Mowi Scotland chalks up record Q2 harvest and doubles operating profit

Mowi Scotland harvested a second-quarter record volume of salmon this year and more than doubled its operating profit compared to the same period in 2020.

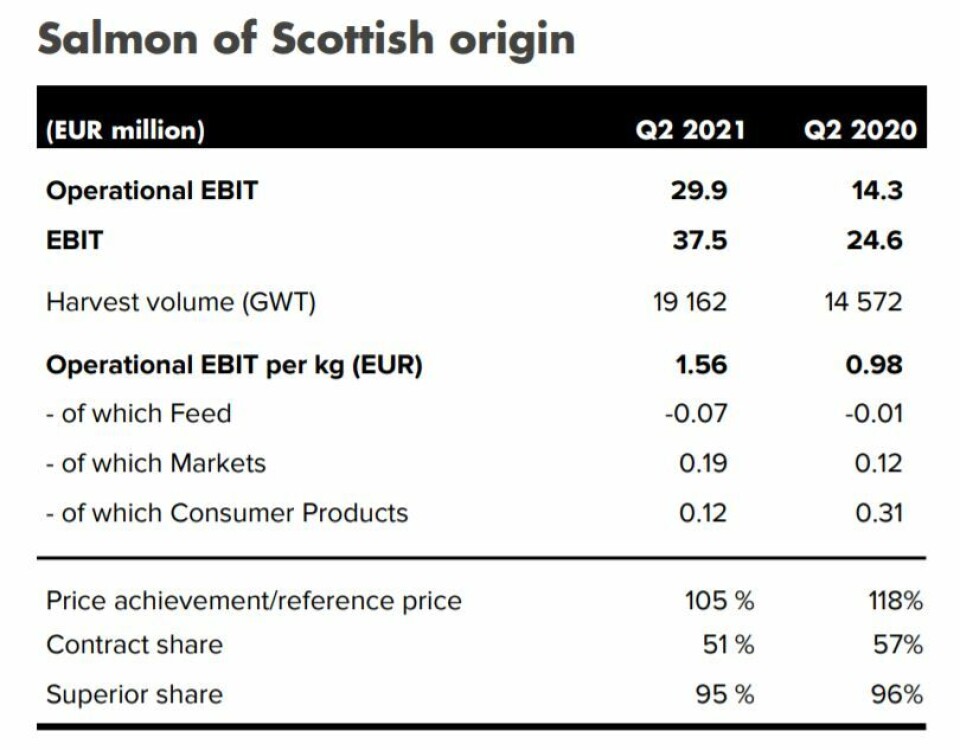

The Scotland division of the world’s biggest salmon farmer made an operational EBIT of €29.9 million (£25.6m), compared to €14.3m in Q2 last year.

Mowi Scotland harvested a record Q2 volume of 19,162 gutted weight tonnes of Atlantic salmon (Q2 2020: 14,572 gwt) and made an operational EBIT per kilo of €1.56 (€0.98).

The increased earnings were due to improved costs and higher spot prices, as well as the record Q2 volumes which came on the back of improved biological performance, Mowi said in its Q2 report today.

Increased guidance

The company has lifted its full year harvest guidance for Scotland from 60,000 gwt to 65,000 gwt.

“Biology has in general improved compared with the second quarter of 2020,” stated Mowi in the report.

“There continues to be a notable reduction in PD (pancreas disease) cases within Mowi Scotland and Pasteurella Skyensis detections have been absent throughout the first half of 2021 following the introduction of a vaccine in 2020.

“However, CMS (cardiomyopathy syndrome) remains at a relatively high rate of detection.”

Incident based mortality losses amounted to €1.5 million (€2.7m) mainly related to treatment losses and CMS.

Lice levels ‘normal’

Mowi said sea lice levels in the Q2 were normal at most locations and the arrival of a second freshwater treatment vessel, along with the high availability of cleaner fish from the company’s breeding programme in Anglesey, North Wales, had provided additional control methods.

Full cost per kg harvested was reduced by 8% from the comparable quarter, mainly related to lower feed costs, improved feed conversion ratio, lower health-related costs, lower mortality costs and a generally lower cost level for the harvested sites. There were also positive scale effects from higher harvest volumes compared with Q2 2020.

However, costs were expected to increase in the current quarter due to harvesting from sites with a higher cost level.

Prices 25% higher

Overall, Mowi reported an operational EBIT of €137m in the second quarter of 2021, compared with €99m in the corresponding quarter of 2020.

“Demand for salmon has strengthened as Covid-19 measures have become less restrictive in most countries,” said Mowi chief executive Ivan Vindheim.

“The demand response was impressive during the quarter with approximately 25% higher global salmon prices year-on-year despite a relatively high global supply growth of 9% including frozen inventory release from Chile.”

Norway and Chile

Mowi’s biggest division, Norway, contributed the most, followed by Scotland, Chile, the Faroes and Ireland. Mowi Canada, which has had problems with infectious salmon anaemia and is in the middle of rebuilding its Atlantic coast business, recorded a loss.

Mowi Norway made an operational EBIT of €93m (€60.1m) on a harvest volume of 56,085 gwt (56,598 gwt). Operational EBIT per kilo was €1.66 (€1.06).

Mowi Chile made an operational EBIT of €14.9m (€11.7m) on a harvest volume of 15,128 gwt (14,227 gwt). Operational EBIT per kilo was €0.98 (€0.82).

Ireland and Faroes

Mowi Ireland, which produces organic salmon, made an operational EBIT of €3.4m, much lower than the record-high €15.3m made in Q2 2020 as a result of a lower harvest volume of 1,850 gwt (4,002 gwt). Operational EBIT per kg was €1.84 (€3.83).

“Harvest volume was 1,850 tonnes gutted weight in the second quarter, a reduction from 4,002 tonnes in the comparable quarter. Last year, harvest volumes were postponed from the first to the second quarter,” stated Mowi.

“Full cost in the quarter was up on significantly lower volumes and increased non-seawater costs.”

Few sites

Mowi Faroes made an operational EBIT of €4.5m (€6.6m) on a harvest volume of 2,356 gwt (3,488 gwt).

“Harvest volumes will fluctuate from year to year in our Faroese operations due to low number of sites, and harvesting was low towards the end of the quarter in order to build biomass for the second half of 2021,” explained Mowi in the report.

“Cost per kg harvested biomass increased compared with the second quarter of 2020. Mowi Faroes harvested from the Haldórsvik site in the second quarter of 2021 compared with Mowi Faroes’ best performing site, Oyndarfjørdur, in the comparable quarter.”

Canada loss

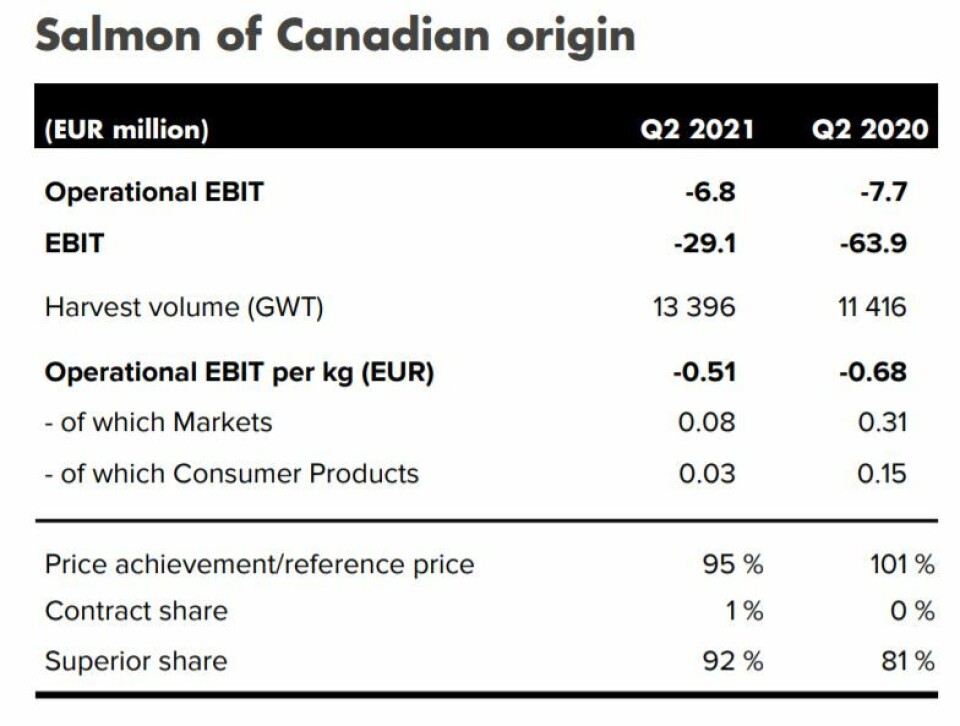

Mowi Canada, which operates on the Pacific and Atlantic coasts, made an operating loss of €6.8m (-€7.7m) on a harvest of 13,396 gwt (11,416 gwt). Operational EBIT per kilo was -€0.51 (-€0.68).

“Earnings were significantly impacted by the recognition of a loss in Mowi Canada East of €15.0 million in the quarter mainly related to harvesting out ISA (infectious salmon anaemia) fish in Newfoundland which impacted price achievement and cost,” wrote Mowi.

“Financial EBIT amounted to -€29.1 million (-€63.9m), and was negatively impacted by impairment losses of €39.8m in Mowi Canada East related to the turn-around plan decided in the first quarter.”

€6m ISA cost

Incident-based mortality losses amounted to €6.0m related to ISA in Canada East (€1.7m).

“Overall production and biological performance in Canada West was stable in the quarter. In Canada East, operations and performance were negatively impacted by the ISA challenges.

“The turn-around of Mowi Canada West and East is progressing. However, due to the length of the production cycle it will take time before this will take down the cost level.”