Domestic production essential for Irish processors

The need to draw up a plan to help Ireland’s beleaguered salmon processing industry has caused one the country's key salmon farming representatives to launch an attack on the government policy.

Bord Iascaigh Mhara (BIM), the Seafood Development Agency, recently set up an industry forum in Portlaoise for 12 Irish seafood processors, who are suffering from the fact that the average import price of salmon has increased by 23% in the last year, while the average retail price increased by only 3%.

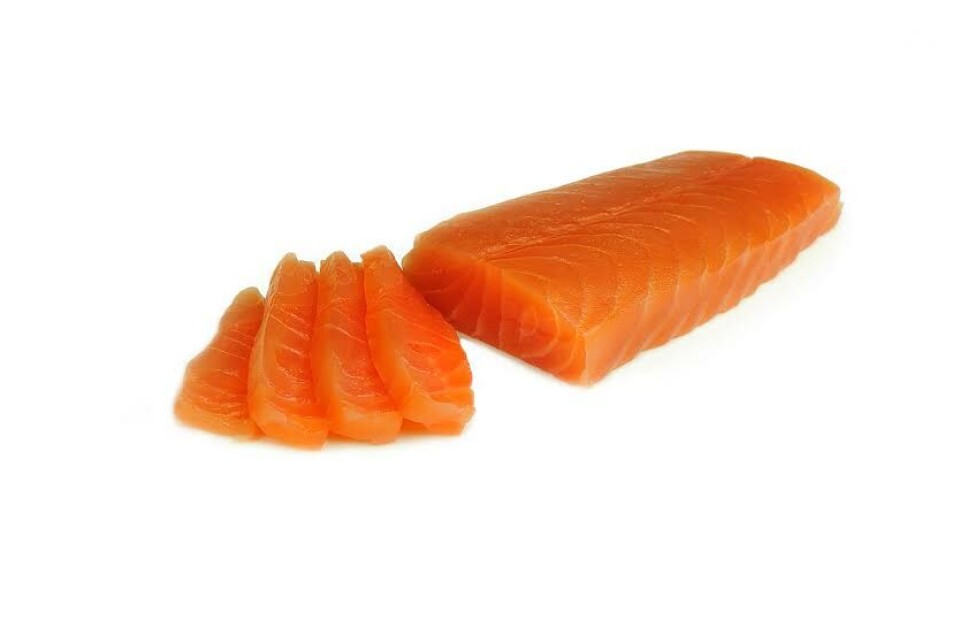

BIM’s Director of Business Development & Innovation Donal Buckley outlined the agency’s plans to assist the industry, saying: “This is the most sustained price increase our processing sector has faced to date. As demand for salmon continues to grow but global production reaches saturation, our processors are losing margin on what is our most popular and valuable product worth €92 million in domestic sales alone. As a result of discussions at this forum, we will establish a Domestic Seafood Council with seafood processors in order to find solutions and pool resources to mitigate the risk of trading in this sector. BIM will provide funding and supports to the Council in the areas of common research and business development.”

However, Richie Flynn, head of IFA Aquaculture, believes that BIM's plan should not be necessary, as Ireland has the resources to grow sufficient salmon to keep its processing industry content.

Although he sees the sense in the scheme, he is convinced that - with sufficient governmental support - the Irish aquaculture and processing sectors would both be thriving.

As he explained to Fish Farming Expert: “The inevitable has happened – having ignored the clear advice of IFA Aquaculture and all the signals from the market about the growing popularity and demand for Irish salmon, we have now arrived at a quite absurd situation in the Irish seafood industry. The same politicians and government officials who have deliberately held back the aquaculture industry to avoid upsetting a tiny vocal minority of wealthy private fishery owners and a handful of technocrats in the EU are now sanctioning an initiative by BIM to encourage farmed salmon imports into Ireland to keep our vital processing sector alive. It really would make you question the basic purpose and real agenda of the state when you have communities up and down the coast crying out for jobs and investment yet they cannot get licences for new salmon farm sites or upgrade their existing sites.”

At the forum BIM’s Richard Donnelly outlined trends in Irish salmon production and the outlook for future salmon supply; Cora Campbell from Irish research agency Kantar World Panel detailed the growing demand and consumer desire for salmon in the Irish retail market and the potential to grow this market further; Jan Erik Øksenvåg from International research agency Kontali gave a detailed insight into global salmon production trends, with forecasts for short and longer term supply and the effects this may have for the Irish Seafood Sector; finally, Brendan O’Donovan from AIB explained how seafood companies can look at currency hedging as an insurance policy to minimise risk.

A number of high level discussions followed on the key areas and possible solutions relevant to the current market including: options to increase raw material supply from Ireland; developing more efficient costing models for processing and sales of salmon and the potential for group purchasing logistics to drive efficiencies.

BIM says it will work closely with the processing sector in the weeks ahead to establish and drive the Domestic Seafood Council and provide financial and advisory supports.