Mowi profits rocket on back of soaring salmon prices

The world’s biggest Atlantic salmon farmer, Mowi, almost doubled its operating profit in the first quarter of 2022 compared to the same period last year because of high spot prices, it reported today.

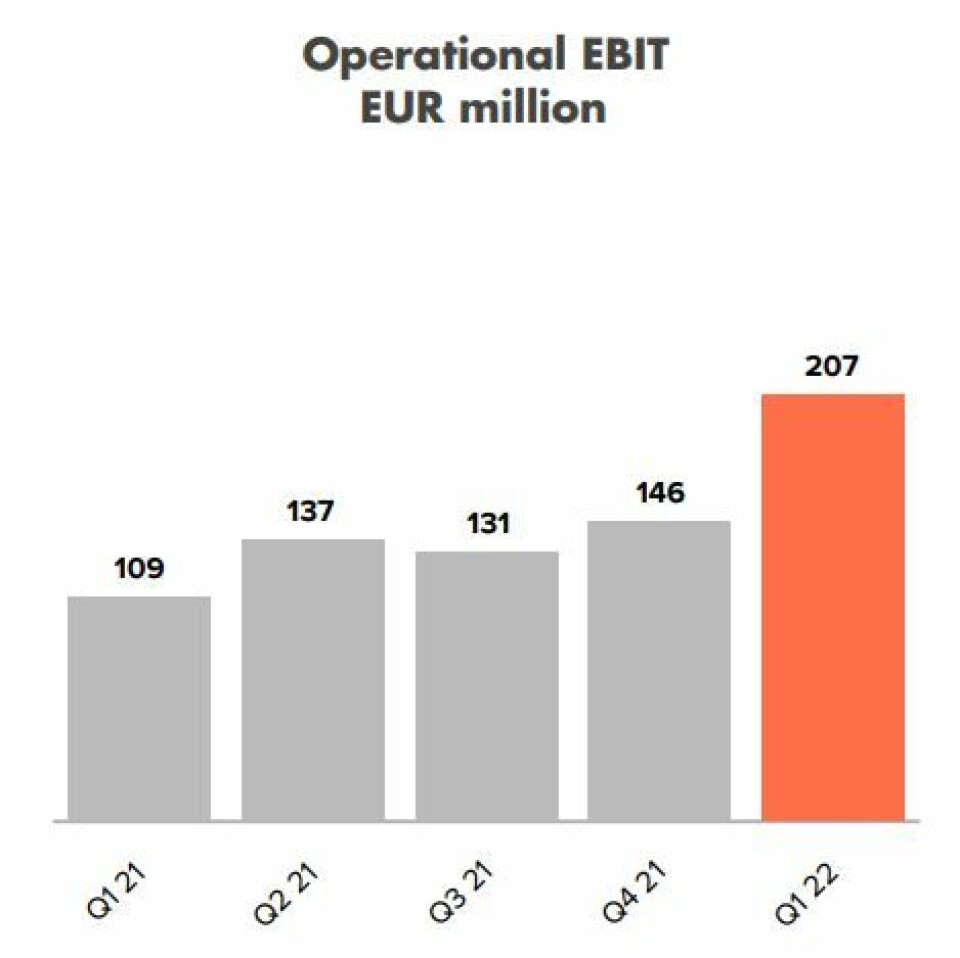

Mowi made operational EBIT of €207 million (Q1 2021: €109m) on record revenues of €1,095 million (€1,022m).

The increased operating profit and revenues were made despite the company’s Q1 harvest of 96,600 tonnes gutted weight being 28,869 tgw (23%) lower than in Q1 last year. Full-year harvest guidance for 2022 is unchanged at 460,000 tonnes.

‘Strong megatrend’

“The increase in salmon prices coming out of the pandemic have been impressive. Salmon is a fantastic product with great product features and the beneficiary of strong megatrends, and I firmly believe this will continue to boost demand going forward,” said Mowi chief executive Ivan Vindheim in a press release.

Mowi Farming’s results improved substantially in the quarter, driven by the high prices.

“I am pleased to see that our Norwegian Farming operations achieved record-high earnings and prices in the first quarter. It is also encouraging that our operations in Canada West are improving and delivering solid results,” Vindheim said.

Lower earnings in Scotland

Mowi Scotland’s operating profit of €10.7m was much lower than the €26.6m made in Q1 2021, partly due to a lower harvest of 10,541 tgw (18,273 tgw). The lower harvest volumes meant that the contracted share of Mowi Scotland’s sales made up a higher percentage of its overall sales than it would have wanted during a time when spot prices were at record high levels. The proportion of fish sold on contract rose from 43% in Q1 2021 to 77%.

“As a result of the high spot prices, contribution from contracts relative to the reference price was negative in the first quarter of 2022 compared with a positive effect in 2021,” said Mowi.

Organic salmon farmer Mowi Ireland’s operational EBIT was €2.5m (€5.3m) on a harvest of 667 tgw (1,157 tgw). Mowi said the reduction was mainly due to the lower harvest volume, partly offset by improved costs. Sales of eggs to Mowi Scotland contributed positively to the result, and the Irish operation again had the highest operational EBIT per kilo, earning €3.71 (€4.55).

Canada turnaround

Mowi Canada pivoted from a €3.9m operation loss in Q1 2021 to an operational EBIT of €22.5m in the first quarter of this year, despite a lower harvest volume of 8,759 gwt (10,741 gwt). Unlike Mowi Scotland, the Canadian operation had no contracts to fulfil and was able to sell all its fish on the spot market.

“Market prices for salmon of Canadian origin increased significantly in the quarter on strong demand and reduced supply into the North American market, particularly from Chile, compared with the first quarter of 2021,” said Mowi in its Q1 2022 report.

Overall production and biological performance in Canada improved compared with the first quarter of 2021.

Consumer Products

Mowi Consumer Products also delivered another good set of results considering the record high raw material prices, by means of sound operational performance and raw material management.

“It is comforting that Mowi’s processing business continues to deliver strong results despite significantly higher raw material prices. This demonstrates the value of Mowi’s integrated value chain and the organisation’s relentless quest for increased productivity and cost efficiency,” Vindheim said.

Mowi said that although the world economy is currently facing an unprecedented inflationary pressure, soaring salmon prices have so far more than offset increasing input prices for salmon.

Salmon will stand out

“We expect salmon to continue to stand out versus other animal protein sources due to its substantially lower feed conversion rate and energy usage, and its superior sustainability credentials,” Vindheim said.

Mowi’s board has decided to pay a quarterly dividend of NOK 1.95 per share, consisting of NOK 1.44 per share in ordinary dividend and an extraordinary dividend of NOK 0.51 per share supported by a strong financial position and a favourable outlook.