Lerøy includes full grow-out option in post-smolt plan

Norwegian salmon farmer Lerøy is planning to spend around NOK 1 billion (£85m) on an on-land post-smolt facility that could also be used to grow fish to harvest size in Vestland in western Norway.

The recirculating aquaculture system (RAS) facility would be built in three stages and comprise three modules, each capable of around 2,000 tonnes of biomass production.

The first module of the facility at Årskog, Fitjar would grow six million smolts from 160 grams to 500 grams. The second and third modules would have capacity to grow the post-smolts on from 500g to 1.2 kilos.

The third module may also be used for growing fish to full harvest weight, Lerøy said in a presentation accompanying its report on the fourth quarter of 2020.

Q4 profit down by NOK 328m

The development is projected to provide an annual increase in production in the sea of 8-10,000 gutted weight tonnes. A decision on whether to go ahead with the facility will be taken shortly, with construction work scheduled for completion in 2023.

Lerøy Seafood Group (LSG), which includes salmon and trout farming and caught fish, achieved a turnover of NOK 5.17 billion in Q4, compared with NOK 5.239bn in the same period in 2019.

Operating profit before value adjustments related to biological assets was NOK 441 million, down from NOK 769m in Q4 2019.

“The Covid-19 pandemic had a negative effect on demand and has resulted in lower prices for both red fish and white fish. Weaker price achievement is the main reason for lower earnings in the fourth quarter of 2020 compared with the same quarter last year,” wrote LSG, which owns a 50% in Scottish Sea Farms.

‘Well positioned’

For 2020 as a whole, the group reported a turnover of NOK 19.96bn, compared with NOK 20.427bn in the corresponding period last year.

Operating profit before value adjustments related to biological assets in 2020 was NOK 1.95bn (2019: NOK 2.734bn).

Profit before tax and value adjustments related to biological assets was NOK 1.869bn (NOK 2.718bn).

“Strong and long-term customer focus has meant that we have emerged stronger from a demanding year, and are well positioned for the years to come,” said chief executive Henning Beltestad.

Farming division

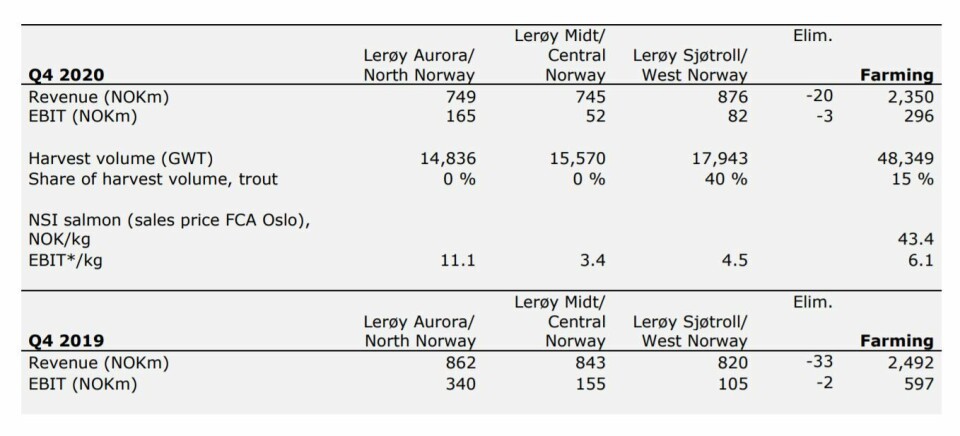

Operating profit before value adjustments related to biological assets in LSG’s farming division was NOK 296m in Q4 (NOK 597m.

The farming division harvested 48,000 gutted weight tonnes, compared with 43,000 gwt in Q4 2019.

The division’s three regional companies delivered the following EBIT / kg in Q4:

- Lerøy Aurora (northern Norway) NOK 11.1

- Lerøy (central Norway) NOK 3.4

- Lerøy Sjøtroll (southern Norway) NOK 4.5.

In total, EBIT / kg in the division fell from NOK 14.0 in Q4 2019 to NOK 6.1.

Reduced costs

“Compared with the same quarter last year, cost per kilo is somewhat reduced, but the reduction in price achievement in the period is significantly greater. We have had a positive development in our cost per kilo of fish harvested in 2020, and the fourth quarter confirms this development,” said Beltestad.

“By 2021, we expect that recent years’ measures and investments will provide a significant growth in volume, that this will scale the cost base, and give us lower costs.”

The company’s harvest volume increased from 158,000 gwt in 2019 to 171,000 gwt last year. It expects this year’s harvest volume, including its share of volume from associated companies, to be between 205,000 and 210,000 gwt.

Retail optimism

LSG’s directors said it was impossible to say anything precise about either the duration or the consequences of the Covid-19 pandemic, but experience that the volume growth in the grocery market was cause for optimism.

“It seems that seafood is constantly improving its position among consumers and we are therefore optimistic with regard to the underlying future development of seafood,” the company stated.

Relatively modest growth, together with a weakened Norwegian krone, had resulted in very high prices.

“This provides incentives for the production of salmon also in new areas and with new alternative technologies. These incentives have been present for a few years, but due to long lead times in the industry, Norwegian sea-based production has maintained its dominant position.”

Building knowledge

The harvest volume from land-based salmon is still insignificant in the end market, added LSG, but added that “the market share of Norwegian Atlantic salmon will, in the long term, be affected by production from regions and places where there has previously been no production of salmon and trout”.

“Through business development, investments and a clear operational focus on competitiveness, the group will ensure that the group’s value chain will perform well in the competition in the years to come. In addition to the development of existing aquaculture operations, the group builds knowledge and expertise in both land-based and offshore-based production of salmon.”