Benchmark operating loss increases during Ectosan 'transition period'

But company's two largest business areas have performed well, says chief executive

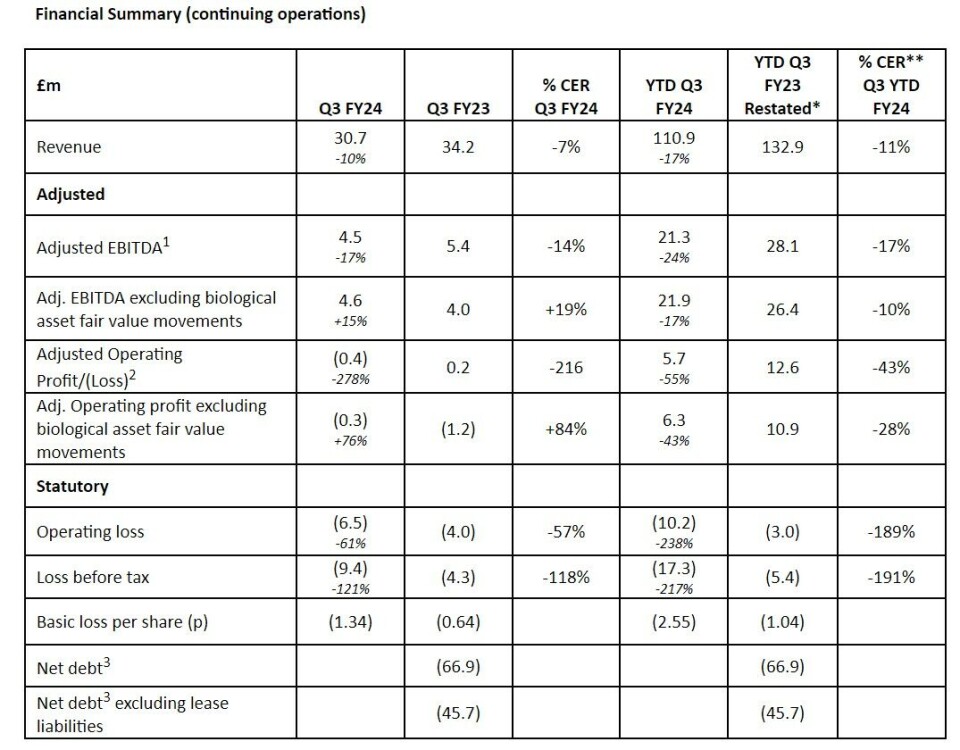

Aquaculture biotechnology group Benchmark Holdings has reported lower revenue and an increased operating loss for the third quarter (Q3 FY24) of its financial year, which runs from October to September.

Revenue for the UK registered company was £30.7 million in the quarter, 10% below the same period last year, or -7% constant exchange rate (CER) which takes into account the cost of exchanging revenue earned in NOK into sterling.

Benchmark’s operating loss in Q3 was £6.5m, up from a £4m loss in Q3 FY23.

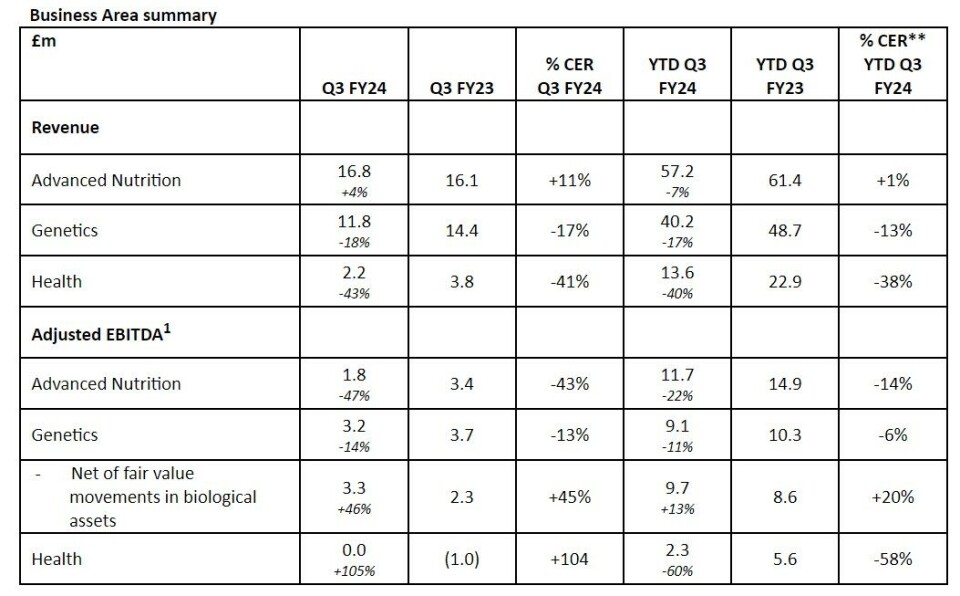

“This resulted from revenue growth in Advanced Nutrition of 4% (+11% CER) offset by 18% lower revenues in Genetics (-17% CER) and a 43% drop in Health revenues (-41% CER) following the decommissioning of the CleanTreat units,” said Benchmark in its Q3 FY24 report.

Low financial exposure

CleanTreat is a filtration system used in conjunction with Benchmark’s salmon lice bath treatment, Ecotsan Vet (imidacloprid), which must be used in a closed system. Benchmark operated two CleanTreat systems housed on repurposed platform supply vessels (PSVs) that moored next to wellboats using Ectosan Vet, but the PSVs proved too expensive to continue using.

“We have retained the capabilities to deploy Ectosan Vet and CleanTreat on to customer infrastructure, be it a barge or integrated wellboat solution, both of which we are able to support, but now with very low financial exposure. Ectosan Vet and CleanTreat remains a compelling solution to the sea lice pressure experienced in the industry,” the company wrote.

Benchmark said the drop in Genetics revenue was due to a shift from direct egg sales to indirect sales through the company’s joint venture in Norway, Salmar Genetics, “as well as a difference in the timing of harvest income against the prior year and lower ancillary revenues”.

Joint venture

Salmar Genetics was formed in 2017 and is a 50/50 joint venture between Benchmark and salmon farming heavyweight SalMar to provide genetics, health and knowledge services connected with the Rauma strain owned by SalMar. Benchmark can sell surplus eggs from this programme to external customers of the company.

Adjusted EBITDA in Genetics (not including adjustment for fair value movements in biological assets) was up 46%, reflecting progress across all growth vectors - Chile, shrimp and genetic services - and higher JV profits, said Benchmark.

Group revenue for the first three quarters of FY24 was £110.9m, 17% below the prior year (-11% CER) due to the same reasons that revenue was lower in Q3. Operating loss was £10.2m, up from a loss of £3m in the first nine months of FY23.

Progress in Chile

Chief executive Trond Williksen said: “Our two largest business areas, Advanced Nutrition and Genetics, performed well in Q3. In Genetics, it is particularly pleasing to see continued progress in our Chilean business as well as the positive results of the recent reorganisation of our shrimp genetics activities. Our Advanced Nutrition business remains resilient to the continuing soft conditions in the shrimp markets and is well positioned for market recovery.

“Having streamlined our Health business, rightsizing it to focus on Salmosan Vet (azamethiphos) during the transition period to a new business model for Ectosan Vet and CleanTreat, we now have a profitable business which maintains its capability to deliver Ectosan Vet and CleanTreat.”