Bluefront makes biggest-ever investment to buy milt freezing firm

Seafood investor Bluefront Equity is buying an 80% stake in Cryogenetics, which freezes salmon milt for Norwegian and international fish egg producers, fish farming companies, and administrative bodies.

The cost of the deal has not been disclosed but Bluefront partner and chief investment officer Simen Landmark said it was the company’s largest investment ever.

Bluefront partner and chief executive Kjetil Haga said: “Cryopreservation is an important support tool for breeding fish with the right characteristics. A sophisticated breeding process enables even better fish welfare and health. This is exactly what Cryogenetics helps the fish farming industry to achieve.”

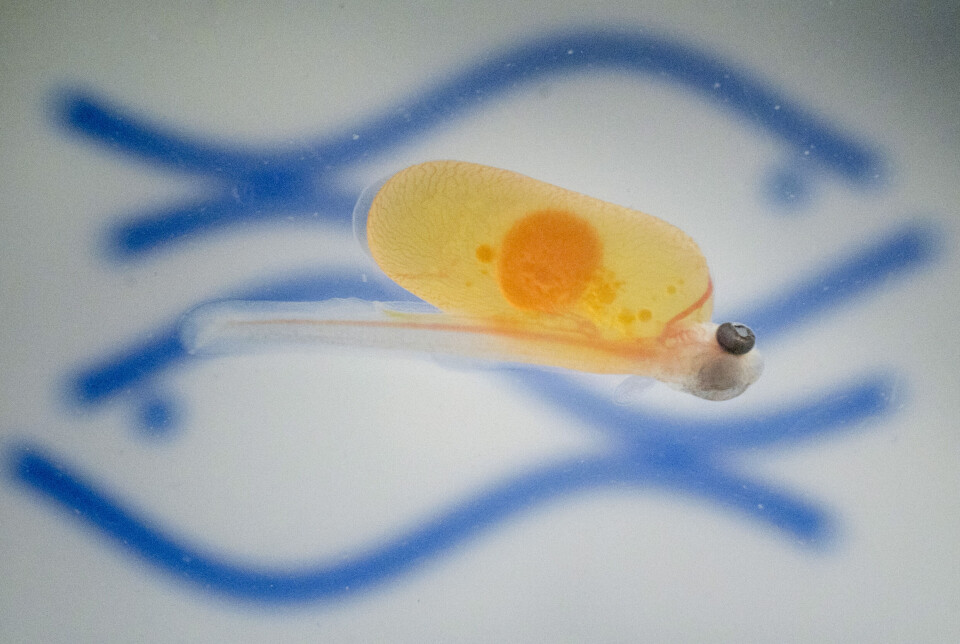

Cryogenetics, headquartered in Hamar, Norway, was established in 2002 through a research cooperation between the leading players in genetics and livestock breeding, including today’s largest shareholder - Geno - with its experience from development and sale of frozen bovine semen. Cryogenetics has since developed technology and methods that support advanced fish breeding through cryopreservation of salmon milt and milt from other species. Freezing and storing fish milt enables it to be kept for use when the female fish is mature.

Optimal quality

“Freezing of salmon milt allows us to combine different year classes, optimise genetics and secure optimal milt quality year-round. Further, cryopreservation enables the development of advanced product design for salmon egg producers and the ability to safeguard valuable genetics in case of loss of the broodstock. We have grown substantially in recent years and look forward to our next growth chapter with support from Bluefront,” said Cryogenetics managing director Eli Sætersmoen.

The company has established preservation laboratories in fish farming nations such as Norway, Canada, the United States, and Chile, and has 18 employees.

Salmon farming is Cryogenetics’ largest market today, but there is plenty of room for growth. Even in an industry keen to improve biological results, only 20% of farmed fish derives from frozen milt. The corresponding figure for the livestock industry is more than 90%.

“We believe that advanced breeding is one of the keys to improved animal welfare, growth and profitability for the fish farming industry. Cryopreservation is an essential support tool for advanced breeding, and we therefore envisage significant growth opportunities going forward, not only within the salmon business but also within farming of trout,” Sætersmoen said.

£3.9m turnover this year

Following completion of all transactions related to the acquisition, Bluefront will own approximately 80% of the shares in Cryogenetics. Another Norwegian investment company – Investinor - and Sætersmoen will own the remaining shares. Cryogenetics expects to deliver revenue of approximately NOK 55 million (£3.9m) in 2024, which is equal to a revenue growth of more than 20% compared to last year.

The transaction highlights a substantial value increase for co-owner Investinor, which first invested in Cryogenetics in 2012. Investinor will re-invest the majority of its proceeds and become shareholder together with Bluefront.

“Cryogenetics has demonstrated an impressive ability to innovate and have contributed towards revolutionising breeding processes for the aquaculture industry globally. Bluefront have ambitious and exciting plans for the company, and we look forward to continuing our partnership through this next growth phase,” said Investinor investment director Ronny Vikdal.

Otto Søberg, former chief executive of Export Credit Norway, becomes new chair of Cryogenetics. Alf-Helge Aarskog, the former chief executive of the world’s biggest salmon farmer, Mowi, and current industry advisor to Bluefront, also joins the board of directors along with Bluefront-partner Kjetil Haga.