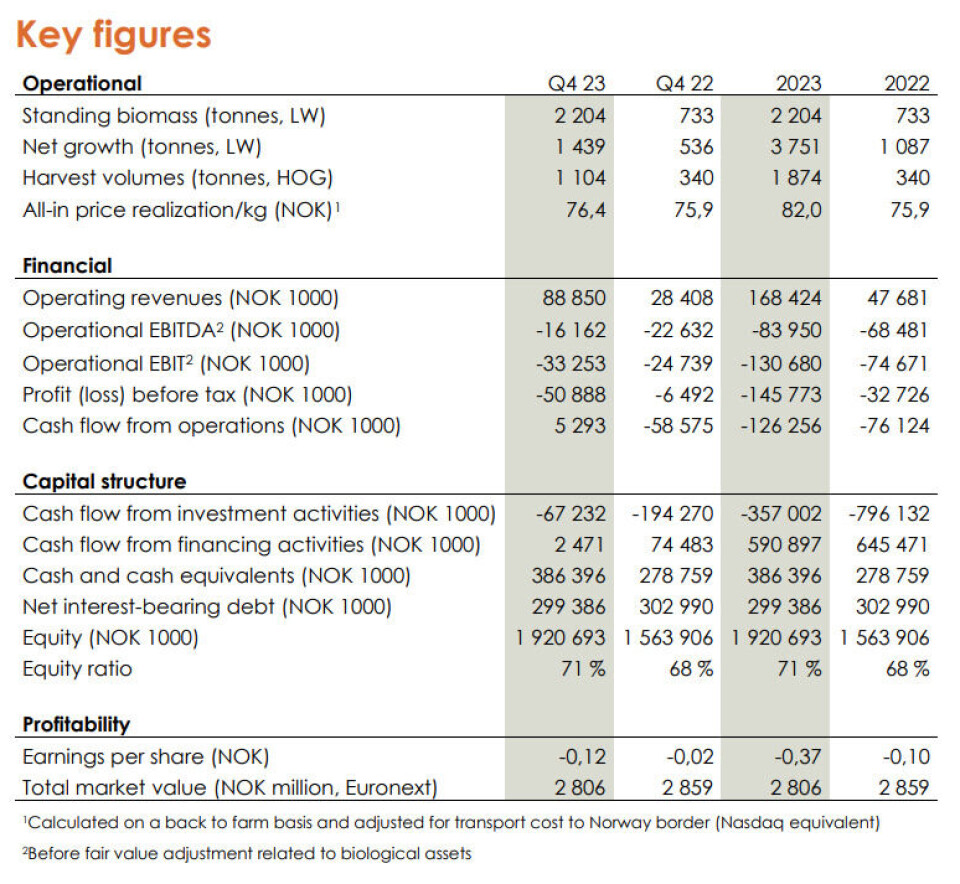

In Norway, Q4 2023 “marked a significant milestone for Salmon Evolution, with a harvest volume of over 1,100 tonnes HOG with good results and achieving EBITDA ‘break-even’ in the farming segment for the first time”, said chief executive Trond Håkon Schaug-Pettersen.

“Looking into 2024, we remain optimistic and we are very pleased with our slaughter results so far this year, which show increasing slaughter weights, an exceptionally high superior share and strong price realisations.”

The company reports the following highlights in Q4 and so far in Q1:

- EBITDA (earnings before interest, tax, depreciation, and amortisation) ‘break-even’ in the farming segment for the first time.

-

For Farming Norway, revenue in Q4 increased to NOK 85.85 million, up from NOK 13.35m in Q4 2022, and operating losses (operational EBIT) fell by 30% from NOK 23.88m in Q3 to NOK 16.72m.

- Harvest volume of 1,104 tonnes (HOG) in the fourth quarter, with an average weight of ~3.5 kg (HOG) and superior share of 90%.

- Still strong biological performance, with good appetite and low mortality.

- Standing biomass of over 2,200 tonnes live weight per 31 December 2023.

- All-time high biomass production in the fourth quarter with 1,439 tonnes of net biomass growth.

- Q1 QTD volume of 457 tonnes (HOG) after harvesting two of four batches.

- Average weight of ~3.9 kg (HOG) and superior share over 95%.

- Moving towards production costs in line with the conventional industry.

- Available liquidity of NOK 645 million as of December 31, 2023, including committed available unused credit lines.

Salmon Evolution currently has capacity for 8,000 tonnes HOG in its completed Phase 1 at Indre Harøy and is now working on Phase 2, which will double capacity. Phase 3 will take capacity to 32,000 tonnes.

During 2023, the company harvested 1,874 tonnes (HOG).

“In the fourth quarter, the company had another period of good biological performance, and ended the quarter with over 2,200 tonnes of standing biomass and all-time high biomass growth of 1,439 tonnes,” the company said it its Q4 report.

“Biomass growth in the fourth quarter was affected by high slaughter activity, concentrated in November, which temporarily reduced biomass production. In addition, the fourth quarter was used to make the two production lines at Indre Harøy more efficient, which led to a higher than normal number of fish transfers and starvation days.”

The high activity at Indre Harøy had a limited impact on other key parameters. Mortality ended at 1.2% in the quarter, which is within the target of 3-5% mortality on an annual basis.

The company deployed batch 9 in October, while batch 10 was partially deployed in December, and the rest of the volume was deployed in early January.