Cermaq achieved 95% fish survival in 2021

Salmon farming heavyweight Cermaq Group achieved an Atlantic salmon survival rate of 95% last year, it said in its newly published Sustainability Report 2021.

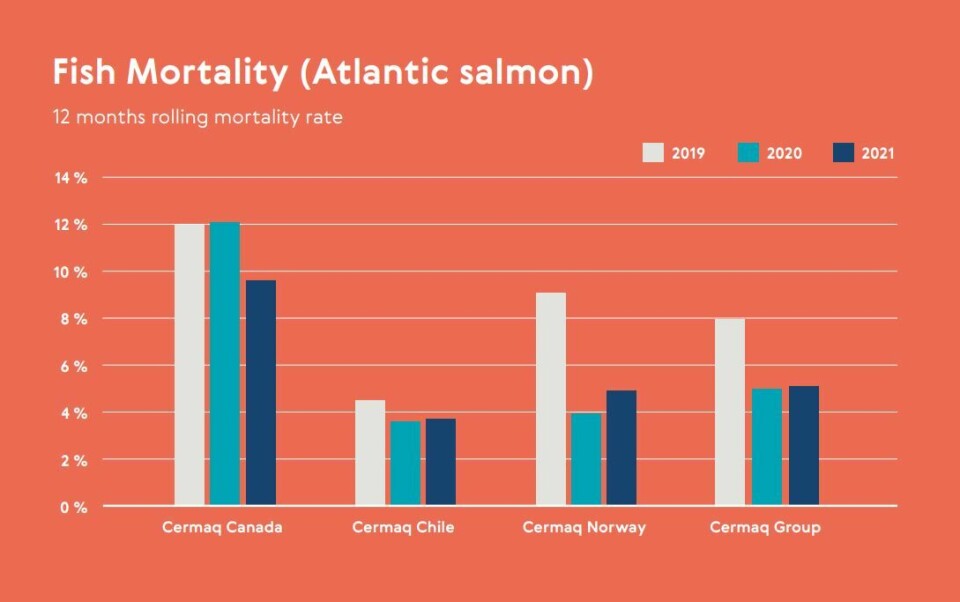

The rate, slightly lower than in 2020, is the average of the survival percentages from Cermaq’s divisions in Norway, Chile and Canada.

Cermaq Chile had the lowest mortality rate of under 4%, and Cermaq Canada had the highest at just above 9%, an improvement over 2020 when around 12% of fish died over the course of the year. Cermaq Norway’s mortality rate rose slightly from 4% to just under 5%. In Chile, where Cermaq farms coho salmon, the survival rate of that species increased from just over 91% to 95%.

Rolling rate

The survival rate is based on a 12-month rolling mortality rate that measures the number of fish mortalities for the last 12 months as a proportion of an estimated number of fish in the sea the last month.

Cermaq, owned by Japanese industrial giant Mitsubishi, says the benefit of a 12-month rolling rate is that long term trends are better represented. The indicator is a precise measure and a better “steering wheel” for management.

The Sustainability Report incorporates both industry-specific data and information based on Global Reporting Initiative (GRI) Protocols. It includes detailed information about vaccination of fish, medicine use, sea lice treatment, ingredients in salmon feed, interaction with wildlife (birds and mammals), escapes, energy use, health and safety figures, and taxes and investments per country.

Constructive discussion

“Facts about salmon farming performance are needed for improvement in operations but also for constructive discussion and dialogue with stakeholders,” said Lars Galtung, Cermaq’s director for sustainability and communication.

“This has been the basis for Cermaq’s comprehensive sustainability reporting and why our report is externally reviewed by our auditors.”

According to the report, Norway-based Cermaq made operating revenue of NOK 12.6 billion (Can $1.68bn at today’s exchange rate) last year and sold 202,000 gutted weight tonnes of salmon (Atlantic and coho).

No fish escaped from its farms in British Columbia or Chile, but 5,609 salmon escaped in Norway.

Sea lice

Average sea lice levels over the year were below the local action levels of three ovigerous females in Chile (1.6), 0.5 adult females in Norway (0.11) and three lice in Canada (2.47), although levels in BC were above three from August last year.

The average fallow time of farms between harvest and stocking of new fish was 14 weeks in Canada, 12 in Chile and 13 in Norway.

Antibiotic use fell by 7% to 68 grams per tonne of live weight fish produced in Canada and rose by 35% to 348 grams per tonne in Chile. No antibiotics were used in Norway.

The amount of in-feed sea lice treatment used in 2021 fell by 71% to 0.133 grams per tonne of live weight fish produced in Canada but rocketed by 1,098% to 1.446 grams per tonne in Chile. It also rose by 56% to 0.086 grams per tonne in Norway.

Net producer of marine ingredients

Cermaq saw better use of marine ingredients in feed, which is primarily supplied by BioMar but also by Skretting and Cargill (EWOS).

“Efficient use of marine ingredients is important, and farmed salmon is well known to be very efficient in its feed conversion,” said Cermaq in the report.

“For example, in 2021, Cermaq estimated a consolidated marine nutrient dependency ratio of 0.47 (compared to 0.50 in 2020 and 0.56 in 2019), which means that the build-up of marine proteins by salmon has been higher than the amounts received through the feed. For marine oil the development is similar. Cermaq’s feed suppliers used less marine oil in the feed (0.80) than the amount produced by the salmon. For comparison EWOS used 0.71 units of oil in 2020 and 0.67 units in 2019. Farmed salmon is now a net producer of marine protein and oils.”

Revenue and taxes

Most of Cermaq’s revenue – NOK 1,826m – came from Norway, where the company paid NOK 400m in tax, invested NOK 358m and employed 648 people.

In Chile, Cermaq made revenue of NOK 751m, paid NOK 201m in tax, invested NOK 345m and employed 1,793 people.

In British Columbia, Canada, the company made revenue of NOK 226m, paid NOK 66m in tax, invested NOK 95m and employed 285 people.

Cermaq spent NOK 2.9m on community investments in Canada, more than the NOK 1.7m spent in Norway and NOK 0.6m in Chile.