High prices push Mowi Scotland’s profits up in Q4

The demand for high-quality Scottish salmon has been highlighted in fourth-quarter results from the country’s biggest producer, Mowi.

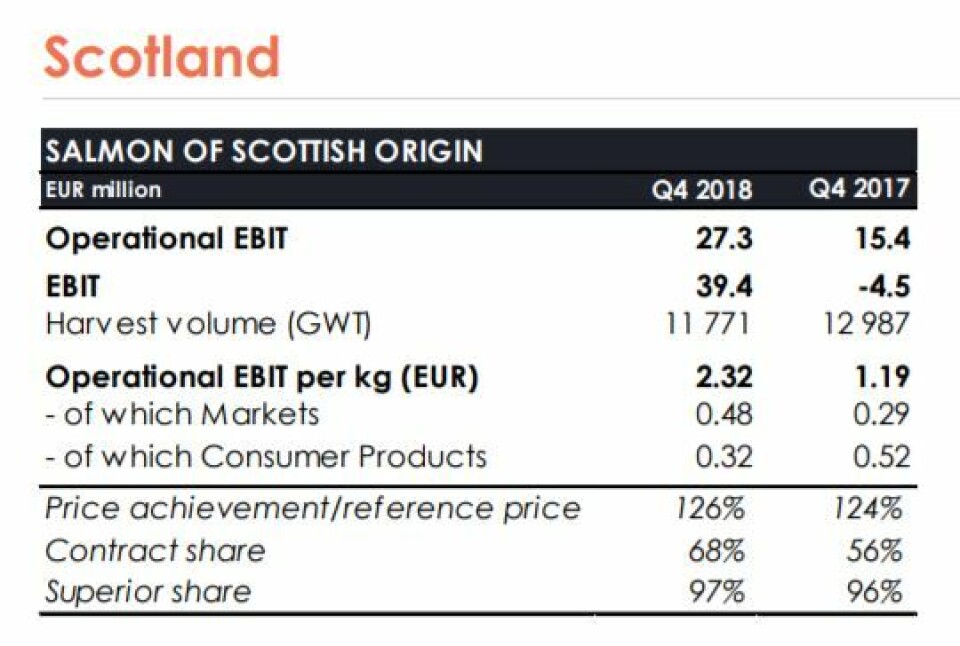

Mowi Scotland (formerly Marine Harvest Scotland) made an operating profit of €27.3 million in Q4 2018, nearly double the €15.4m made in the corresponding period in 2017.

In its Q4 results presentation today, Mowi said the good result was driven by a very good price achievement, with Mowi Scotland’s salmon selling for 126% of the reference price.

Improved biology

Reduced costs due to improved biology, good growth and a significantly higher biomass in the sea also point to a successful 2019 for Mowi’s Scottish operation, which plans to ramp up its harvest from 38,400 gutted weight tonnes in 2018 to 60,000 gwt this year.

Overall, Mowi – the world’s biggest salmon farmer – achieved an operational EBIT of €213m in Q4 2018, (Q4 2017: €181m). For the full year, Mowi made an operational EBIT of €753m, the second-best year ever financially for the group.

Mowi achieved an operational revenue of €1,074m in the quarter and €3,815m for 2018. Full-year turnover is a record high for the group.

Strong demand

“2018 was a very good year for Mowi. Strong demand for salmon and high prices in all markets resulted in great earnings for the company. I am proud of all my colleagues who work hard to produce healthy and tasty seafood for consumers all over the world. They have all contributed to the strong results,” said Mowi chief executive Alf-Helge Aarskog.

Mowi reported operational revenues of €1,074m (€1,010m) in Q4. Total harvest volume was 105,783 gwt (112,628 gwt). Harvest guidance for 2019 is 430,000 gwt.

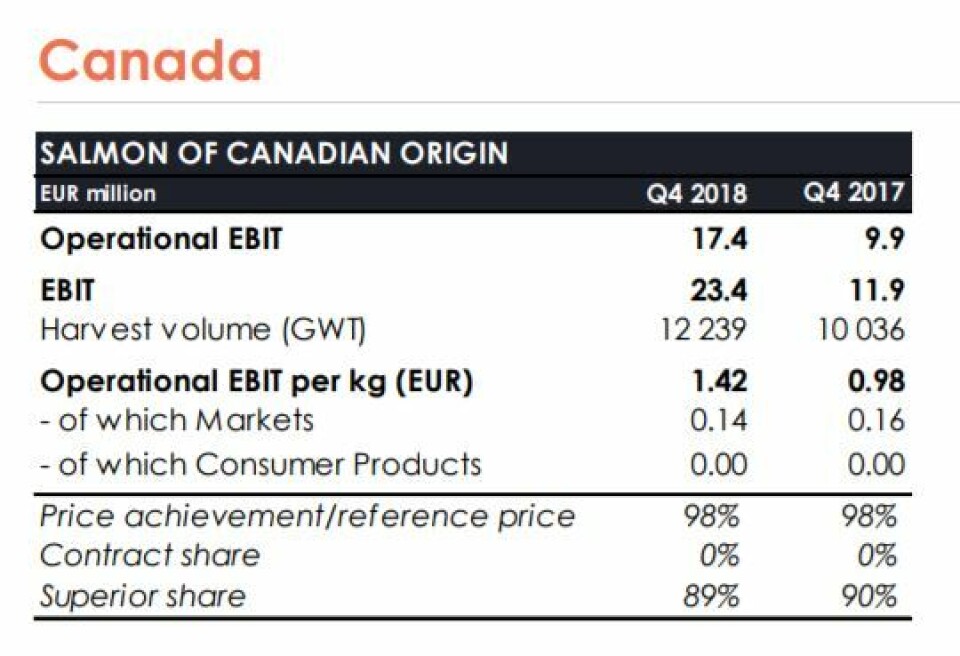

Salmon of Irish origin achieved the highest operational EBIT per kilo of €2.45 in Q4, a cent ahead of Norwegian salmon’s €2.44 (€1.77). Salmon of Scottish and Canadian origin achieved €2.32 (€1.19) and €1.42 (€0.98) respectively. Faroese salmon made an operational EBIT of €1.36 (€3.13) and salmon from Chile made €1.25 (€1.03).

€61m cost savings

Mowi Feed reported an operational EBIT of €5.8m (€ -2.8m). Mowi Consumer Products reported an operational EBIT of €38.0m (€29.1m).

Mowi saved €61m in last year’s cost improvement programme and intends to tighten its belt again this year, targeting a further €30m in savings.

In Norway, where Mowi grows nearly two-thirds of its fish, the group reported good results and improved biology in Region North, good results but biological challenges in Region Mid, and low harvest volumes and a poor-performing 2017 generation in Region South.

Operational EBIT was €144m (€117.3m) in Q4 and harvest volume was 58,602 gwt (66,384 gwt). Mowi harvested 230,500 gwt in Norway in 2018.

In Chile Mowi harvested 17,200 gwt in Q4 and 53,200 gwt in 2018. The Chilean operation made an operational EBIT of €21.5m (€17.6m) in Q4, and reported improved biological conditions and reduced levels of SRS (Salmon Rickettsial Syndrome) and reduced medicine use.

Northern Harvest

In Canada, Q4 operational EBIT increased to €17.4m (€9.9m) and harvest volume increased to 12,239 gwt (10,036 gwt) following the acquisition of Northern Harvest in Atlantic Canada.

Canada’s harvest for 2018 totalled 39,300 gwt and is forecast to rise to 55,000 gwt this year as the operation benefits from the full-year effect of buying Northern Harvest.

Biological challenges drove up costs, which are expected to continue to rise in the current quarter because of a lower harvest volume.

Ireland’s Q4 2018 operational EBIT fell to €4m (€6.7m) on the back of a lower harvest volume of 1,615 gwt (2,358 gwt), but Mowi reported strong market conditions for the organic salmon grown by the Irish operation.

Ireland produced 6,200 gwt in 2018 and is guided to harvest 9,000 gwt this year.

Results of Mowi Faroes were impacted by higher cost, lower quality fish and reduced prices. Q4 operational EBIT was €5.9m (€11.8m) on a harvest volume of 4,356 gwt (3,767 gwt). Price achievement was the same as the reference price, whereas in Q4 2017 Mowi Faroes fish had been selling for 154%.