A laser focused investment

Danish company Novo Holdings' purchase of a majority take in Stingray gives long-term stability to firm offering an innovative sea lice solution

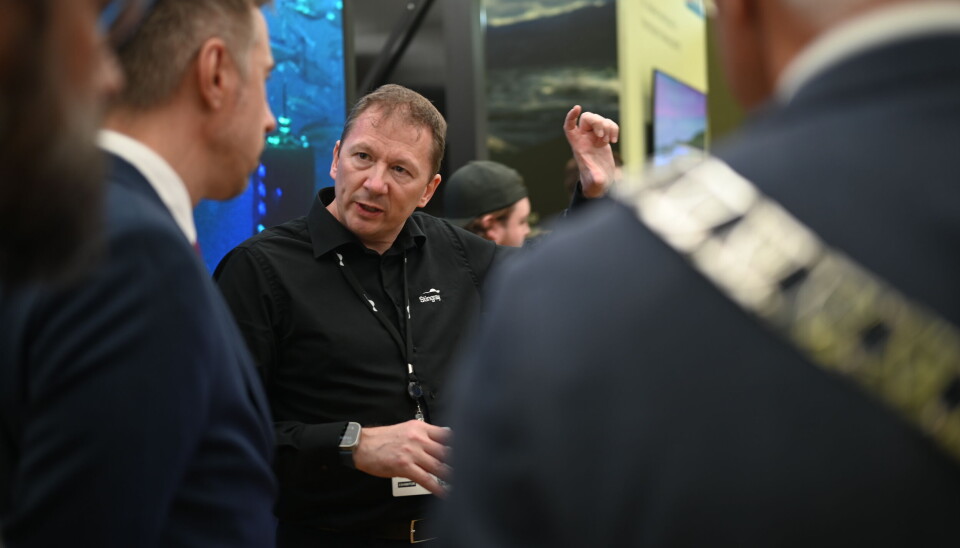

"This is a huge recognition of many years of hard and targeted work from the entire Team Stingray, and we are very pleased to welcome Novo Holdings as the new main shareholder in Stingray Marine Solutions AS," stated Stingray chief executive John Arne Breivik in a press release.

He added that the acquisition will provide the company with financial security and long-term stability, but that the employees and management will still have significant ownership going forward.

It has been 10 years since Stingray launched its salmon lice laser for removing salmon lice, using camera technology, advanced software, and a targeted laser which is controlled by artificial intelligence. The company is approaching 200 employees and soon a billion Norwegian kroner in annual revenue.

Stingray has produced 1,750 lasers so far and has installations at more than 100 locations at over 30 aquaculture companies.

First in aquaculture

The acquisition of Stingray is the first investment in aquaculture technology for Novo Holdings, which had assets worth €149 billion under management at the end of 2023.

"We are pleased to invest in a company that not only offers an innovative solution for the aquaculture industry, but also has sustainability as a core value. This is an important factor in the marine sector and for the entire aquaculture industry," said Cynthia Kueppers, partner at Planetary Health Investments at Novo Holdings.

Planetary Health Investments operates in Europe, North America, and Asia, and invests in areas where science and technology can help solve global challenges.

Carnegie was the financial advisor and Schjødt was the legal advisor for Stingray and the sellers, while DNB Markets was the financial advisor for Novo Holdings.