Norway exported 13% more salmon in July but real-world earnings stayed flat

The Norwegian salmon industry exported a 13% larger volume of fish in July than in the same month last year but earned less per kilo in real terms, figures from the Norwegian Seafood Council (NSC) show.

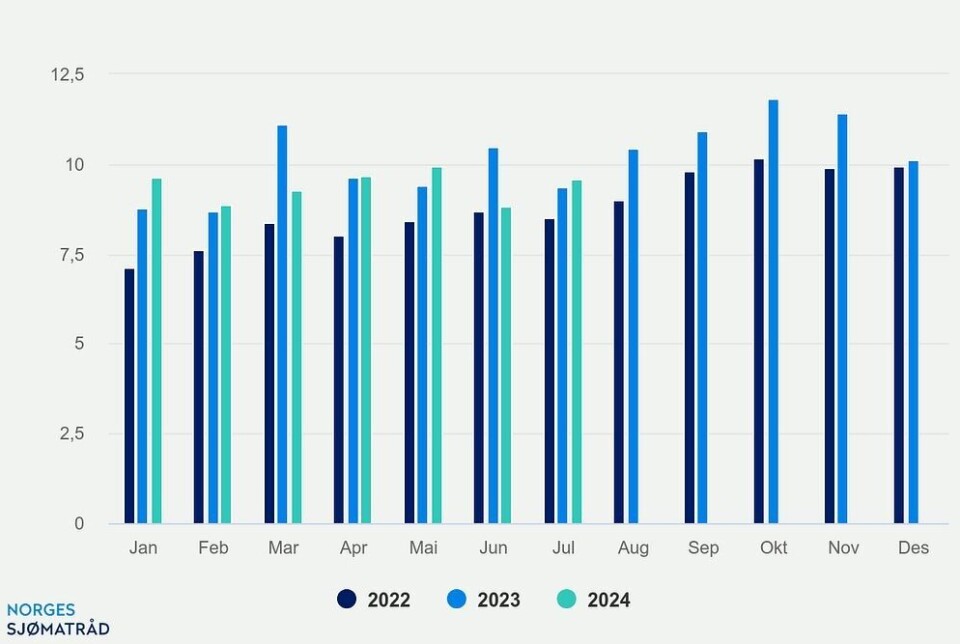

Norway exported 107,442 tonnes of salmon worth NOK 9.6 billion. That’s an increase of just 3% compared to July 2023, and that was due to a weaking of the krone against major currencies.

Measured in euros, the export value was unchanged from July last year, while measured in US dollars, the export value fell by 2%.

Growth in Germany

“Despite the fall in prices, the value of exports to several of the major markets is increasing,” said NSC seafood analyst Paul Aandahl.

“Germany saw the greatest growth in value in July, with an increase in export value of NOK 142 million, or 46%, compared with the same month last year. The export volume to Germany ended at 4,800 tonnes, which is 53% higher than the same month last year. This development must be seen in the context of low supplies at the beginning of the year, as well as the currency situation, which is favourable from an export perspective.”

Poland, the Netherlands and the United States were the largest markets for salmon in July.

Trout and cod

Norway exported 8,025 tonnes of trout worth NOK 698m in July.

The value increased by NOK 186m, or 36%, compared with the same month last year, and volume was up by 38%.

Thailand, Ukraine and the US were the largest markets for trout in July.

July was a bad month for wild caught cod but good for cod farmers.

The decline in landings of fresh cod continues, and the

export volume of fresh wild cod in July fell by 45% to just 1,429 tonnes, the

lowest July figure since 2019. The export value of fresh wild cod fell 37 per

cent to NOK 80 million.

For fresh farmed cod, the export volume increased by 200% to 955 tonnes, while the export value increased by 185% to NOK 58m. Farmed cod accounted for 42% of the export value of fresh cod.

“The decline in fresh cod exports is expected, with lower quotas resulting in fewer landings and a lower volume. At the same time, we see that exports of farmed cod are stable at around 1,000 tonnes per month,” said NSC seafood analyst Eivind Hæstvik Brekkan.

Currency effect

Overall, Norwegian seafood export value in July totalled NOK 13 billion, an increase of NOK 727m, or 6%, from the same month last year. The largest markets for Norwegian seafood exports in July were Poland, Denmark and the Netherlands, all of which are home to secondary processing sectors.

“The reason behind the increase in export value for July is a weakened Norwegian krone against both the euro and the dollar. We see that a sharp decline in salmon prices was compensated by volume growth, and in the end, it is the currency effect that adds value,” said NSC chief executive Christian Chramer.

UK demand soars

The United Kingdom saw the greatest growth in value, with an increase in export value of NOK 381m, or 64%, compared with the same month last year. The export volume to the UK ended at 19,092 tonnes, which is 117% higher than the same month last year.

“So far this year, total exports to the UK have grown by 8% in value terms in Norwegian kroner and by 12% in volume terms. Apart from a positive trend for salmon and trout, the other growth is mainly due to exports of fishmeal and fish oil,” said Victoria Braathen, the NSC’s director in the UK.

“Frozen whole cod has an overall volume growth of 3% and continues to take a larger share of Norwegian exports. The UK is a significant market for Norwegian haddock. It is positive to see a clear increase for both frozen and fresh whole haddock to the market in July.”