Mowi reports record harvest volume but operating profit falls

The world’s biggest salmon farmer, Mowi, harvested an all-time high volume of 161,000 gutted weight tonnes in the third quarter of this year, and made record-high revenue of €1.44 billion (£1.2bn).

But lower spot prices limited Mowi’s operating profit to €173 million, down from €203.1m in the same quarter last year, when the company harvested 26,000 fewer gutted weight tonnes. It is the lowest operating profit in the last five quarters.

Focusing on Mowi’s steadily increasing harvest volumes, chief executive Ivan Vindheim said: “We’ve never had more fish in the sea, with biomass in sea up 4.4% year-on-year at quarter end."

Outpacing the industry

The company said in a press release that it is well positioned to meet its harvest volume guidance of 500,000 gwt for 2024, and that record-high biomass in the sea supports 2025 volume guidance of 520,000 gwt. Mowi aims for an annual harvest of 600,000 gwt by 2029.

The salmon farmer said 520,000 tonnes in 2025 represents growth of 145,000 tonnes since 2018, equivalent to 4.8% compound annual growth rate, almost double the 2.7% average for the industry.

“We aim to continue growing faster than the wider industry, by expanding our use of post-smolt and through increased smolt release. We expect another year with limited supply growth for the wider industry at 2% or lower,” Vindheim said.

Norway

Mowi’s farms in its primary production area, Norway, harvested 105,776 gwt (Q3 2023: 86,228 gwt) of salmon in Q3, and made the highest operating profit of €1.38 per kilo, although this was lower than the €2.15/kg made in Q3 2023.

Operating profit was €145.5m (€185.51m).

“Lower market prices adversely impacted results. Earnings were also negatively influenced by gill issues and high sea lice pressure, especially in the last part of the quarter, on the back of record-high sea temperatures from central Norway and northwards. These issues were partly offset by all-time high harvest volumes,” wrote Mowi in its Q3 2024 report.

Incident-based mortality costs amounted to €25.7m (€18.8m).

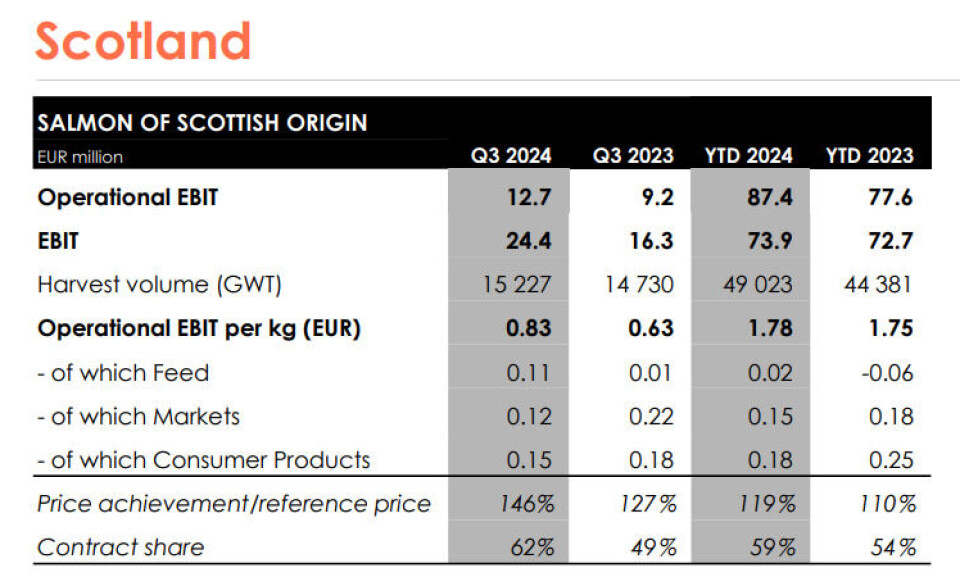

Scotland

In Scotland, Mowi harvested 15,227 gwt (14,730 gwt) and made an increased operating profit per kilo of €0.83 (€0.63). Operating profit was €12.7m, up from €9.2m in the same period last year.

Volume guidance for this year is 64,000 gwt, rising to 67,000 gwt next year.

“Cost decreased from the comparable quarter on the back of the downward trend in feed prices and higher survival rates combined with higher average weights,” reported Mowi.

“Production, mortality, feed conversion rate and harvest weights all improved from the comparable quarter.

“Sea temperatures have been lower than in Q3 2023 and the seasonal challenges associated with algae and jelly fish have been less of an issue this year. Amoebic gill disease remains relatively high, but higher treatment capacity is available to Mowi Scotland, due to the challenging presence of this gill condition in recent years.”

Chile

In Chile, Mowi harvested 23,211 gwt, up from 17,651 gwt in Q3 last year. Operating profit was €13.6m (€8.5m) and operating profit per kilo was €0.59 (€0.48).

“Overall biological performance was good in the quarter, although there were challenges at certain sites related to presence of jellyfish during the fall and subsequent SRS (rickettsia) outbreaks. As part of Mowi Chile's efforts to further improve operations, the use of freshwater treatments have been ramped up, with good results so far for sea lice and gill issues,” Mowi wrote.

Ireland, Faroes, Iceland

Mowi harvested 3,663 gwt (1,994 gwt) in Ireland, and almost trebled operating profit to €4.3m (€1.5m). Operating profit per kilo was €1.18 (€0.75).

In the Faroes, Mowi harvested 3,051 gwt, an increase on the 2,532 gwt harvested in Q3 2023, but made a reduced operating profit of €1.8m (€4.8m). Operating profit per kilo was €0.61 (€1.91).

“Earnings and margins for Mowi Faroes were reduced on lower sales prices and higher cost compared with the third quarter of 2023, partly offset by higher harvest volumes. We harvested from the site Haldórsvik in the quarter which carries a higher cost level compared to our other sites in the Faroes,” reported Mowi.

The company’s farms in Iceland harvested 3,407 gwt (4,383) and made an operating profit of €1.3m (€0.9m). Operating profit per kilo was €0.37 (€0.20).

Canada

Mowi Canada recorded a loss of €-3.6m (€-4.6m), due to algal blooms in the Port Hardy and Klemtu regions of British Columbia (BC). Mowi Canada West consequently made a loss of €-3.9m, mitigated slightly by an operating profit of €0.3m made by Mowi Canada East, which turned around from a €-4.1m loss in the same period last year.

“Harvest volume was 6,684 gwt (7,485 gwt),” Mowi wrote. “In Canada West, the harvest volume was 6,228 tonnes, up from 5,855 tonnes in the comparable quarter due to site mix. In Canada East, the harvest volume was low, with only 456 tonnes (1,630 tonnes) in the quarter due to lower opening biomass.”

Mowi is guiding for a lower harvest volume of 16,000 gwt for 2025 for BC (21,000 gwt for 2024) and an increased volume of 15,000 gwt for Canada East (9,000 gwt for 2024).

Earlier this year Mowi announced a strategic review of its operations in BC following a federal government decision to ban open net pen salmon farms in the province by July 2029. “This is now ongoing. Mowi will explore all available options before taking the appropriate action,” the company said in its report today.

Value added products

The lower salmon prices in Q3 spelled good news for Mowi’s Consumer Products secondary processing division, which recorded a record operating profit of €43.5m (€39.7m).

“Operational performance was good, volumes were strong and seasonally lower raw material prices contributed positively,” reported Mowi, which employs hundreds of people at its secondary processing facility in Rosyth, Fife. “Margin pressure in Europe was more than compensated by an improved result in the US and strong performance in Asia.”

Feed

Q3 was also the best ever quarter for Mowi’s Feed division, which includes a feed mill at Kyleakin, Skye. The division recorded record-high operational EBITDA (earnings before interest, tax, depreciation and amortisation) of €25.2m (€20.3m).

Operational EBITDA in Norway was €20.3m (€17.5m) and €4.9m (€2.9m) in Scotland.

“Sold volumes from our Feed division were record-high at 191,279 tonnes (168, 945 tonnes) following good seawater growth and demand from Farming,” reported Mowi. “Produced volumes were also all-time high at 162, 100 tonnes (145,943 tonnes).”

The volume delivered from Mowi Feed to its European farming operations accounted for 96% (93%) of total feed consumption in the third quarter.

Raw material costs decreased from the third quarter of 2023, said Mowi.

“Raw material market prices have improved for most input factors. During 2023 this decline was offset by high prices for marine ingredients, i.e. fish oil and fish meal. In 2024, these prices have also come down, positively affected by the good results of the first anchovy wild catch season in Peru with regards to volumes and yield, and expectations also of good fisheries ahead.”