Grieg reports lower harvests and profits for Q4

Grieg Seafood has reported a fall in profits for the fourth quarter of 2017 as a result of lower market prices and reduced harvested volumes.

Grieg Seafood Group harvested 18,667 tonnes of salmon in Q4 2017, an 11% drop on the 20,917 tonnes harvested in Q4 2016.

"The harvest volume is lower than expected mainly as a result of the transfer of 3,000 tonnes to 2018," the company writes.

Grieg's total operating expenses also increased by NOK 0.50 per kg (£0.05), and its EBIT (operating profit) before biomass adjustments ended at NOK 151 million (£13.86m), down from NOK 456 million (£41.85m) in the same quarter of 2016.

EBIT / kg was NOK 8.1 (£0.74) in the quarter, down from NOK 21.8 per kg (£2.00) in Q4 2016.

Decline in salmon prices

Grieg's Q4 report shows that the average spot price (Nasdaq Salmon Index) for the period was NOK 49.42 per kilo, a decline of NOK 17.70 per kg from the same period in 2016.

The company points out that the decline in salmon prices must be seen in conjunction with an increased supply of salmon in the market.

"Lower market prices are expected to stimulate increased market activity, which will lead to higher demand throughout the year. This could positively affect salmon prices by 2018."

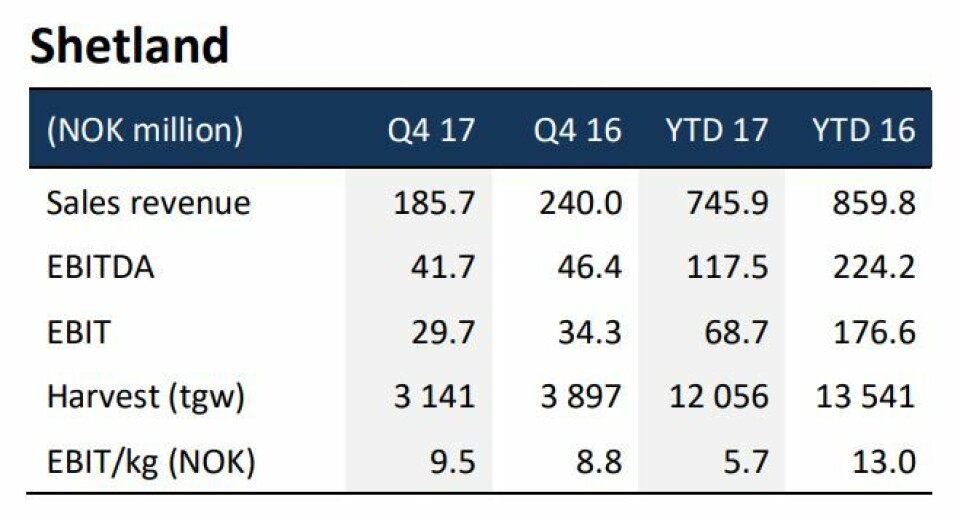

In Shetland, 3,141 tonnes were harvested in the fourth quarter, compared to 3,897 tonnes in the same quarter last year. Total sales revenues amounted to NOK 185.7 million (£17m), down from NOK 240m (£22m) in the fourth quarter of 2016.

Lice and algae

"Costs in Shetland remain high, mainly because of issues with lice and algae. Nevertheless, the cost level continued to decline during Q4, against the previous quarter. The cost per kg is, however, expected to increase because of low harvested volumes," Grieg writes.

"Sea production was relatively stable over the quarter. The company collaborates closely with other aquaculture companies in the region to solve any issues. Longer fallowing periods and other initiatives to suppress the number of lice, will be prioritised going forward."

EBIT before biomass adjustments was NOK 9.5 per kg (£0.87) for the quarter, up from NOK 8.8 per kg (£0.81) in Q4 2016.

Shetland is expected to harvest only 900 tonnes in the first quarter of this year, a fall of 32% on the corresponding period in 2016, but is forecast to then harvest 11,100 tonnes over the rest of 2018, a rise of 3%.

Early harvesting

In the Rogaland region of Norway, Grieg harvested 4,278 tonnes in Q4 compared with 5,766 tonnes in Q4 2016. Sales revenues amounted to NOK 219.9m, down from NOK 371m in the same period in 2016. Volumes were affected by early harvesting in the third quarter because of pancreas disease. Lice also remain a problem.

In the Finnmark region, Grieg harvested 8,626 tonnes in the quarter, compared to 9,336 tonnes in Q4 2016. Sales revenue amounted to NOK 422.3m, compared with NOK 580.9m in Q4 2016. The company points out that at the end of Q4 2016, ILA was detected at a location in Hammerfest. These fish were slaughtered in January 2017, which contributed to a 3,000-tonne reduction in ehe harvest volume in Q4 2017.

More fish from Canada

Grieg's operations in British Columbia, Canada, harvested 2,622 tonnes in the quarter, compared to 1,917 tonnes in Q4 2016. Operating revenues therefore increased to NOK 155.3m in the period, compared to NOK 119 million for the same quarter last year.

Grieg Seafood also has an overall goal of increasing production by at least 10% per year until 2020, while also having production costs that are on a par with, or lower than, the average for the industry. The company intends to harvest 80,000 tonnes in 2018, an increase of 28% on 2017.

More and bigger smolts

It is focusing on increased smolt capacity and larger smolt to increase capacity. As part of this, Grieg has entered into cooperation agreements with Norway Royal Salmon (NRS) and Bremnes Seashore for expansion of the companies' smolt capacity in Finnmark and Rogaland respectively.

In addition, Grieg is expanding its internal smolt plant in Norway with several separate lines, which spreads the biological risk associated with smolt production between several land facilities.

Despite the optimistic tone of Grieg's report, Nordea Bank market analyst Kolbjørn Giskeødegård writes: "All in all a fairly weak report and in a neutral market, we should we expect a negative share price reaction from start today."