SalMar plans dividend after strong Q3

Norwegian salmon farmer SalMar has bucked the industry trend of lower year-on-year results by reporting an increased operating profit of NOK 646.8 million (£53.9m) for the third quarter, a 5% increase on the NOK 613.5m made in the same period last year.

It is now proposing to pay a dividend of NOK 13 per share.

“Fantastic efforts from our employees over time makes it possible for SalMar to once again deliver strong quarterly results,” said chief executive Gustav Witzøe in a press release.

“Good strategic assessments and a clear operational focus have led to strong biological and operational performance throughout the entire value chain. This has resulted in good capacity utilisation, good cost development and solid price achievement with associated margins. This in a period of increased uncertainty both for employees and in the market caused by the Covid-19 pandemic.”

NOK 2.9bn revenues

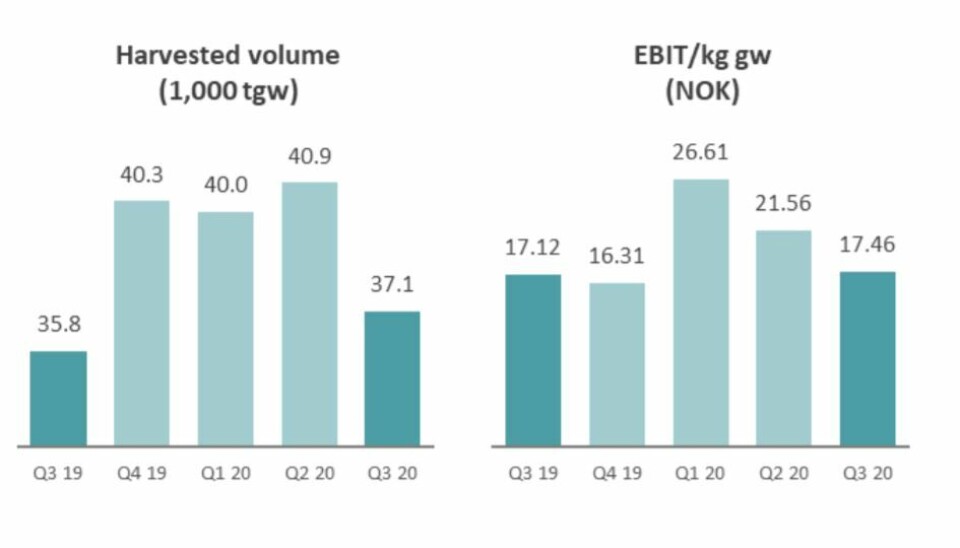

SalMar, which co-owns Scottish Sea Farms with fellow Norwegian salmon farmer Lerøy, made revenues of just under NOK 2.9 billion (Q3 2019: NOK 2.8bn) on a harvest of 37,100 tonnes gutted weight (35,000 tgw) in Norway and Iceland.

Operational EBIT per kg came to NOK 17.46, (NOK 17.12 per kg) despite the average spot price for salmon during Q3 being NOK 2.08 per kg lower than in the same period last year.

Income included NOK 46m from SalMar’s share of Scottish Sea Farms’ post-tax profit in Q3. SSF’s harvest volumes are not counted in SalMar’s total because it is an associate company, not a subsidiary.

Central Norway

The bulk of SalMar’s harvest and income came from its Central Norway region, where it harvested 30,100 tgw (28,100 tgw) at an EBIT per kg of NOK 17.51 (NOK 19.35). The increased volume offset some of the fall in the spot price.

The Northern Norway region harvested 5,300 tgw (5,400 tgw) for an EBIT per kg of NOK 11.55 (NOK 1.08).

SalMar said the region had good biological and operational performance, but profits were lowered by harvesting taking place in September, when prices were at their lowest.

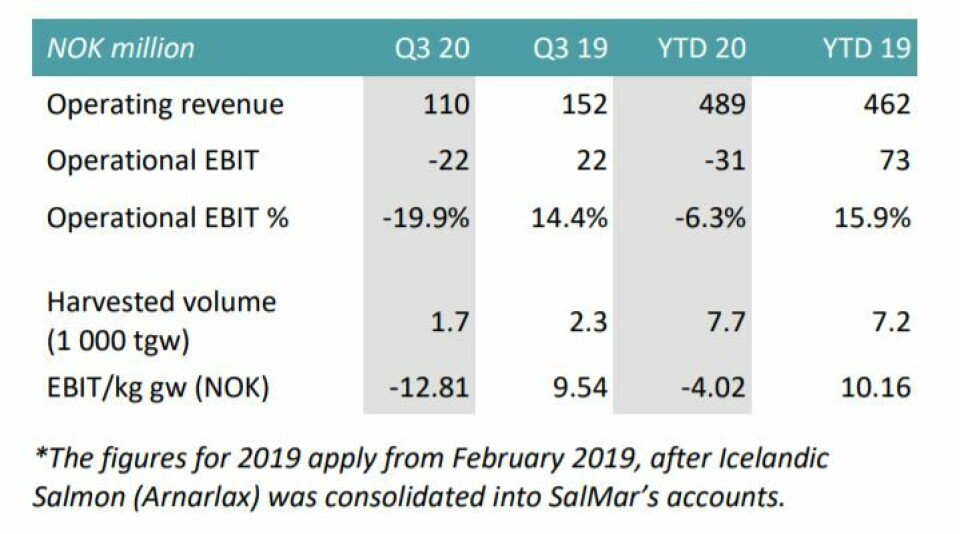

Loss in Iceland

The company’s Iceland Salmon subsidiary (formerly Arnarlax) made an expected operating loss of NOK 22m on a harvest of 1,700 tgw.

“The result was affected by weak price achievement and high production costs for the 2018 generation that was harvested during the period,” said SalMar.

“In the fourth quarter, the segment will start harvesting the 2019 generation, which has performed better biologically and with a lower cost level. The segment therefore expects to harvest a higher volume and achieve lower costs in the fourth quarter.”

Solid finances

SalMar, which bought an extra 8,000 tonnes of biomass capacity in Norway’s “traffic light” auction, expects to harvest a total of 152,000 tonnes of salmon in Norway in 2020 and 163,000 tonnes next year.

It expects to harvest 12,000 tonnes in Iceland this year and 14,000 tonnes next year.

“The last few quarters have proven SalMar’s ability to handle demanding market conditions by delivering strong results and maintaining a solid financial position,” said the company. “Based on this, the board proposes to pay out NOK 13 per share in dividend and will invite to an extraordinary general meeting on December 4, 2020.”