US coalition bids to end reliance on imported salmon eggs

Lack of home-produced ova is holding sector back, says SalmoGen

SalmoGen, a company formed by North American aquaculture businesses and a Native American tribe, has revealed plans to create a new supply of salmon eggs for United States fish farmers from 2027.

Its aim is to end the US sector’s reliance on imported ova, which it says is a factor limiting growth of salmon farming in the country.

SalmoGen points out that many US states apply strict bio-security standards to prevent potential importation of disease from distant locations or escape of non-native strains. In some states, only one approved import source exists.

25 million eggs

The company has had broodstock under development since early 2023 in two partner locations. Next year, the fish will be transferred to a broodstock facility being developed on Penobscot Trust Land in Maine in a partnership with the Penobscot Indian Nation.

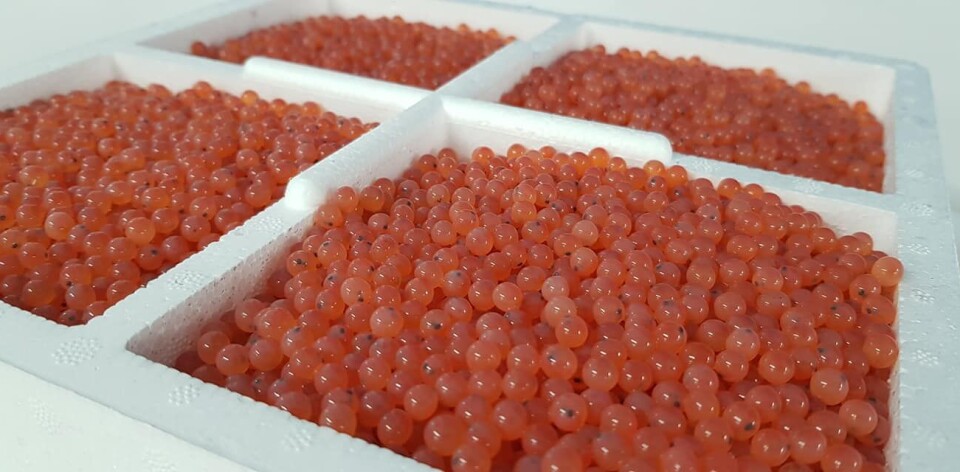

First stage production capacity is an annual capacity of 25 million eggs suitable for both land-based and marine fish farms.

SalmoGen is an investment partnership between Cuna Del Mar, Builders Vision, the Penobscot Indian Nation, and Xcelerate Aqua.

Cuna Del Mar is a US-based sustainable aquaculture investment fund backed by Christy Walton, the billionaire daughter-in-law of Walmart founder Sam Walton, and Builders Vision is a philanthropic organisation and impact investor run by her son, Luke. Two Cuna Del Mar companies, the Centre for Aquaculture Technologies, and Innovasea, are SalmoGen’s strategic development partners.

Long-term need

Xcelerate Aqua is owned by former Nordic Aquafarms Inc. chief executive Erik Heim and his wife, Marianne Naess, who are aiming to build a 10,000-tonnes-per-year recirculating aquaculture system (RAS) salmon farm in Millinocket, northern Maine.

“We are pleased to be a part of an initiative that addresses a long-term aquaculture industry need in the US, and also in a US effort with many strong players involved. The breeding strategies employed set a path for development of traits that will be attractive to producers,” said Heim.

Chris Perry, of Cuna Del Mar, said: “We have been contemplating an Atlantic salmon broodstock opportunity for years, and in the SalmoGen case, the pieces came together in a way that moved us to invest and to also be a committed industry partner.”

SalmoGen said it is collaborating with some of the most experienced resources in the US and beyond in breeding programme development. US partners include resources from the US Department of Agriculture (USDA), the University of Maine, the University of Idaho, and the University of Maryland.

The Atlantic salmon strain being used is from Maine and has been sourced from the USDA's National Cold Water Marine Aquaculture Centre in Franklin, Maine. Breeding development in SalmoGen is emphasising performance in land-based systems, with both US and international markets in mind. First product in the market is scheduled for 2027.