Production costs still going up in Norway

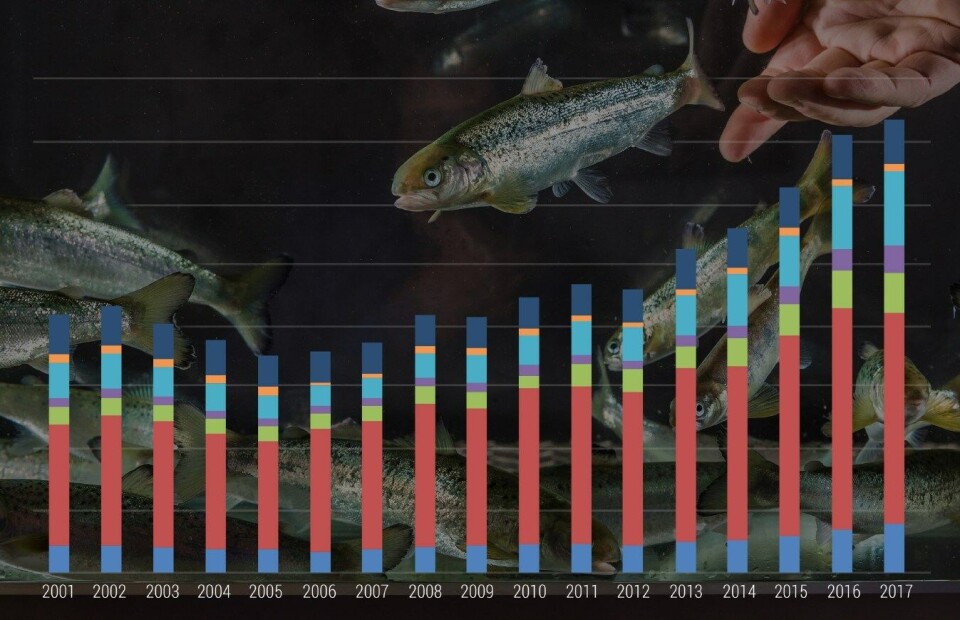

Production costs continued to rise in Norway’s salmon industry last year despite hopes that they had peaked in 2016, a new analysis has revealed.

The analysis by experts from Nofima and Kontali Analysis for the Norwegian Research Fund, FHF, showed costs up by around 4% in 2017.

“Last year, it looked brighter, with lower raw material costs and lice costs that seemed to be heading down. However,

unit costs increased from NOK36 per kg to close to NOK37.50/kg (finished, harvested and packaged), or about 4%,” they wrote.

Feed, lice control, smolts

They point out that feed prices, as well as the lice and disease situation, continue to have the biggest impact in terms of cost development.

“But we have also seen other cost items evolve, and in the year’s report, we have looked at smolt costs and the costs associated with investments in plant and equipment.”

Changes in these costs reflect changes in the challenges the industry has and changes in operational strategies to meet the challenges, the analysts explain.

The big question is whether cost increases have now stopped.

£6.19 billion turnover

“Right now, the industry is in the middle of the most demanding period of lice handling. To be on the safe side, we may not imply that costs have stopped increasing,” they write.

Overall, Norwegian fish farmers turned over NOK 66.3 billion (£6.19bn) in 2017, made a combined operating profit of approximately NOK 21bn (£1.96bn) and paid a total of NOK 4.7bn (£438m) in taxes.

A much more in-depth look at the Norwegian industry’s figures and a full analysis are available in the current NF Expert nr3 edition of Fish Farming Expert’s sister magazine, Norsk Fiskeoppdrett magazine (in Norwegian). Much of the information will also be the November edition of Fish Farming Expert.