Aquaculture tech supplier OTAQ warns of lower-than-expected revenue

Aquaculture and offshore technology company OTAQ today warned that its revenues for the current financial year will be below market forecasts.

In a trading update, OTAQ said that although it has strong pipeline of new orders, a number of these orders have taken longer to convert and are now not expected to be completed until the next financial year.

“The Offshore division is continuing to work on a number of existing and significant new orders and sales for the division in FY24 will be in line with management expectations. However, the Aquaculture division has seen existing customers and new sales prospects defer the decision to place firm orders,” OTAQ stated.

The company’s board has taken cost saving measures and is evaluating further measures including seeking shareholders’ approval to withdraw the company’s shares from trading on the AQSE Growth Market.

Brighter next year

Chief executive Phil Newby said: “We are encouraged by the pipeline of new opportunities across the group. While conversion of these opportunities is often more protracted than we would hope, and the outturn for the current financial year is uncertain, OTAQ’s strong relationship with our core customer base means that the prospects for next year are encouraging.”

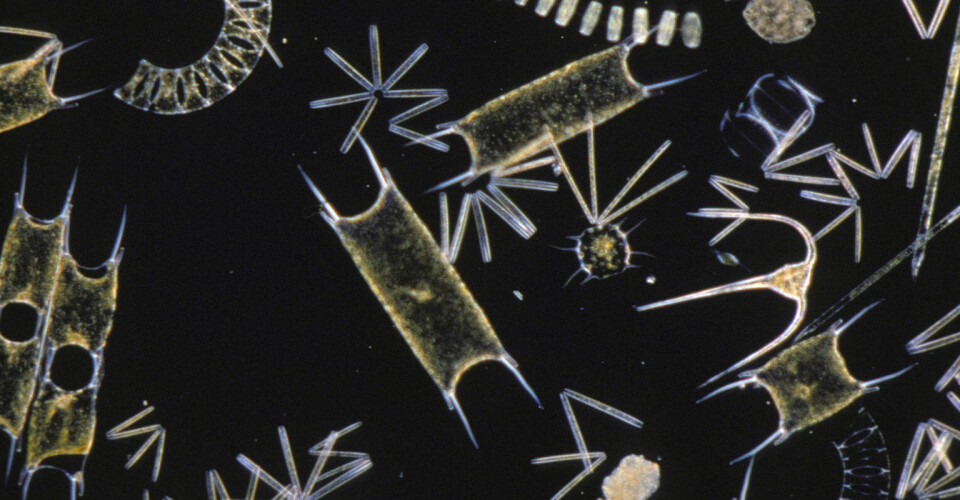

Lancaster-headquartered OTAQ, which has offices in Ulverston and Aberdeen, and in Puerto Montt, Chile, has developed a Live Plankton Analysis System (LPAS) to give fish farmers early warning of algal blooms.

It also produces the Sealfence acoustic deterrent device to keep seals and sea lions from attempting to predate farmed fish, although such devices are currently not used by the salmon industry in Scotland.

OTAQ made revenue of £1.51 million in the first half of the 2024 financial year, down from £1.801m in the same period last year. The company made an operating loss of -£805,000 (H1 2023; -£709,00).