More salmon and lower prices in 2018, says bank

Global salmon prices have fallen 30 per cent because of an increase in supply, and are expected to remain at that level next year, according to a report by the Equity Research arm of Nordic bank, Nordea.

The bank report focused on the world's two largest salmon producers, Norway and Chile, but the increase in supply is certain to affect Scottish prices, too.

In a press release, Nordea stated: "After a long period of negative global supply growth, we now expect positive year-on-year growth. This has brought salmon prices down 30 per cent from their peak in Q2. As we expect the year-on-year salmon growth rate to accelerate into Q4 and onwards into 2018, we believe prices will remain low. We expect a salmon spot price of NOK 52 per kilo for 2018. This is NOK 8 lower than the 2017 level, with the decline mainly driven by supply growth."

Sector priced too high

Nordea added: "We believe the sector is priced too high and we thus stick to our current negative stance. Austevoll Seafood, our top pick in the sector, is the only name with a Hold rating, amidst a sea of Sells."

The bank recommends selling shares in Bakkafrost, Grieg Seafood, Leroy Seafood Group, Marine Harvest, Norway Royal Salmon, and SalMar. Marine Harvest is Scotland's biggest salmon farmer, while Grieg Seafood Shetland and Leroy and SalMar - which jointly own Scottish Sea Farms - are also significant players.

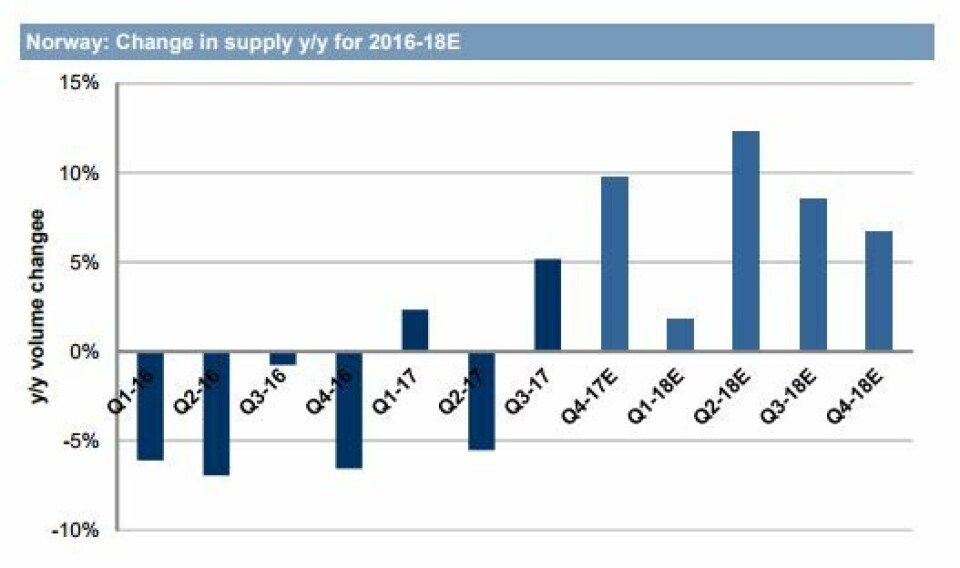

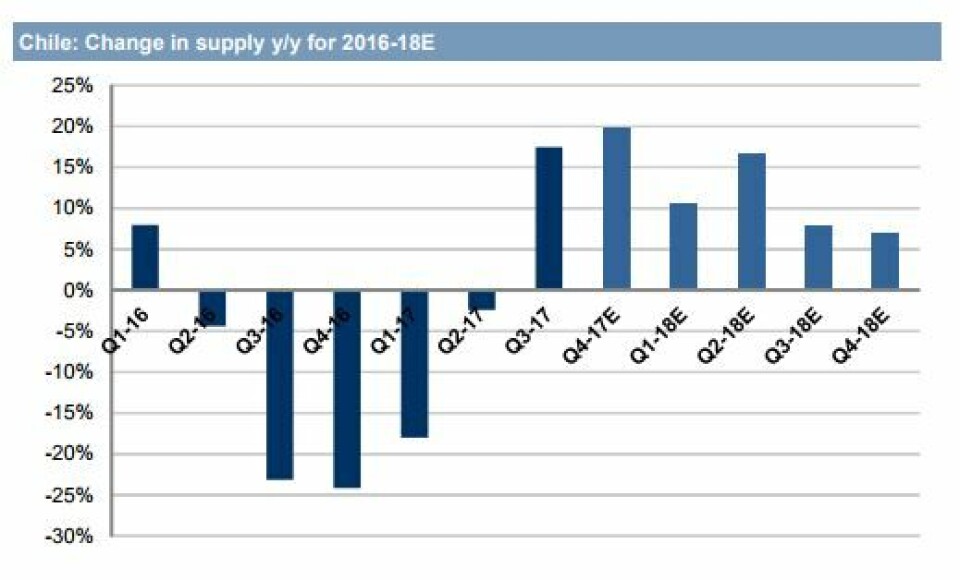

On supply, Nordea stated: "Global supply growth was negative for five consecutive quarters – Q1 2016 to Q2 2017. As of Q3 2017, we estimate 10 per cent annual growth. The first growth phase (H2 2017) is mainly a base effect, with high growth rates from the low 2016 base. Our expectation for the second phase (2018) is that supply levels in Norway will exceed historical high levels from 2015, while Chile will be on a par with its 2015 figures."

Incentive to processors

The bank continued: "Farmers have gradually passed high salmon prices on to end-consumers. The new price equilibrium has resulted in a substantial decline in price-sensitive markets and segments, mainly the EU and Russia. For normalised volumes to be absorbed, we believe that prices must come down to offer an incentive to processors and end-consumers to buy more salmon.

"The combination of accelerating supply growth and weaker demand paints a challenging picture. The most efficient way to build new demand is through lower prices. We maintain our €5.8 estimate for 2018-19 spot prices. Based on our EUR/NOK forecast of NOK 9 for 2018, this translates into a salmon spot price of NOK 52, up NOK 3 from our previous price estimate."

Nordea pointed to costs as a reason for its Sell ratings. "Our estimate for industry costs at NOK 40 per kilo implies margins of NOK 12 per kilo for the industry. Current pricing in the stock market suggests margins of NOK 18-23, depending on which multiples are used. On average we see 15 per cent downside compared to the current pricing in the market. In our view, this justifies keeping our Sell rating on most of the names, but we reiterate our Hold recommendation on Austevoll Seafood, a company that also offers interesting exposure to the protein market (fishmeal and fish oil)."