Mowi celebrates record revenues and ups harvest guidance for 2025

Salmon farming giant Mowi generated record-high operating revenues of €1.5 billion (£1.25bn) in the fourth quarter which translated into an operational profit of €226 million (Q4 2023: €203m).

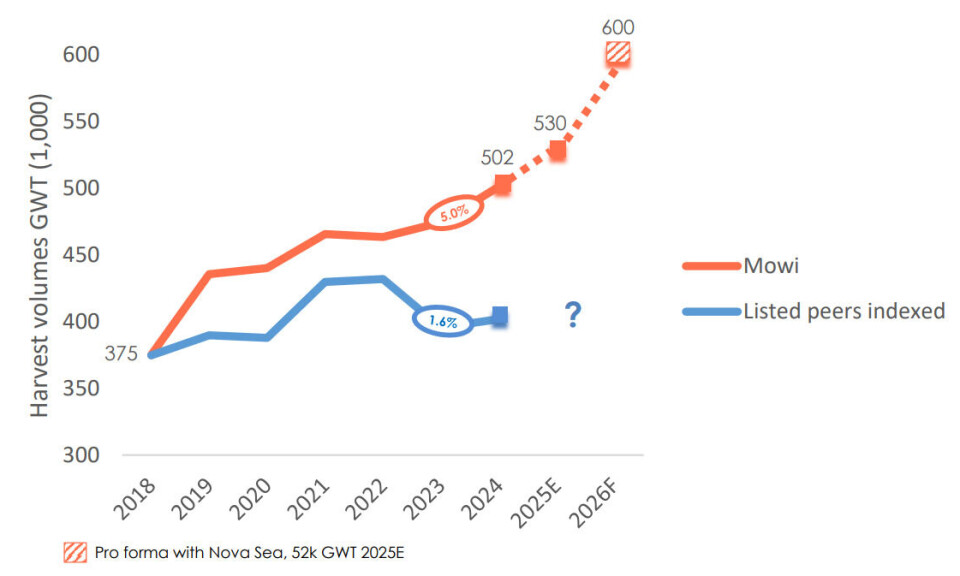

Mowi said it ended 2024 with a string of records, for both the fourth quarter and the full year. It has never had higher turnover and harvest volumes than in 2024 when revenue was €5.62bn on 502,000 tonnes of salmon harvested. A harvest volume of 134,000 tonnes in Q4 was a seasonal record.

Operating profit for 2024 was €828.9m, down from €1.027bn in 2023. Overall profit for the year was €474.8m (€439.5m).

“Our margins show that we were once again competitive on cost in 2024, which is vitally important in salmon farming. Falling feed prices have also contributed to somewhat reduced costs, and we expect that trend to continue in 2025,” said chief executive Ivan Vindheim.

Upgraded volume guidance

The company’s seawater production was very strong in the fourth quarter, and this has continued into 2025, Mowi said in a press release about its Q4 and full year 2024 results. This has led to the company adjusting harvest volume guidance for 2025 upwards from 520,000 gutted weight tonnes to 530,000 gwt.

With Nova Sea on board, we expect our volumes to reach 600,000 tonnes next year, and we will be well on our way to harvesting 400,000 tonnes in Norway alone.

Mowi CEO Ivan Vindheim

Mowi’s recent agreement to increase its ownership of Norwegian salmon farmer Nova Sea from 49% to 95% will boost harvest volumes further from 2026.

“With Nova Sea on board, we expect our volumes to reach 600,000 tonnes next year, and we will be well on our way to harvesting 400,000 tonnes in Norway alone,” said Vindheim, who highlighted the company’s dramatic expansion in recent years.

“Mowi was harvesting 375,000 tonnes globally as recently as 2018, so our volumes will have grown by 225,000 tonnes in just a few years. This corresponds to annual growth of 6.1% compared with 3.1% for the wider industry,” he said.

Will keep on growing

Volume growth across the value chain is an important strategic pillar for Mowi and the company has no plans to stop growing now, it said.

“We will continue to invest in the whole value chain and have a number of growth initiatives underway. Perhaps the most important of these is our post-smolt strategy, which is now starting to show results. We expect larger, more robust smolt to have a significant impact to our biological performance, including on fish welfare,” explained Vindheim.

Mowi Consumer Products, the group’s value-added business, had a strong quarter and year with record high operational profit of €53m for Q4 and €146m for the year. Consumer Products, which includes a secondary processing facility in Rosyth, Scotland, also set a new volume record, producing 247,000 tonnes in the year, up 6.5% on 2023.

“We are seeing good retail demand for our products and continue to develop new and innovative high-quality products to keep up with new trends and consumers’ ever-changing needs,” Vindheim said.

Strong results for Feed

Mowi Feed also had another strong quarter, delivering record volumes and revenues. The full year was also record-breaking, with operational profit of €62m on 585,000 tonnes of feed.

“Our feed division has seen substantial growth in recent years, most recently growing by 12% in 2024 compared with the previous year. With Nova Sea on board we will need additional feed capacity in Norway in order to continue to grow, therefore we are undertaking a 60,000-tonne expansion project at our feed plant at Bjugn, Norway, with expected completion in the second quarter of 2026,” Vindheim said.