Grieg adds £15m to price of Scottish salmon assets

Norwegian salmon farmer Grieg Seafood expects to sell its Shetland operation for around £140 million (NOK 1.635 billion) before the end of this year, it said in its first quarter report and presentation today.

That’s a higher price than it placed on its Scotland assets in its annual report in March, when it valued them at NOK 1.481bn (£125m).

Grieg announced in November that it planned to offload its Scottish farms in Shetland and Skye so that it could concentrate its resources on Norway and Canada.

In his introduction to Grieg’s Q1 report, chief executive Andreas Kvame wrote: “The process to divest our business in Shetland is ongoing and is proceeding according to plan.”

In a note at the end of the report, Grieg explained that the value of a part of the business held for sale is measured at the lower of book value and fair value, less cost of sale.

Book value

“Fair value estimates as at 31 March 2021 indicate that the Shetland assets are not impaired, and the assets are therefore measured at book value as at 31 March 2021,” stated Grieg.

“To assess the value of the assets held for sale, numerous published analyst reports, as well as statements made by finance professionals in the media, have been used as input to establish a range of likely transaction values. In addition, previous comparable acquisitions have been used as input to guide our estimate.”

The valuation includes Grieg’s UK sales operations.

55% bigger harvest

Grieg Seafood Shetland harvested 3,169 tonnes in Q1 2021, an increase of 55% compared to Q1 2020.

Production on mainland Shetland was strong in the quarter. The superior share was 94% in Q1 2021, compared to 85% in Q1 2020.

Grieg decided last year that it would close its farms on Skye due to the logistical difficulties caused by the distance from its main operation in Shetland. The last of the fish on Skye, which have been affected by severe biological challenges in prior periods, were due to be harvested in the current quarter.

Challenges at Skye

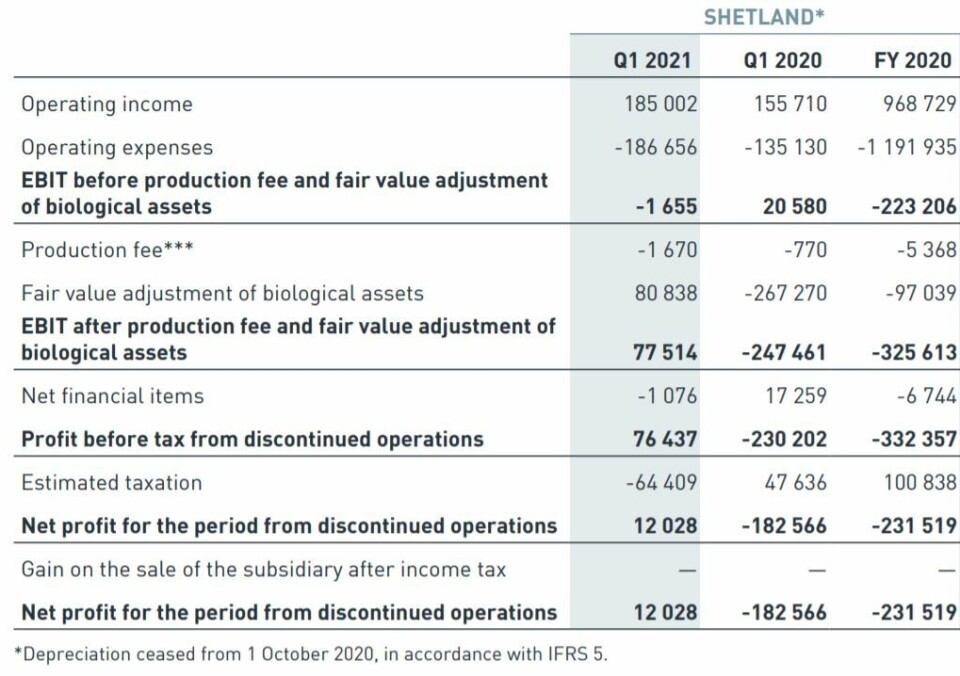

Operating income from Grieg Shetland amounted to NOK 185m in Q1, (Q1 2020: NOK 155.7m) but this was slightly outweighed by operating expenses of NOK 186.7m high costs, leading to an operating profit/loss of NOK -1.65m (Q1 2020: NOK 20.5m). EBIT was impacted by high cost related to the biological challenges at Skye.

EBIT after fair value adjustment for biological assets was NOK 77.5m, and net profit after estimated taxation was NOK 12m.