Norway’s salmon tax cut to 25%

Government is forced to reduce rate in exchange for crucial support in parliament

Norway’s government has won enough support to crowbar its controversial salmon tax through parliament but has been forced to reduce the rate from 35% to 25%.

The minority Labour Party and Centre Party government has been struggling to achieve a consensus for the tax, with leftist parties wanting a higher rate and those on the right wanting a lower rate.

Labour and the Centre Party have 76 seats between them, and 85 are required for a majority in Norway’s parliament, the Storting.

Today, the Liberal Party (Venstre), which has eight seats, and Patient Focus, which has one seat, agreed to give the government the required votes for the salmon tax, also known as the ground rent tax or basic rent tax, in return for concessions.

Tax changes

The proposal is based on what has previously been put forward by the government, but with the following changes:

- The effective tax rate is reduced from 35% to 25%.

- The valuation discount in wealth tax is increased from 50% to 75%.

- The host municipalities and counties are guaranteed a higher income from the Aquaculture Fund for 2023.

In addition, several request proposals are put forward to strengthen the environmental profile and contribute to technology development.

“After a long process, we are now ensuring that the Storting adopts the principle of ground rent in aquaculture. The parties to the agreement also secure a majority for a tax rate of 25% and an increase in the discount on the property tax value for farming concessions to 75%,” says the Centre Party's Geir Pollestad in a press release. Pollestad has been chairing discussions to reach a majority.

No more games

“The Liberal Party has won approval for our main demand to lower the tax rate to 25%, in addition to several environmental victories,” said party representative Sveinung Rotevatn.

“Coastal Norway cannot afford for the Storting to play political games and create uncertainty around one of our most important industries. This is a good solution both for the coast, the aquaculture industry, and the community.”

Kari Elisabeth Kaski, of the Socialist Left (SV) Party, told Fish Farming Expert’s Norwegian sister site, Kyst.no, that the agreement is bad both when it comes to the environment and distribution, which is why they could not support it.

She said that the government is now introducing a ground rent tax without SV, which is the government’s budget partner, and with a narrow majority.

“This creates unpredictability for the industry, something we have warned the government about.”

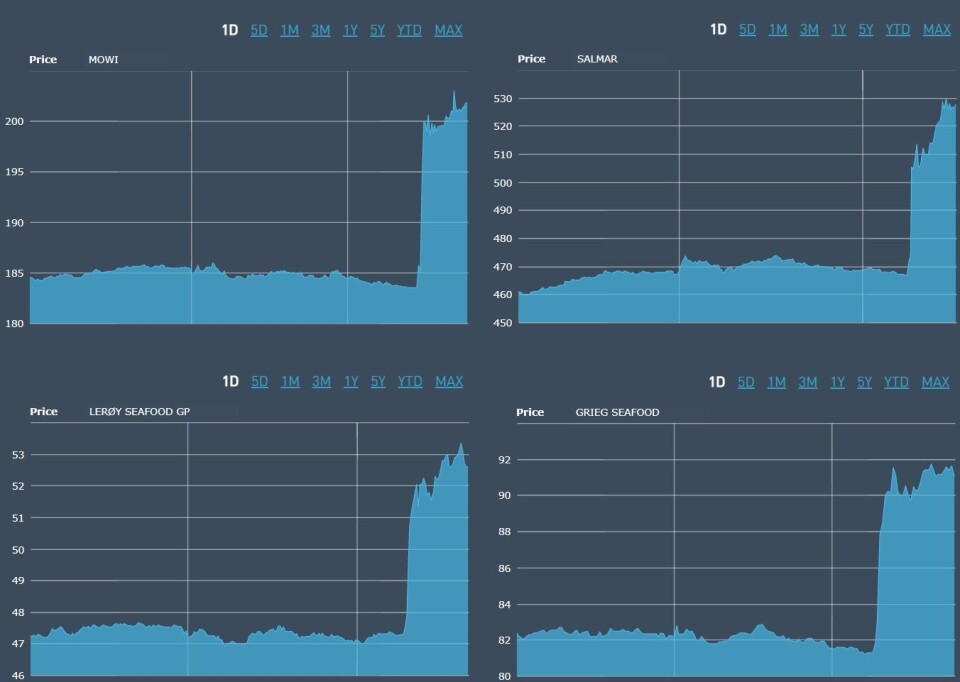

Salmon farming shares rise

The tax will apply on the value added to fish during their time in net pens, and is on top of the corporation tax already paid by fish farming companies.

The stock market reacted quickly and positively to the tax announcement. The market value of Scottish Sea Farms co-owners Lerøy Seafood and SalMar jumped by 11.5% and 12.4% respectively, Grieg Seafood was up 11%, Mowi was up 8.5%, and Måsøval was up 13.33%.

The equipment supplier AKVA group was also up, by 6.7%.

The market value of this increase for the listed fish farmers amounted to approximately NOK 20 billion (£1.47bn), although that is less than half of the NOK 43bn wiped off their value when plans to introduce a salmon tax of 40% were announced by the government in September last year.