Norway reports record high export earnings for salmon

Seafood exports were worth NOK 17.3 billion (£1.24bn) in November, an increase of NOK 1bn, or 6%, compared to the same month last year. Salmon exports were worth NOK 12.1bn.

"We have put behind us several consecutive months of solid growth for seafood exports, and this trend continued in November. Thanks to price increases for salmon, mackerel, cod, haddock, and herring, this was the best November ever measured in value," says Christian Chramer, chief executive of the Norwegian Seafood Council.

No overall currency effect

Unlike previous months, the NOK value of seafood exports this time did not receive a boost from a weak currency.

"Compared to the same month last year, the Norwegian krone is slightly stronger against the euro but weaker against the US dollar. Overall, this results in no currency effect, so the value growth is mainly driven by higher prices and increased volumes for some of our most important species," explains Chramer.

More costs and competition

He emphasises that even though Norwegian seafood exports are increasing in value, this does not mean a bed of roses for industry players.

"On the wild catch side, many are concerned about the consequences of new quota cuts, in the land industry the fight for raw materials is intensifying, while many salmon companies are experiencing greater biological challenges as sea temperatures rise. When this is combined with increased cost growth and intensified global competition, many have faced a more demanding economic situation even as seafood exports increase," says Chramer.

Strong growth for sales to China

As usual, it was the countries in the EU zone that bought the most Norwegian seafood. In total, Norway exported seafood worth 10 billion kroner to this market in November.

"Europe is strong and had value growth in November. The United States declined somewhat, while Asia is becoming increasingly important. Last month, there was strong growth for both shrimp and salmon to China," explains Chramer.

Heading for a new export record

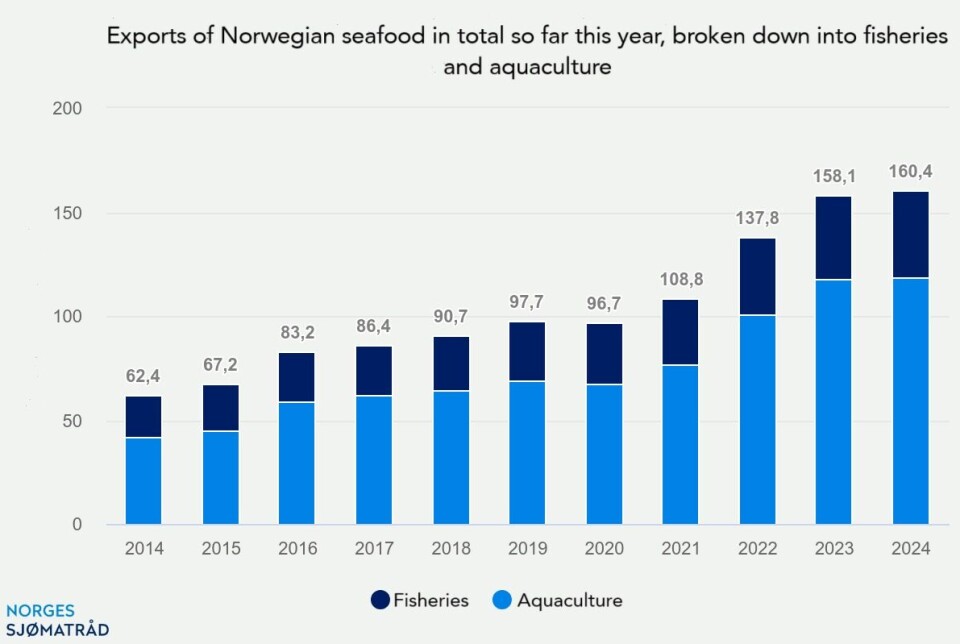

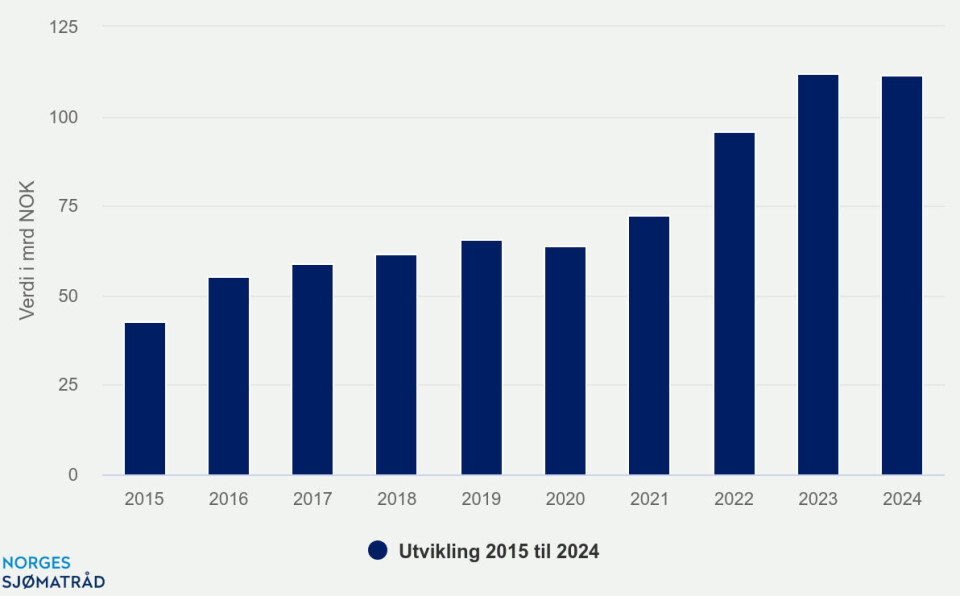

So far this year, Norway has exported seafood worth NOK 160.4bn. This is NOK 2.3bn, or 1.5%, higher than at the same time last year.

"2024 has so far been a good year in terms of value for Norwegian seafood exports. Higher prices have largely compensated for the quota cuts for cod, herring, and mackerel. If the positive trend continues in December, we will surpass last year's export record of NOK 172bn by the end of the year," says Chramer.

This was the seafood export in November

- The largest markets for Norwegian seafood exports in November were Poland, the US, and the Netherlands

- The Netherlands had the largest value growth, with an increase in export value of NOK 174m, or 17%, compared to the same month last year. The export volume to the Netherlands ended at 15,908 tonnes, which is 10% higher than the same month last year

- Seafood was exported to a total of 113 countries in November. This is five fewer than in November last year.

Record high value for salmon

- Norway exported 131,232 tonnes of salmon worth NOK 12.1bn in November

- The value increased by NOk 619m, or 5%, compared to the same month last year

- There was a volume growth of 3%

- Poland, France, and the Netherlands were the largest markets for salmon in November

This is a record high export value for salmon in a single month, NOK 224m higher than the previous record month, which was in October 2023.

Germany had the largest value growth in November, with an increase in export value of NOK 149m, or 34%, compared to the same month last year.

The export volume to Germany ended at 5,881 tonnes, which is 34% higher than the same month last year.

Increased domestic consumption in Germany

"The value growth to Germany is mainly due to increased domestic consumption. There is both increased frequency and larger volume per purchase for both fresh natural and smoked salmon," says the Norwegian Seafood Council's envoy to Germany, Kristin Pettersen.

In the third quarter, 5% more salmon was sold in discount chains compared to the same period last year.

"Compared to the price of meat and other seafood, the price of salmon is perceived as more stable than in previous periods. 55% of Germans say they are "flexitarians", meaning they switch between different proteins and reduce their share of meat. Salmon is the closest substitute for meat," explains Pettersen.

Good demand in China

China was the second largest growth market in November, with an increase of NOK 121m, or 33%. In total, importers in China bought Norwegian salmon for NOK 490m last month.

"China received a boost last year after the coronavirus pandemic, and the market was particularly strong at the beginning of 2023. This year, the import volume of Norwegian salmon has continued to increase, and this autumn the demand has been significantly stronger than at the same time last year," says Norwegian Seafood Council seafood analyst Paul Aandahl.

Norway is the largest supplier of fresh whole salmon to China and has a market share of about 45%.

Good month for trout

- Norway exported 6,595 tonnes of trout worth NOK 592m in November

- The value increased by NOK 34m, or 6%, compared to the same month last year

- There was a growth in volume of 4%

- Lithuania, Ukraine, and the US were the largest markets for trout in November

Lithuania had the largest value growth in November, with an increase in export value of NOK 45m, or 93%, compared to the same month last year.

The export volume to Lithuania ended at 1,142 tonnes, which is 93% higher than the same month last year.