Salmon tax may double for Faroes farmers

Government proposes rise in spot price-linked rate from 5% to 10%

Salmon farmers in the Faroe Islands are facing increased revenue taxes of up to 10%, the country’s biggest fish farmer, Bakkafrost, said today.

The Faroese Government has officially presented to the Parliament a proposal to adjust the Faroese revenue tax on the salmon farming industry, Bakkafrost said in a press release.

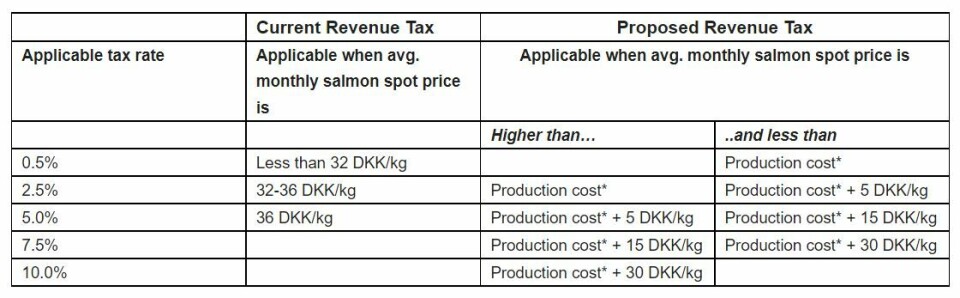

This proposal includes three changes to the current revenue tax system, originally introduced in 2014:

- Changing the number of applicable tax rates from three to five

- Increasing the salmon price thresholds that determine when each tax rate is applicable

- Linking the salmon price threshold to the average production cost for the Faroese salmon industry, which will be assessed annually.

For 2023, the proposed change means that the revenue tax rates, which are currently pegged at 5%, would be:

- 0.5% if the salmon spot price is less than 39.15 DKK/kg (approximately 55 NOK/kg)

- 2.5% if the salmon spot price is between 39.15 and 44.15 DKK/kg (55-62 NOK/kg)

- 5% if the salmon price is between 44.15 and 54.15 DKK/kg (62-76 NOK/kg)

- 7.5% if the salmon price is between 54.15 and 69.15 DKK/kg (76-97 NOK/kg)

- 10% if the salmon price is above 69.15 DKK/kg (97 NOK/kg)

Bakkafrost pointed out that the changes have not yet been passed by the Parliament.

Bakkafrost made operating revenue of DKK 3.323 billion in the Faroes and Scotland in the first half of this year, including DKK 2.338 bn from its Faroese salmon farming operation. It is investing heavily in its Scottish operations which it acquired when it bought the Scottish Salmon Company in late 2019.

Two other companies farm salmon in the Faroes: Hiddenfjord and Mowi Faroes.