Salmon industry will be most profitable aquaculture sector in H1 2024, says bank

The salmon industry will continue to be the world’s most profitable aquaculture sector in the first half of 2024, a new report by analysts at Rabobank concludes.

“Normalising salmon supply and likely better fish meal and fish oil production will soften prices in 2024, but only marginally, establishing a new higher price normal,” said the bank’s senior global seafood specialist Gorjan Nikolik.

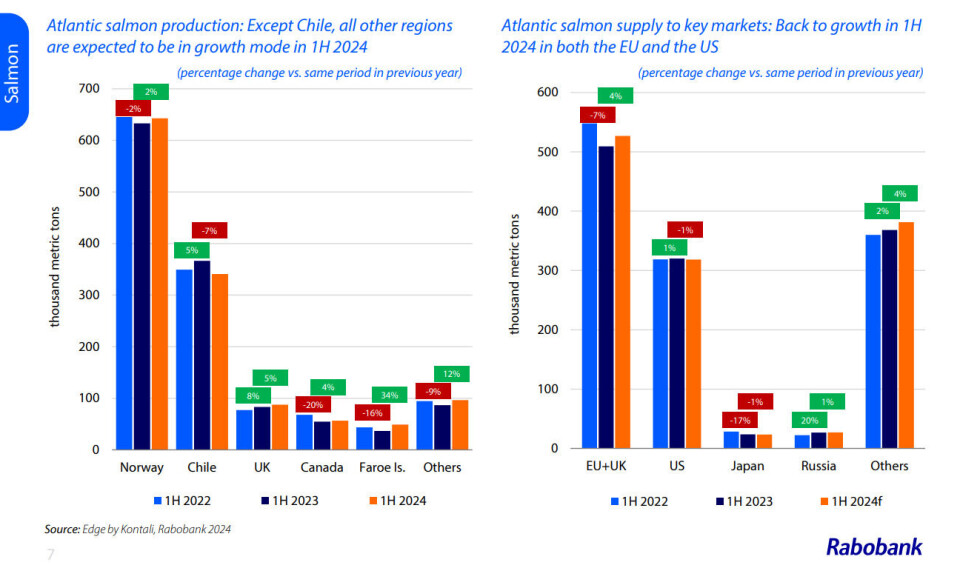

Rabobank expects salmon supply to increase slightly in H1 2024 compared to the same period last year, driven by a 2% increase in supply from the world’s biggest producer, Norway. Increased harvests in the Faroes (+34% year-on-year), Canada (+4%), Scotland (+5%), and Iceland (no country-specific percentage given) are also expected.

However, supply from the world’s second-largest producer, Chile, is expected to fall by 7% y-o-y, which will help maintain global prices. Losses due to algal blooms, combined with corrections for certain companies which have exceeded the legal limit of total production per concession, will depress Chilean supply. The Chilean sector could also see further biological challenges induced by El Niño.

As such, the global supply growth is mild, especially in Q1, and given the persistently good demand, salmon prices will remain supported, writes Rabobank.

Price competitive

“Moreover, salmon is still price competitive versus other proteins. While we do not expect the price peaks seen in the previous two years, 1H 2024 will see only slightly lower prices compared to 1H 2023.”

Another encouraging forecast for salmon farmers is that fish meal supply is expected to improve as El Niño conditions weaken, enabling a normalisation of prices. El Niño forced the cancellation of the first Peruvian anchovy fishing season last year, sending prices of the premium fish oil ingredient to new levels.

“With El Niño conditions expected to weaken throughout the first half of the year, we can expect fishing in Peru to improve,” said Nikolik. “Consequently, better fish meal supply should enable normalisation of the price as terrestrial commodity alternatives such as soybean meal have been easing in price throughout 2023, with further mild softness expected for the first half of 2024.”

The news is not so good for shrimp farmers, with the bank predicting that weak demand in the West coupled with persistently strong supply from Ecuador mean that current low prices may become “the new normal”.