Mowi Scotland shines as fish health improves

Mowi Scotland outperformed all the company’s other farming operations except Ireland in the last quarter of 2020, mainly due to lower costs following improved biological performance.

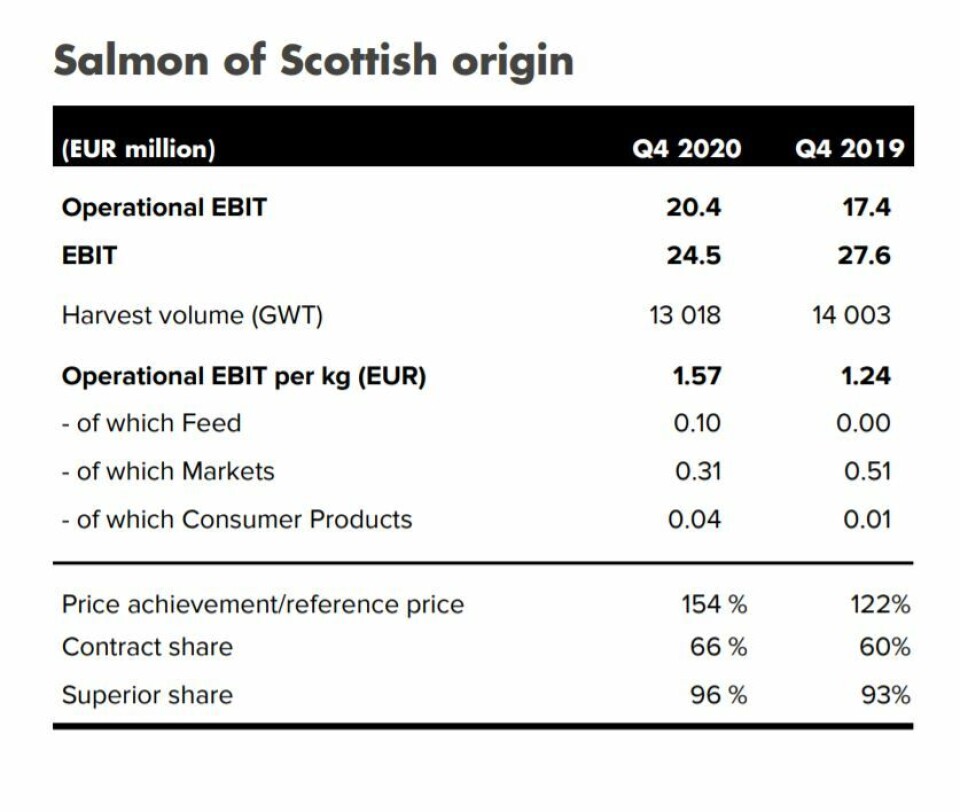

The Scottish subsidiary made an operational EBIT of €20.4 million on a harvest volume of 13,018 gutted weight tonnes in Q4, and an operational EBIT per kilo of €1.57.

In comparison, Mowi’s Norway operation made an operational EBIT of €58.9m on a harvest of 78,473 gwt, which worked out at an operational EBIT per kilo of €0.75.

66% contract share

“The overall price achieved [in Scotland] was as much as 54% above the reference price in the quarter (Q4, 2019: 22% above),” Mowi wrote in its Q4 2020 report today.

“Contribution from contracts relative to the reference price was positive in the fourth quarter of both 2020 and 2019. The contract share was 66% in the quarter compared with 60% in the fourth quarter of 2019. In addition, spot performance was strong in the quarter.

“The fourth quarter harvest volume was 13,018 tonnes gutted weight, which was somewhat lower than the 14,003 tonnes in order to build biomass. Average harvest weight improved by 14% from the comparable quarter.”

Reduced PD and CMS

Biology had in general improved in Scotland the Q4, said Mowi, with a notable reduction in sites positive for pancreas disease (PD) and cardiomyopathy syndrome (CMS).

“Additionally, the combination of vaccination and reduced mechanical treatments resulted in much lower levels of Pasteurella Skyensis,” the company reported.

“Full cost per kg harvested was reduced by 7% from the comparable quarter. Seawater costs improved mainly related to lower health costs and a generally reduced cost level for the harvested sites. Non-seawater costs improved mainly due to lower mortality costs.”

Incident-based mortality losses amounted to €1.6m, mainly related to gill issues. This is a significant reduction from Q4 2019, when losses cost Mowi Scotland €10.7m.

Ireland does well

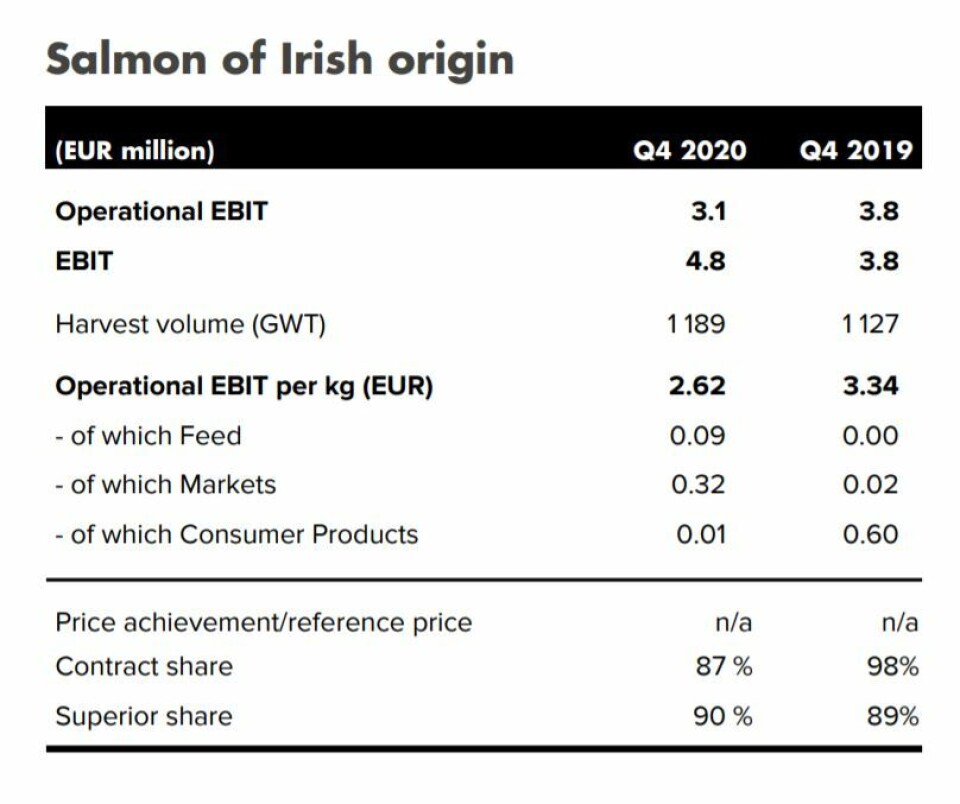

Mowi Ireland, which produces organic salmon, was the best performer in Q4. It made operational EBIT per kilo of €2.62 on a harvest of 1,189 gwt.

“Operational EBIT amounted to €3.1m in the fourth quarter (€3.8m),” reported Mowi. “Lower prices and allocated margin as well as somewhat increased costs negatively affected the earnings. Although the quarterly results were somewhat reduced from Q4 2019, full year earnings for 2020 were the second best ever for our Irish operations.”

Losses in Canada, Chile and Faroes

Mowi Canada reported an operating loss of €14.1m in Q4 on a harvest of 12,417 gwt, higher than the €8.7m operating loss made in Q4 2019, largely due to increased costs.

“Cost per kg harvested in the fourth quarter of 2020 increased by 13% from the comparable quarter. The salmon harvested in the quarter carried a high cost level due to a prolonged period of environmental challenges both in Canada West and East,” wrote Mowi.

“Furthermore, costs were impacted by low harvest volumes and mortality costs related to knock-on effects from the algal bloom in Canada East during the summer and autumn of 2020 and gill issues in Canada West.

Higher harvest weights

“Overall production and biological performance in Canada West improved somewhat in the quarter. Average harvest weights were 10% higher than in the fourth quarter of 2019. In Canada East, biological conditions are in general more challenging.”

Mowi Chile made an operating loss of €9.9m in Q4 (€13.2m), as a result of low prices caused by the market effects of the Covid-19 pandemic.

Mowi Faroes made an operating loss of €1.1m due to lower volumes, reduced prices and higher costs.

Record harvests

Overall, Mowi harvested 126,634 gwt in Q4, which was an all-time high for a quarter and took the company’s annual harvest volume to a record high of almost 440,000 gwt. It also produced a record-high 540,000 tonnes of feed in 2020.

Mowi made an operational EBIT of €49.4m in Q4, down from €165.7m in Q4 2019, and €337.7m for 2020, which is less than half the €720.9m earned in 2019.

“The pandemic still impacts out-of-home consumption to a large degree, and although retail sales are strong and offset some of the demand shortfall, overall demand was down by approximately 5%,” said Mowi chief executive Ivan Vindheim.

“However, we still strongly believe in the positive long-term market outlook for the industry. A significant share of new customers in retail are expected to permanently increase their retail consumption rates post Covid-19, even as the foodservice segment gradually re-opens in due course.”