Salmon price plunge dents Norway's seafood export earnings

But revenues for first six months of 2024 were still the second-highest ever

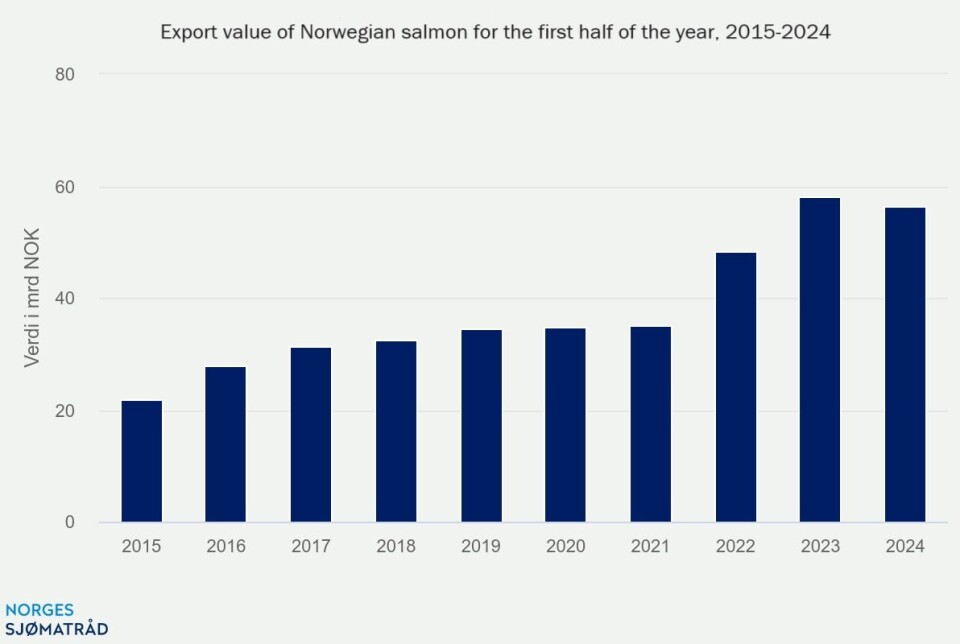

A dramatic fall in the price of farmed salmon in June has prevented Norway chalking up another six-month record for seafood earnings.

Nevertheless, seafood export revenues for the first six months of 2024 totalled NOK 80.6 billion (£6bn), the second highest half-year earnings ever recorded, and topped only by the NOK 82.2bn made in the same period last year.

“A weak Norwegian krone and high prices for cod and salmon boosted value in the first five months of the year. However, the growth stopped in June, which is largely driven by falling salmon prices,” said Christian Chramer, chief executive of the Norwegian Seafood Council.

In June, the value of seafood exports fell by 18%, or NOK 2.7bn, compared with the same month last year, largely due to lower salmon prices.

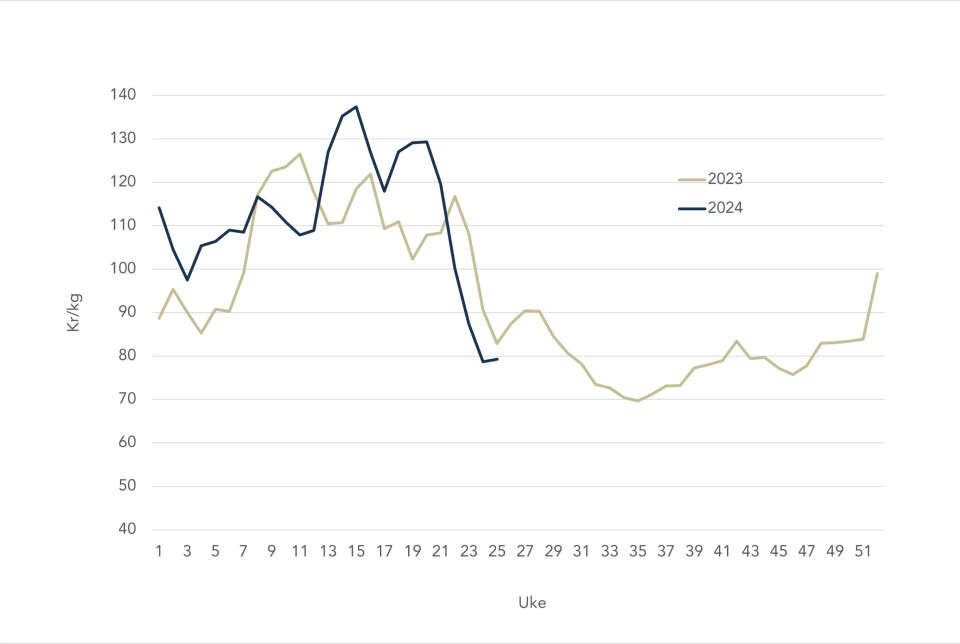

In May, the export price for fresh salmon was NOK 116.66 per kg. This fell to NOK 85.85 per kg in June, a record fall of NOK 30.81 per kg.

“Salmon still accounts for 70% of the total value of Norwegian seafood exports, so when the price of fresh whole salmon fell by as much as NOK 31 in June compared with the previous month, it had a major impact on the total value,” said Chramer.

“The situation was demanding in the first half of the year. Biological challenges resulted in lower harvesting volumes and a change in product composition towards more fillets. In June, global competition from other producer countries also increased, which had a negative impact on prices. The battle for salmon customers has now really intensified.”

Weakened spending

Demand in the major consumer markets is still characterised by weakened purchasing power.

“Even with lower inflation and the prospect of real wage growth in our key EU market, prices for both food and other goods have risen more than incomes in recent years. Real wages in the EU are not expected to return to 2021 levels until 2025,” said Chramer.

Norway exported 500,660 tonnes of salmon worth NOK 56.3bn in the first half of the year. Volume fell by 4% and revenue by NOK 1.8bn, or 3%, compared with H1 2023.

Poland, Denmark and the United States were the largest markets for salmon in the first half of the year. Both Poland and Denmark carry out secondary processing of salmon which is re-exported.

Still a record average

Despite June’s price fall, the average price of fresh whole salmon for the first half of 2024 was a record high of NOK 107 per kg, which is NOK 1 per kg higher than the previous record, set in the first half of 2023.

Norwegian Seafood Council analyst Paul Aandahl said June’s fall in salmon prices was primarily due to a 27% increase in the volume of fresh whole salmon in Norway compared with May.

“In addition, global competition is increasing. This has particularly affected prices to markets that have traditionally paid the most for salmon. In June, there was a big drop in prices to markets such as Italy, South Korea, China and the USA,” he explained.

44% more trout

Norway exported 29,839 tonnes of trout worth NOK 2.9bn in the first half of the year.

Volume increased by 44% compared to the same period last year, but revenue increased by only NOK 628 million, or 27%.

Ukraine, the US, and Thailand were the largest markets. Exports to Ukraine totalled 6,586 tonnes, which is 272% higher than in the first half of last year.

“Ukraine is a market for both salmon and trout. Despite a 30% decline in the export volume of salmon, the export volume of salmonids increased by 11%. The shift towards trout to Ukraine must be seen in the context of lower prices for trout compared with salmon,” said Aandahl.

So far this year, the average price of salmon to Ukraine is NOK 111.29 per kg, while the average price of fresh trout is NOK 88.69 per kg.

The price of fresh trout fillets is at a record high of NOK 154 per kg. This is NOK 7 per kg higher than the previous record, which was in the first half of 2023.

Records for farmed cod

Lower catch quotas led to Norway’s export volumes of wild cod falling by 29% to 22,014 tonnes in H1, but the export volume of fresh farmed cod increased by 28% to 6,436 tonnes, while the export value increased by 51% to NOK 372m. Farmed cod accounted for 21% of the export value of fresh cod in the first half of the year.

“The proportion of farmed cod has never been so high in the first half of the year. It is also both the highest export value and the highest export volume we have had for fresh farmed cod in a six-month period,” said Seafood Council analyst Eivind Hestvik Brækkan.

“With the prospect of a further decline in cod quotas in 2025, as well as continued growth in the production of farmed cod, farmed cod will account for an increasing share of cod exports from Norway.”