Faroese government confirms tax hike for salmon farmers

Salmon farmers in the Faroes face a financial hit after the country’s parliament voted to increase the top rate of a revenue tax on the sector from 5% to 20%.

The increase follows elections for the Faroese parliament, the Løgting, in October last year, which gave Prime Minister Mette Frederiksen a left-wing majority. The opposition had also proposed raising the maximum rate, but to only 10%.

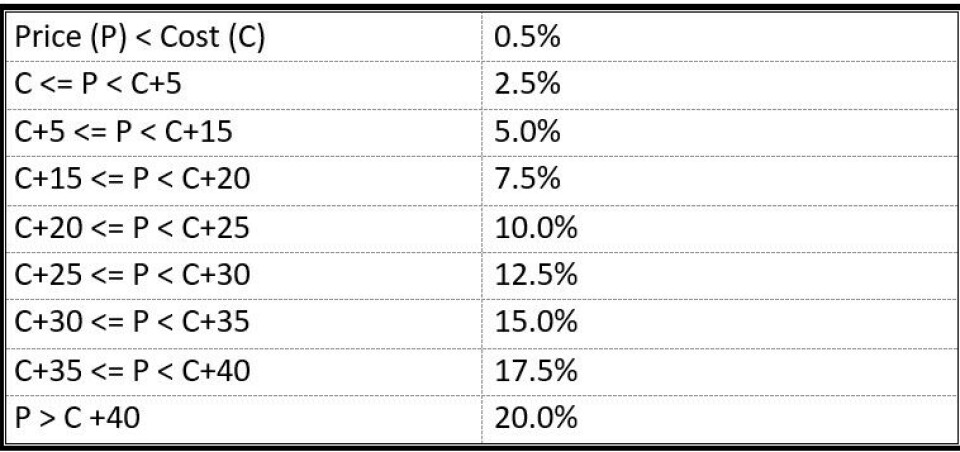

The tax continues to follow the principle that different rates should be applied dependent on the difference between the monthly FishPool Index prices (spot prices) and the average production cost for the Faroese salmon industry which will be assessed twice a year.

The current revenue tax has three different rates, topping out at 5%, but from 1 August, when the revised tax system comes into force, there will be nine rates ranging from 0.5% to 20%.

When the tax was proposed in March the Faroes’ biggest salmon, Bakkafrost, said the 2021 average Faroes production cost of DKK 39.15 (around NOK 59 per kg) was proposed as a baseline for the tax calculation.

“Hence, a FishPool Index price exceeding around 119 NOK/kg would result in the maximum tax rate of 20%,” Bakkafrost said in March.

The new tax regime not only adds six higher tax bands – 7.5%, 10%, 12.5%, 15%, 17.5%, and 20% - but also lowers the threshold for higher taxation. Farmers will pay 0.5% revenue tax even if the FishPool price is less than the cost of production.

If the price is between DKK 0 and DKK 5 per kilo more than the production cost, the tax rate will be 2.5%. For every DKK 10 increase in the gap between the production cost and price, the tax will rise by 2.5%. Once the price is more than DKK 40 per kilo above the production cost, the tax will be pegged at 20%.

According to Norwegian salmon industry statistics provider, Akvafakta, the average spot price for the first 18 weeks of this year is NOK 107.15/kg, which is approximately DKK 68 at current exchange rates.

If a production cost of DKK 39.15 was deducted from that price, Faroese farmers would be assumed to be making an operating profit of DDK 28.85 per kilo, which would attract a tax rate of 12.5% (see panel).

The three salmon farmers in the Faroes are Bakkafrost, Hiddenfjord, and Mowi Faroes.