Russian ban and flat spot prices hit Bakkafrost in Q4

Faroese salmon farmer Bakkafrost has reported a fall in sales revenue, operational EBIT and EBIT per kilo in the last quarter of 2018, compared to the same period in 2017. Full-year figures were also lower than in 2017.

Chief executive Regin Jacobsen blamed difficult market conditions and a period of limited market access for the weaker-than-expected results and said the outlook for 2019 was better.

In Q4 2018 Bakkafrost had a turnover of DKK 750 million (£88m), compared to DKK 906m in Q4 2017, while the full year ended at DKK 3,177m (DKK 3,770m).

Larger harvest

Operational EBIT per kg in Q4 2018 was DKK 16.98 (DKK 23.14).

The total harvest volume in Q4 2018 was higher than in Q4 2017 at 12,234 tonnes gutted weight (11,470 tgw), but the volume for 2018 was much lower year-on-year at 44,591 tgw (54,615 tgw).

Bakkafrost moved 1,500 tonnes of harvest to 2019 and has consequently increased the expected volume for 2019 to 54,500 tgw.

The Bakkafrost group, which also runs fishmeal, oil and feed operation Havsbrun, made a loss for Q4 2018 of DKK 6.6m (DKK -21.9m) but for 2018 the profit was DKK 960.3m (DKK 511.4m).

Temporarily vulnerable

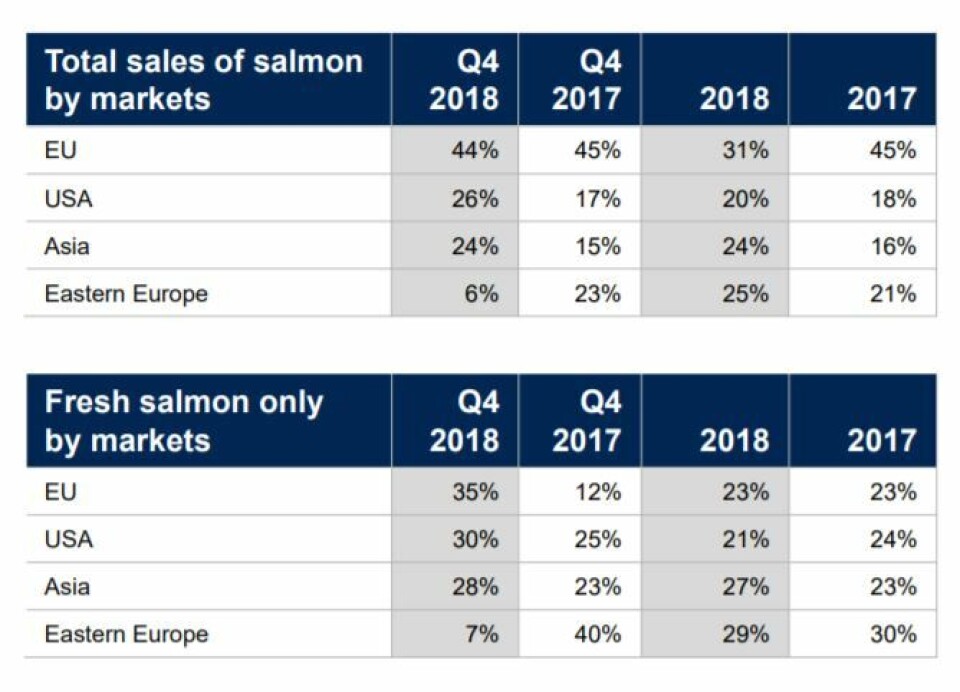

In a statement today, Bakkafrost said revenue in the farming segment for Q4 2018 was negatively affected by a combination of various circumstances, including flat spot prices.

“As the market strategy for sales in 2018 was primarily focused on fresh whole salmon to the high-end spot market, volumes to the VAP segment were exceptionally low throughout 2018. Consequently, Bakkafrost was temporarily vulnerable and limited in flexibility to mitigate the following disruptions: Bakkafrost’s harvesting plant in Glyvrar was banned access to the Russian market in Q4 2018 and had a disruption in delivery to other high-end markets from the new harvest plant in Suðuroy, due to delay in issuance of certificates to these markets.

“The market disruptions are more or less solved as volumes to VAP contracts now have increased, the certificates to the harvest factory in Suðuroy are in place and access to the Russian market is expected shortly.”

‘Eventful year’

Jacobsen said: “2018 was an eventful year with different challenges, but all things considered we are satisfied with the operation and the results for 2018. A lot of effort has also been put on our expansion activities in 2018, and we have now started operation in our new harvesting plant in Suðuroy. In 2019, we plan to further expand our farming operation in Suðuroy.”

Bakkafrost expects to release 13.5 million smolts this year, compared with 12.5 million smolts in 2018 and 9.9 million smolts in 2017.