40% more farmed salmon by 2033, says Kontali

Analyst predicts that tide will turn in favour of increased production after recent stagnation

Production of farmed salmon is projected to increase by 27% by 2030, seafood analyst Kontali said today.

And expanding land-based production is expected to be the largest contributor to increased growth by 2033, when growth is expected to reach 40% above current levels.

Kontali's long-term analysis indicates that the industry’s turnaround after several years of stagnant growth will depend on continued innovation to address regulatory constraints and health challenges. Europe is expected to lead this growth, with production increasing by approximately 25%, while the Americas will experience more modest gains at around 11%. Contributions from Australia and New Zealand will be smaller, at about 17%, and Asia, particularly China, is poised for gradual expansion, with land-based and offshore projects driving growth, though large-scale production is yet to be fully realised.

Challenges and risks

Regulatory limits, such as maximum allowable biomass (MAB) and environmental regulations, pose the primary challenges to growth. In Norway, for instance, sea lice and fish health concerns are closely linked to these constraints. Industry players are investing in solutions such as new sheltered cage technology and biosecurity measures to mitigate these risks.

Additionally, climate change is bringing new weather patterns, temperature shifts, and pathogens to coastal regions, posing additional hurdles for salmon farming operations worldwide. Industry players must continue to invest in adapting to these challenges to ensure the industry’s long-term success.

“The projected 27% growth in global salmon production by 2030 marks a pivotal moment for the industry. Investments in fish health and land-based production are key drivers but overcoming regulatory and environmental challenges will be crucial to realising this potential,” said Filip Szczesny, senior financial analyst at Kontali.

Regional outlooks

Norway: Recovery is expected after recent productivity challenges in the world's biggest Atlantic salmon producing country, says Kontali. Growth beyond the 1.348 million gutted weight tonnes that Norway has averaged over the last two years will be driven by improved production planning, enhanced fish health measures, and investments in submerged cage technologies. However, regulatory restrictions under Norway’s “traffic light system” and tax regime could limit growth potential.

Europe (excluding Norway): Kontali expects Scotland, Faroe Islands, and Iceland to benefit from investments in large smolts and shorter production cycles. Iceland, in particular, faces new regulations aimed at protecting wild stocks and improving biosecurity.

Chile: Political uncertainty remains a key risk, though recent developments have lessened the likelihood of major disruptions to aquaculture operations in key regions, says Kontali. Biosecurity risks continue to grow as the sector nears maximum productive capacity.

North America: Kontali says that in Canada, a transition towards land-based systems is under way following regulatory changes, although in fact this applies only to British Columbia, where marine farm leases will expire at the end of June 2029. In the United States, Kontali expects ocean-farmed production to remain stable, while land-based and offshore projects will provide growth opportunities.

Read more about efforts to make permitting for US offshore projects easier in the current online edition of Fish Farming Expert magazine.

Australia and New Zealand: Warmer sea temperatures have slowed growth in Australia (Tasmania), but a recovery is expected. In New Zealand, new coastal projects will replace existing production, contributing marginally to global growth.

Russia and Asia: In Russia, growing domestic demand for salmon is encouraging the development of new farming sites and infrastructure, though actual production may fall short of ambitious targets, predicts Kontali. In Asia, particularly China, land-based and offshore projects are planned, but large-scale production has yet to be realised.

Land-based

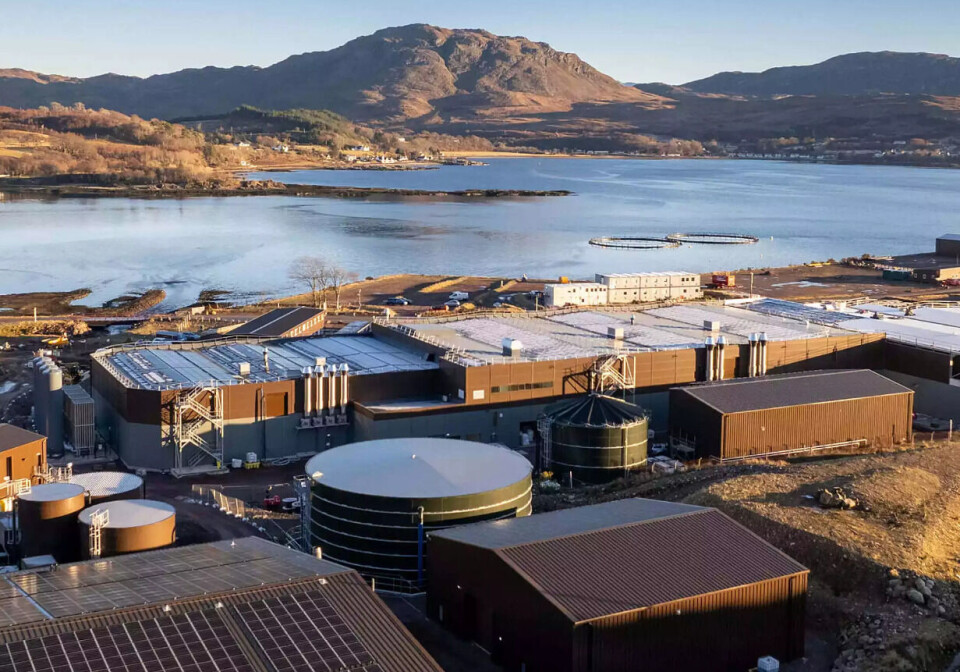

Land-based salmon farming is gaining traction as a politically and environmentally sustainable alternative to traditional farming methods, with growth in this segment expected to be the single largest contributor by 2033, writes Kontali. Norway is developing hybrid recirculation / flow-through technology, and Kontali says North America and Asia are becoming increasingly attractive regions for new investments due to proximity to major markets. Significant investments are also being made in Iceland to support stricter biosecurity regulations.

Wild salmonid catches are projected to remain stable, averaging between 800,000 and 900,000 tonnes per year, with seasonal fluctuations.