Salmon stands apart as other UK food exports to EU fall

Scottish salmon has bucked the trend of falling UK food exports to the European Union, according to figures from the Food and Drink Federation (FDF).

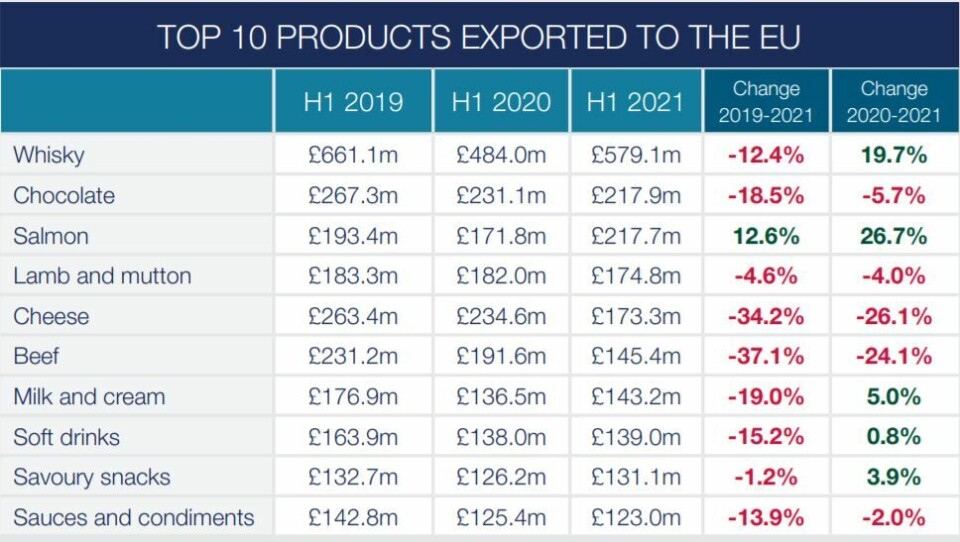

The value of salmon exported to the EU in the first half of this year was £217.7 million, an increase of 26.7% compared to the same period last year, whereas year-on-year revenues for chocolate, lamb and mutton, cheese and beef fell by 5.7%, 4%, 26.1% and 24.1% respectively.

The value of Scottish salmon exports worldwide, including the EU, increased by 17.4% to £355.9m compared to H1 2020, although this remained lower than the £394.3m made before Covid in the first half of 2019.

Whisky and chocolate

Salmon remained the second most valuable UK food and drink export in H1 this year, behind perennial table-topper whisky (£2 billion).

It was the third most valuable export to the EU, behind whisky (£579.1m) and chocolate (£217.9m), which hung on to second spot despite the value of exports to Europe dropping by 5.7% compared to H1 2020.

The FDF’s figures differ from those published last month by Her Majesty’s Customs and Revenue, which valued H1 2021 salmon exports to the EU at £183.4m and total salmon exports at £303m.

£2bn drop

According to the FDF this week, sales of UK food and drink to non-EU countries were up 13%, accounting for 46.6% (£4.3bn) of all UK food and drink exports, but overall sales were down £2bn compared to pre-Covid levels, because of a sharp drop in sales to the EU.

Exports to nearly all EU member states fell significantly, including a loss of more than £0.5bn in sales to Ireland, while sales to Germany, Spain and Italy were each down around a half since H1 2019.

Dominic Goudie, head of international trade at the FDF, said: “The return to growth in exports to non-EU markets is welcome news, but it doesn’t make up for the disastrous loss of £2bn in sales to the EU. It clearly demonstrates the serious difficulties manufacturers in our industry continue to face and the urgent need for additional specialist support.

Labour shortages

“At the same time, we are seeing labour shortages across the UK’s farm-to-fork food and drink supply chain, resulting in empty spaces on UK shop shelves, disruptions to deliveries and decreased production. Unless steps are taken to address these issues, the ability of businesses to fulfil vital export orders will be impacted.”

John Whitehead, of the Food & Drink Exporters Association (FDEA), said it was pleasing to see growth in sales to non-EU countries.

“However, this in no way replaces the loss of £2.2 billion sales to the EU since 2019,” added Whitehead. “There is growing evidence that the complexity of trading with the EU has led to businesses moving operations into Europe and of importers looking for alternative suppliers, contributing to the ongoing decline in both UK exports and UK jobs.”

Read the complete FDF Trade Snapshot here.