Bakkafrost reaches for last portion of Scottish Salmon

The Scottish Salmon Company’s new majority owner, Bakkafrost, expects to make a mandatory offer for the shares of other investors by the end of this week.

Bakkafrost, the Faroe Islands’ biggest salmon farmer, bought a 68.6% stake in SSC from Northern Link in September and has since increased its shareholding to 80.77%.

Yesterday it submitted a draft mandatory offer document relating to SSC to the Oslo Stock Exchange for approval, which it expects to receive this week. It will then make its mandatory offer to buy the 19.23% of SSC shares that it doesn’t own.

Delist SSC

This will be followed by a compulsory offer for the last 10% of the shares in case more than 90% ownership is reached by the mandatory offer.

Bakkafrost intends to delist SSC from the Oslo Stock Exchange if 100% ownership of the company is obtained.

In a note in its third quarter report today, Bakkafrost reiterated its strategic rationale for buying SSC. This includes providing Bakkafrost with access to the Scottish farming region and “potential for material improvement in SSC’s profitability over a five-year horizon through realisation of identified synergies, transfer of best practices and a targeted investment programme”.

It said synergies include a leaner head office structure in Scotland through discontinuing the listed functions of SSC.

Consolidation of sites

“Bakkafrost also believes that there is the potential for transfer of best practices including (i) secondments to stimulate identification and transfer of best practices, (ii) implementation of better farming procedures for improved cost performance, (iii) gradual consolidation of sites, (iv) mitigation of biological threats through delousing expertise,” said the company. “The overall result of these actions is expected to result in larger fish improving price achievement and profitability.

“Bakkafrost also plans to make targeted investments to achieve the efficiencies outlined above. These include investment in a new modern recirculation plant for smolt production replacing SSC’s large number of small smolt facilities. Additionally, investments are planned to be directed towards replacing SSC’s existing seawater equipment.

“Bakkafrost is committed to strong cooperation with local communities and authorities and hopes to stimulate employment through significant investment in the business. Additionally, Bakkafrost is committed to ongoing work to strengthen the Scottish regulatory framework.”

50,000 tonnes

SSC produced 29,913 tonnes gutted weight of salmon in 2018, and according to Bakkafrost it has a production capacity of 50,000 tgw, although it has consent for even more.

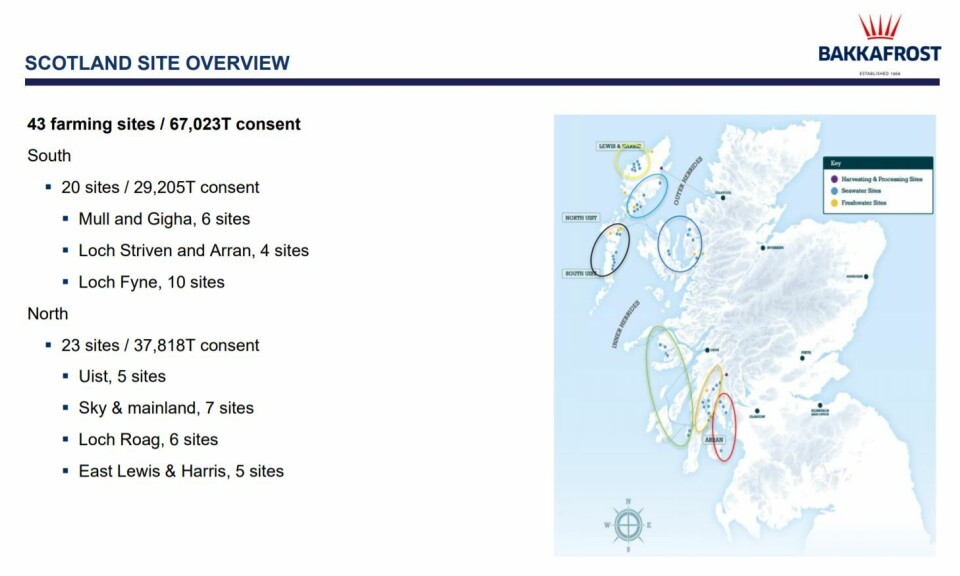

In its presentation of its Q3 report today, Bakkafrost said SSC’s 43 sites have consent for 67,023 tonnes – 29,205 tonnes split among 20 sites in the south at Mull and Gigha (six sites), Loch Striven and Arran (four) and Loch Fyne (10), and 37,818 tonnes at 23 sites in the north, at Uist (five), Skye and mainland (seven), Loch Roag (six) and East Lewis and Harris (five).

Bakkafrost has also listed what it believes the assets and liabilities of SSC are worth in relation to what it is paying for the company, although it points out that the figures provided are subject to further scrutiny and may change as it becomes able to gain access to sufficient information from SSC. If Bakkafrost buys 100% of SSC, the deal will have cost Bakkafrost DDK 4,081.5 million (£470 million), according to its numbers.

Its figures show a significant increase in the value of SSC’s farm licences from a book value of DKK 233m to a fair value-adjusted figure of DKK 2,980m. It said an impairment test performed by SSC as of December 2018 had shown a “significant headroom” on farming licences of £1.2 billion.

Bakkafrost’s assessment of assets and liabilities for SCC is shown below.