Scottish salmon takes a bigger slice of the cake in China

Scottish salmon is taking a bigger share of a growing Chinese market, according to analysis from a Norwegian land-based salmon farmer in Ningbo, south of Shanghai.

Nordic Aqua Farms looked at consumption of imported Atlantic salmon in its report for the second quarter and first half of 2024, to outline the market opportunity it has as a domestic producer.

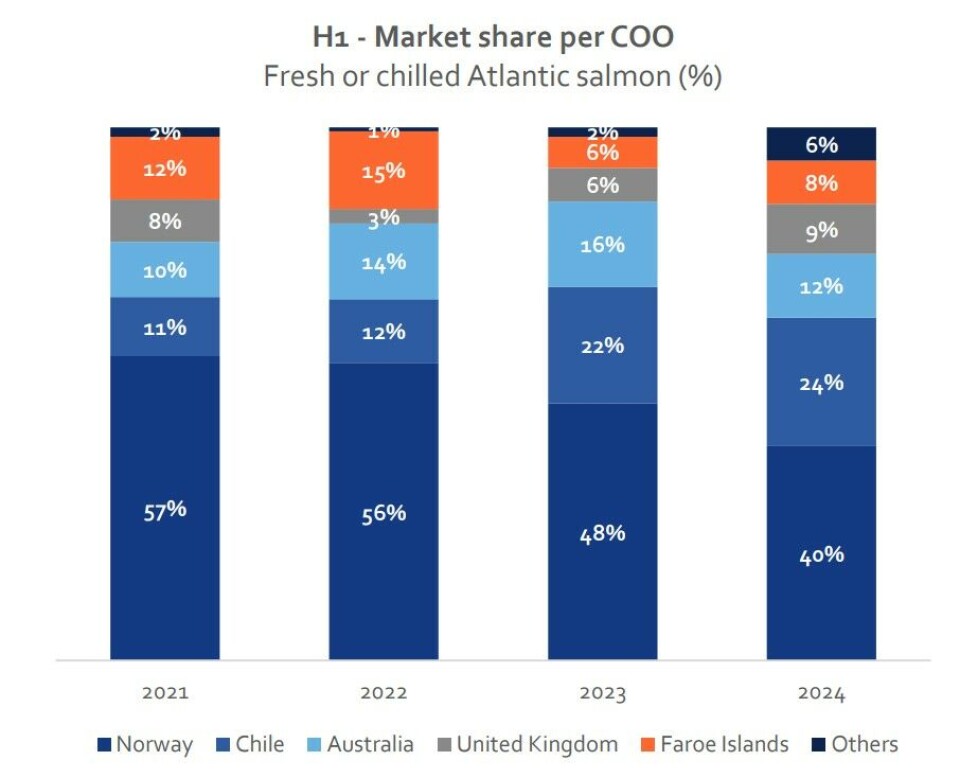

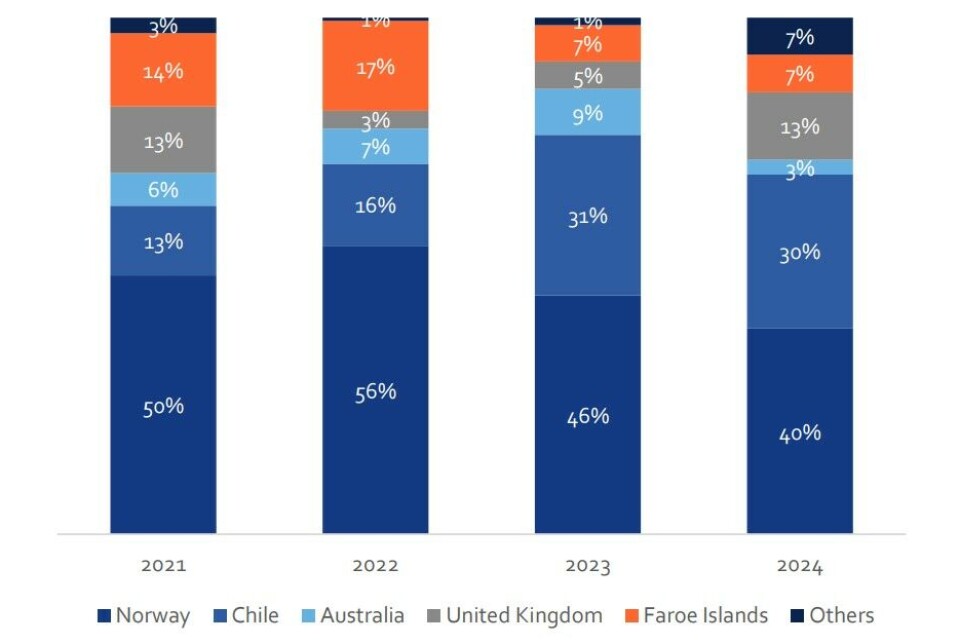

According to bar charts produced by Nordic Aqua from Chinese customs data, Scottish salmon took a 9% share of the Chinese market in the first half of 2024, and 13% in the second quarter.

This may reflect improved demand in China, along with the fact that Scottish producers have more fish to sell in 2024 after two lean years when harvests were reduced by biological and environmental challenges. Last year, Scotland’s H1 share was 6%, and in 2022 it was 3%. In 2021, it was 8%. Scotland’s share of the Chinese market in Q2 was 13% in 2021 but fell to 3% in 2022 and 5% last year.

Home consumption

Nordic Aqua said that while the food service sector remains salmon’s biggest consumer, representing 80-85% of the market, a trend for home consumption of salmon bought online and in supermarkets was growing.

“It is expected the trend of more home consumption and growth of sales via online channels will continue,” wrote Nordic Aqua, which added that imports of fresh whole Atlantic salmon to China reached 51,000 tonnes in Jan-July, 2024, a record high and a volume growth of 10% year-on-year.

“The market demand is still robust, driven by the expansion of its upper middle- and high-income class as well as the growing appetite for healthy, nutritious, and sustainable seafood.

A competitive market

“There are many countries of origin (COOs) of Atlantic salmon competing in the Chinese market. While the H1 market share of Norway, a dominant player, dropped 17 percentage points from 2021 to 2024 (from 57% to 40%), the market witnessed the growth of other COOs, such as Chile and United Kingdom. Also, in 1H 2024, the share of 'other COOs' showed a year-on-year increase of 4%, which indicates the Chinese market is open for new suppliers.”

Nordic Aqua’s statistics follow on from figures released by trade body Salmon Scotland on August 15 that showed Scottish salmon exports to China in H1 2024 were worth £42 million, an increase of £9m (26%) compared to H1 2023.

Surging demand

Globally, Scottish salmon exports were worth £431m in H1, an increase of £125m (41%) over the same period last year.

Commenting on those figures, Scotland’s Deputy First Minister Kate Forbes said they clearly demonstrated the surging global demand for Scottish salmon, which was correctly recognised as a premium high-quality product.

“The Scottish Government is fully committed to working with industry to aid sector growth in overseas markets, whilst solidifying their premier status in domestic markets. In doing so, we will continue to drive sustainable growth, which will have significant economic benefits,” said Forbes.