Proximar sees a clear way ahead

Japan land-based salmon farmer takes action to resolve turbidity in RAS as it prepares for first commercial harvest

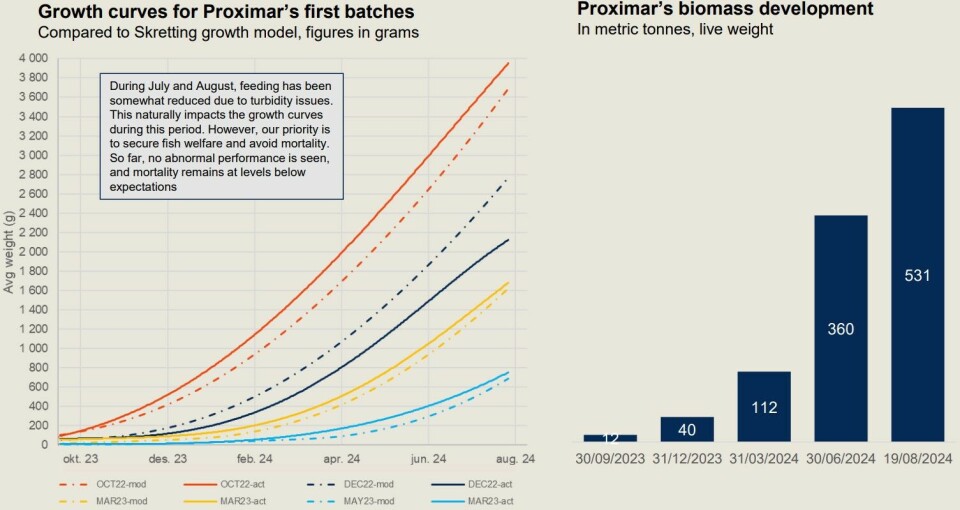

Japan land-based salmon farmer Proximar Seafood is to trial nanobubbles to alleviate turbidity in the water of its recirculating aquaculture system (RAS) facility near Mount Fuji. The issue has had no direct impact on fish health or performance.

“Lately, Proximar has experienced an increasing amount of Total Suspended Solids (TSS) in the production tanks in the grow out facility. This has caused turbidity and limited visibility, both for the fish and the on-site farmers surveilling them,” the company wrote in a report of the second quarter and first half of 2024.

“As a short-term measure, feeding has been reduced. To solve the issue long-term, Proximar is currently installing ozone treatment equipment, in addition nanobubble technology also to be tested in coming weeks.”

'Quality customer'

Proximar will begin its first commercial harvest in September, and a first sales agreement is in place with a “quality customer”.

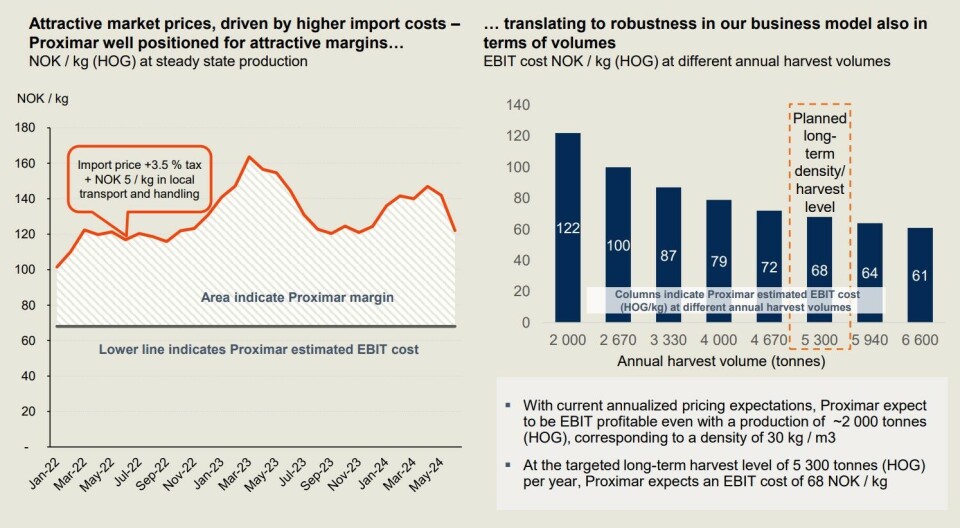

According to the company, the agreement confirms Proximar’s price expectations and a significant cost advantage of local production in Japan.

Phase 1 of the facility can produce around 5,300 tonnes (head on gutted) of salmon annually at a stocking density of 30 kilos per cubic metre.

At that volume Proximar expects a production cost of NOK 68 (£4.89) per kilo (see graphic, below), considerably less than the cost of importing Norwegian Atlantic salmon, which averaged NOK 137 per kilo in Q2 2024 and is currently around NOK 115.

“We see strong interest from buyers in the high-quality market, and we expect the ongoing sales dialogues to materialise in new contracts in the coming months, as we are the only company that can supply fresh, local Atlantic salmon to Japanese consumers,” said chief executive Joachim Nielsen.

Proximar’s brand and logo will be announced in September. Proximar is experiencing high activity and strong interest in its Atlantic salmon, with a lot of visits to the facility and meetings with potential customers. The sales and marketing activities focus on building brand awareness.

4,350 tonnes next year

Phase 1 has four modules in the grow-out building, two of which are completed. The two last modules will be installed and completed in Q3 and Q4. This will enable the company to scale up farming activities towards full production.

Expected harvest volumes for 2024 and 2025 combined are ~4,700 tonnes (HOG), with the target for 2024 of ~350 tonnes. Full utilisation is expected in 2027.

Following minor modifications and improvements, including speeding up delivery processes, the company expects additional capital expenditure of approximately NOK 30m (£2.16m) during the second half of 2024.

“Proximar has the financial flexibility to sell up to NOK 40 million of the convertible bonds held by the company. In addition, Proximar is working with different financial institutions in Japan to secure extra credit facility for working capital purposes to secure adequate buffer going forward,” the company said.