Chocolate knocks salmon off UK food export top spot

The effects of the Covid-19 pandemic on sales meant that farmed salmon lost its place as the UK’s most valuable food export in the first half of this year.

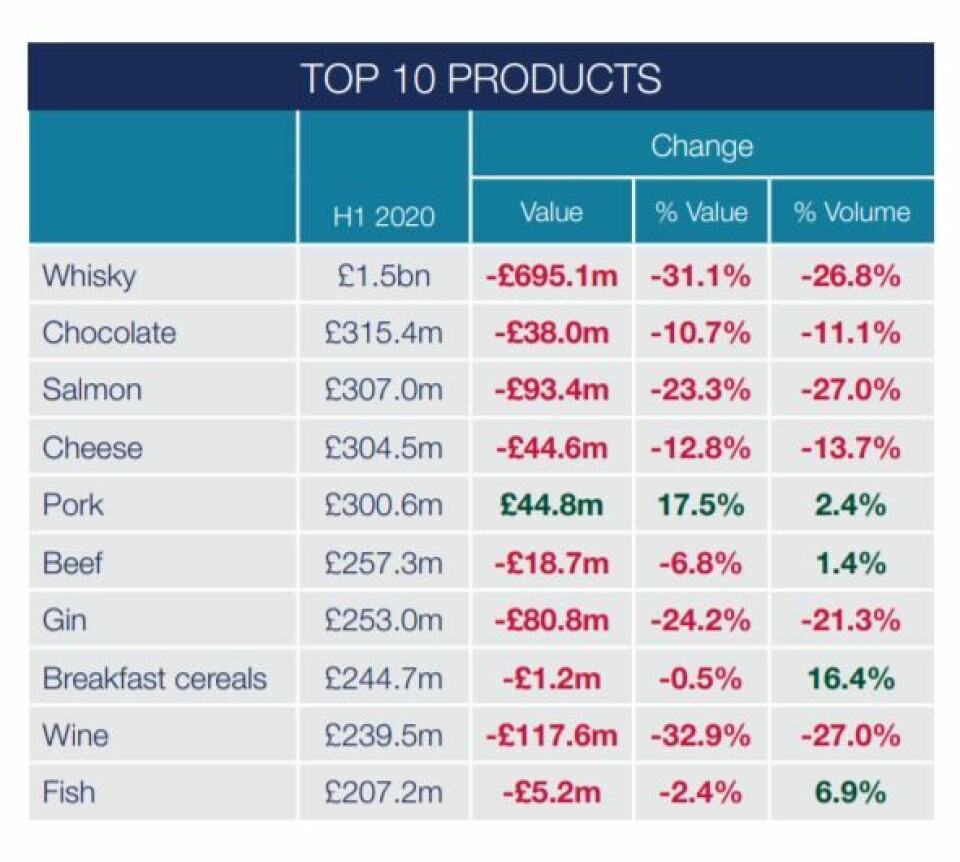

Salmon exports in H1 fell by 27% in volume and 23.3% in value compared to the same period the year before, according to a report from the Food and Drink Federation (FDF) and the Food and Drink Exporters Association (FDEA).

Salmon exports were worth £307 million in H1, a fall of £93.4m on the amount earned from January to June 2019.

First H1 fall since 2015

Chocolate edged past salmon as the No.1 food export, earning £315.4m. Compared to salmon, the chocolate industry suffered a relatively low 10.7% (£38m) decrease in export earnings against H1 2019.

Overall exports of food and drink in the first half of the year fell for the first time since 2015. When compared to the same period last year, exports fell by 13.8%, to £9.7 billion.

Of the UK’s top ten export product categories, only pork saw positive value growth (+17.5%) with sales of £300m, largely driven by exports to China which purchased £132m of UK pork in H1.

Covid lifecycle

Analysis by KPMG as part of the report highlights that differing markets are at varying stages of the Cocvid-19 lifecycle. China is currently experiencing a period of growth, whereas other nations are in recession.

Trade deals such as the UK-Japan preferential trade agreement announced last month present key opportunity for exporters.

Dominic Goudie, the FDF’s head of international trade, said: “A fall in exports in the first half of 2020 demonstrates the huge challenge currently facing UK food and drink exporters.

“We also have serious concerns about our access to existing EU trade agreements, with more than £1.7 billion of UK exports at risk where continuity deals haven’t been agreed.

“However, there remain many opportunities overseas as we navigate our way through economic recovery, strengthen our resilience as an industry, and build relationships through new future trade agreements such as with Japan – the world’s biggest net importer of food and drink.”

Finger on the pulse

Linda Ellett, UK head of consumer markets at KPMG, said: “While the world may be facing Covid-19 collectively, consumers across the world haven’t been behaving equally. For consumer businesses, the real challenge is keeping a finger on the pulse of change, knowing how consumers feel and behave, whilst also adapting to the various opportunities and threats presented in various markets globally.

“Business growth – or at least resilience – remains vital despite the challenging climate. KPMG’s recent consumer insights research clearly shows that trust in brands is a key factor shaping purchasing decision. No consumer business can afford to lose sight of that.”