Record harvest volumes for SalMar

Norwegian salmon heavyweight SalMar harvested a record volume of fish in the last quarter of 2021 and in the full year, it revealed in results published today.

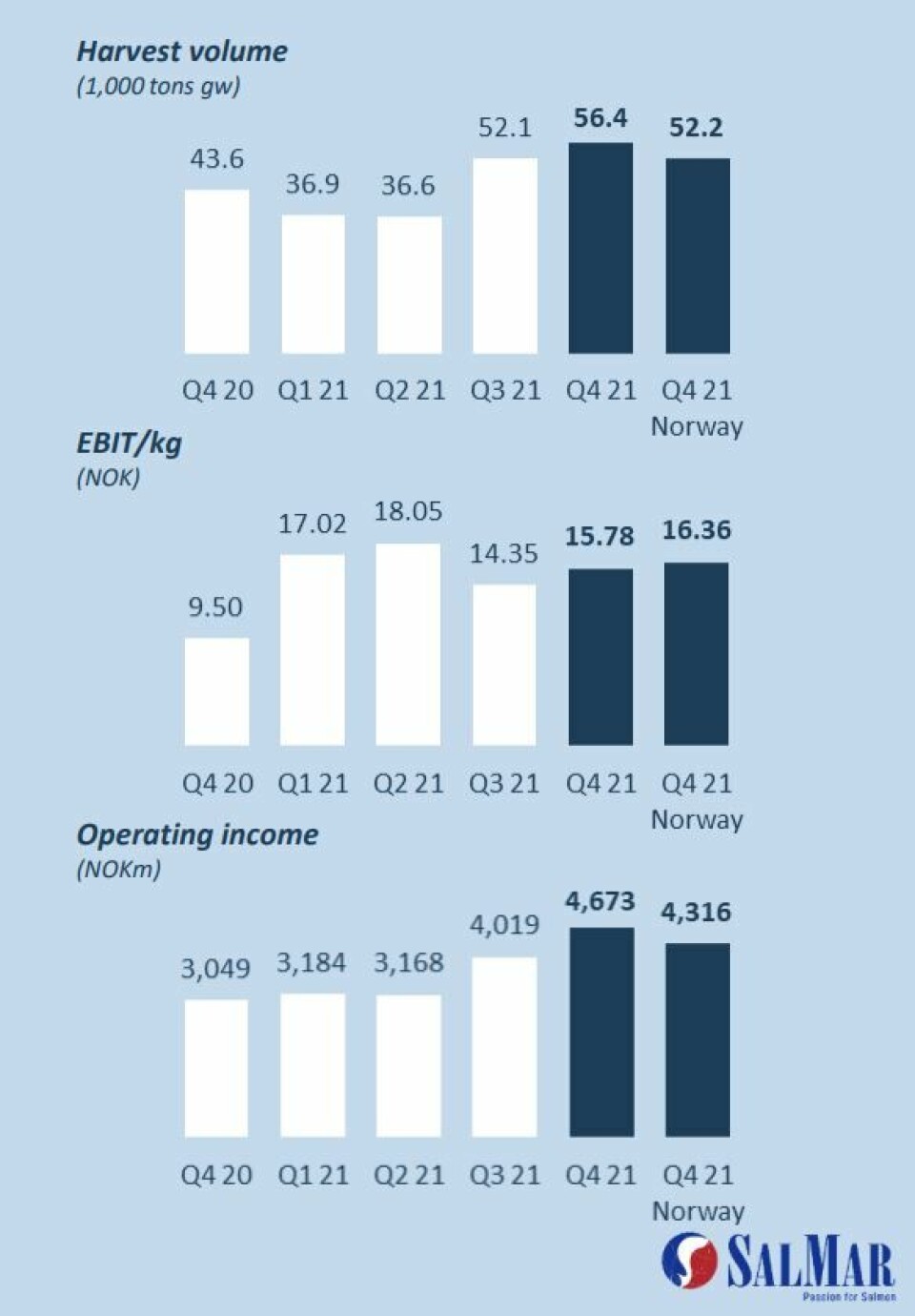

SalMar harvested 56,400 gutted weight tonnes in Q4 in Norway and Iceland, up from 43,600 gwt in the same period the year before. Harvest volumes from Scottish Sea Farms, which SalMar owns 50-50 with Lerøy Seafood Group, are not included because it is classed as an associate company rather than a subsidiary.

The company harvested 182,100 gwt for the full year, up from 161,500 gwt in 2020.

Strong quarter

Operating profit for Q4 more than doubled to NOK 890 million (£73.4m) from NOK 414m in Q4 2020, and EBIT per kilo rose to NOK 15.78 (NOK 9.50).

However, operating profit for the full year was slightly lower at NOK 2.927 billion (2020: NOK 3,008 bn) and EBIT per kg for 2021 also fell slighty to NOK 16.08 (NOK 18.62).

SalMar expects increased volume in all regions this year. The forecast for Norway is 175,000 gwt (2021: 171,500 gwt), Iceland 16,000 gwt (11,500 gwt), and Scotland 46,000 gwt (33,000 gwt).

Room for improvements

“Our team has delivered impressive performance in key areas, resulting in record high harvest volumes in Q4 and for the full year, due to strong utilisation of increased production capacity,” said chief executive Gustav Witzøe.

“But results in Q4 are weakened by higher cost related to handling of biological challenges to safeguard fish welfare and weak price achievement, this showing there is still room for improvements across the entire value chain.”

SalMar is planning to pay up to NOK 15.1 bn for salmon farmer and marine services company NTS ASA after securing commitments to sell from a group of shareholders holding more than 50% of the equity.

Increasing capacity

The company is also spending NOK 2.2 bn on increasing capacity this year. The capex includes new smolt facilities in central and northern Norway, NOK 200m on increased seawater capacity in Iceland, and NOK 200m to upgrade its Ocean Farm 1 exposed site cage and the finalising of design for semi-offshore unit Ocean Farm 2 and the open ocean Smart Fish Farm.

SalMar said its subsidiary SalMar Aker Ocean, formed last year in conjunction with offshore engineering company Aker, is ready for the next steps offshore and is awaiting approval for site application for its first Smart Fish Farm unit.

It is also keen to make an investment decision for a new semi-offshore unit as soon as possible.

SalMar Aker Ocean hopes to produce 150,000 gwt of salmon offshore by 2030.