Bank predicts good year for salmon and shrimp

Strong retail demand and the reopening of foodservice set the aquaculture industry up for another strong year in 2022, especially for salmon and shrimp, according to a report by Rabobank that summarises the main takeaways from the Global Seafood Alliance (GSA) GOAL Conference.

Sustainability-related investments are expected to ramp up this year, as major producers and retailers have set ambitious targets to reduce carbon footprints.

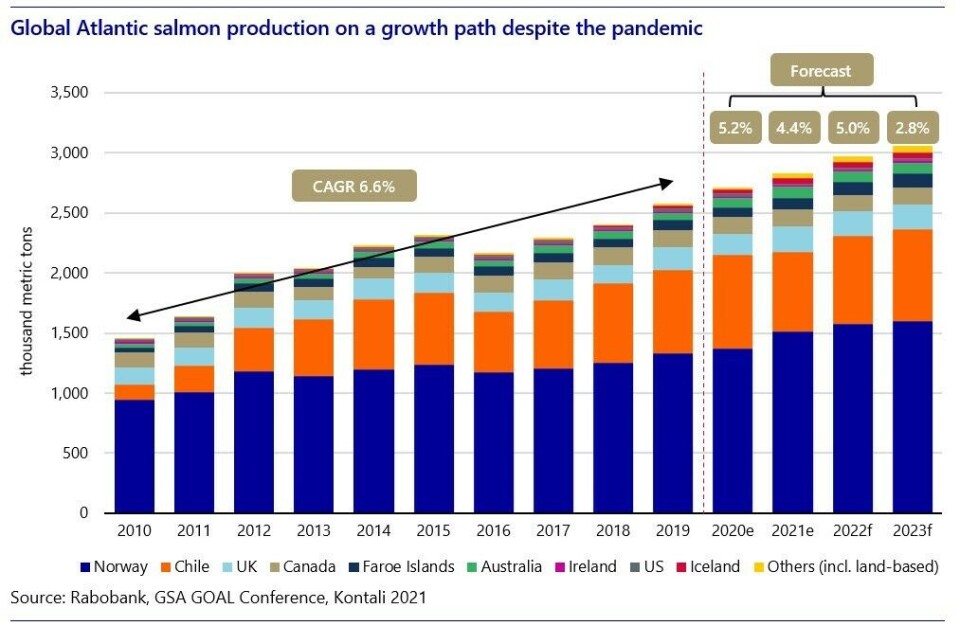

The main salmon-producing regions can look forward to a profitable 2022, with minor increases in volumes produced while prices are set to remain well above-average levels.

20% growth surge in Chile

Norway and Chile experienced complementary supply dynamics in 2021 as volumes in Norway grew by 10.2%, while Chile contracted by 14.1%. Now the Chilean industry is expected to grow at around 20% for a few months in 2022 before slowing down again to reach year-on-year growth of 8% to 9%.

“This projection, combined with the expected normalised growth for Norway, should result in global supply expanding by 5% in 2022. In the current market, this is considered below demand growth and thus supportive to prices,” said Rabobank seafood analyst Novel Sharma.

More shrimp

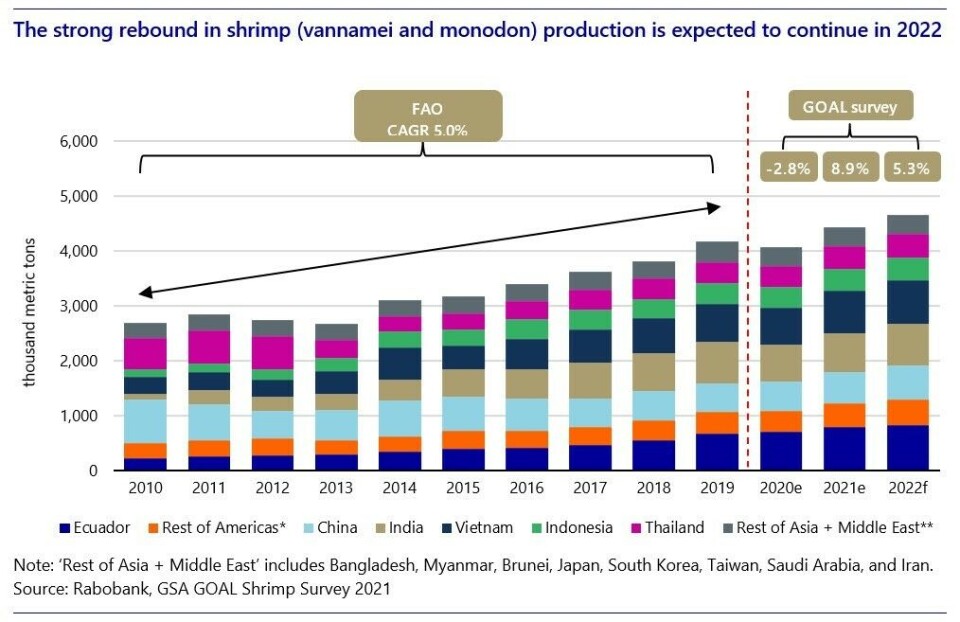

This year is also set to be excellent for major shrimp producers. New data presented at the GSA GOAL conference suggests year-on-year growth will potentially achieve well over 10%, putting shrimp production above pre-pandemic levels.

Global shrimp supply growth has been primarily fuelled by Ecuador and India. “The demand dynamics that enabled this growth resulted from changing consumption patterns, which are expected to persist in 2022, with shrimp producers benefiting from growth in retail consumption in the EU and especially the US,” said Sharma.

Increased demand

Seafood’s newfound popularity in the retail channel in most western countries, combined with the expected further reopening of the foodservice sector, will add to overall demand in 2022. Furthermore, the report highlights that the retail channel has potential to grow further in 2022 if the industry can continue adding convenience options to its product ranges.

Moreover, beef and poultry prices have increased globally, which has led to a structural change in demand for seafood as consumers began to seek alternatives as well as additional healthy options.

Higher costs

With costs rising, GOAL survey respondents ranked market prices as their key concern. The main inflation drivers in the seafood sector are recovering demand, increasing labour costs, energy costs, feed prices, and logistical interruptions. However, the big gain in seafood retail and the reopening of foodservice channels will potentially trump inflationary challenges.

In addition, when compared to other forms of protein such as beef and poultry, the relative price increase of seafood could allow it to take market share.

GHG reductions

“For many countries, 2022 will be the year they make reducing GHG (greenhouse gas) emissions their leading policy,” said Sharma.

“With COP26 in Glasgow nearly coinciding with the GSA GOAL conference, commitments to reduce emissions are more than just top of mind for the aquaculture industry; they are a new key priority for many companies in the industry.”