Bakkafrost Scotland harvested more and reduced financial losses in Q3

Focusing production on first half of year is paying off, says group chief executive after cost of die-offs falls by 81%

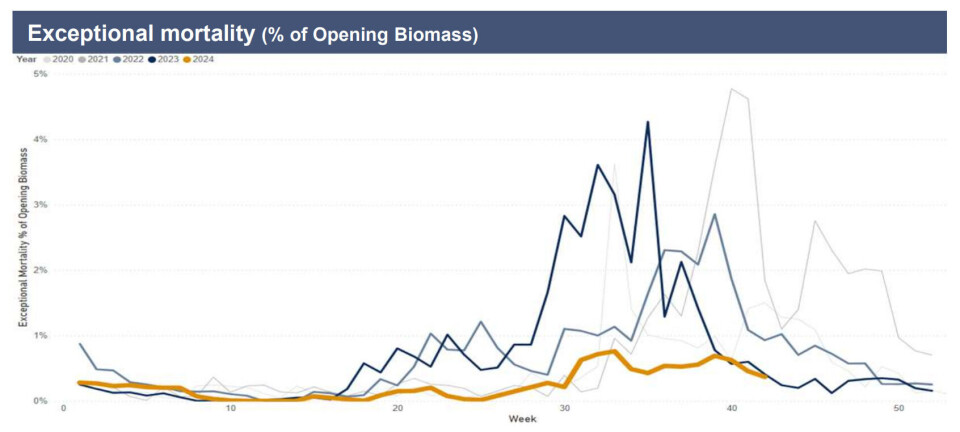

Salmon farmer Bakkafrost Scotland harvested a greater volume in the third quarter of this year than it did in the same period last year, and costs for exceptional mortality were reduced by 81% to DKK 34 million (£3.8m) from DKK 178m (£20m) in Q3 2023.

Bakkafrost harvested 5,411 gutted weight tonnes in Scotland, up by 32% from the 4,100 gwt harvested in Q3 2023.

The Scotland division’s freshwater and seawater farming units made operating losses of DKK -5.7m and DKK -179m respectively, but the seawater unit’s loss was 36% lower than in the same period the year before, when Bakkafrost Scotland made an operating loss of DKK -281m.

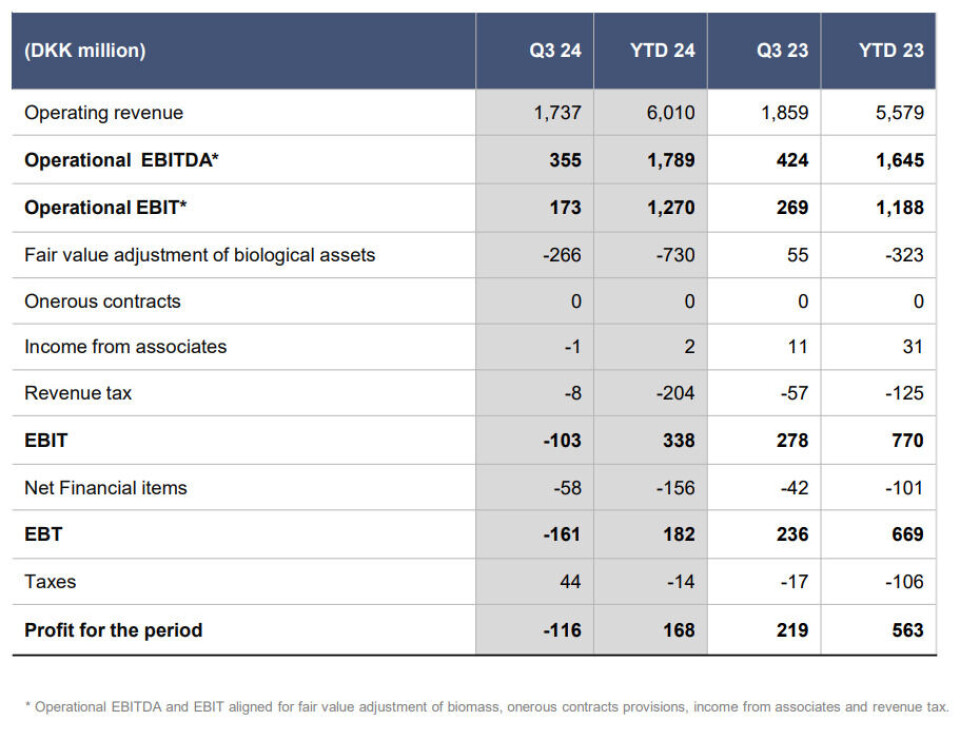

Bakkafrost’s farming unit in the Faroe Islands also made an operating loss, of DKK -28.4m, having made an operating profit of DKK 108m in the same period last year.

Overall, Bakkafrost Group – which includes feed and services units - delivered an operating profit of DKK 173m in Q3, down from DKK 269m in Q3 2024.

"We are not satisfied with our financial results this quarter, primarily impacted by low salmon prices,” said chief executive Regin Jacobsen. “The strike (in the Faroes) in May combined with unplanned harvest of A-19 (also in the Faroes) impacted negatively our ability to adapt to market needs to optimise market value for our products. The early harvest of remaining fish from farming site A-19, where the ISA (infectious salmon anaemia) virus was detected in two pens back in May had a negative financial impact. We are, however, very pleased with the effective response and our strong procedures, which successfully contained the virus. This challenge is now behind us, allowing us to focus forward.”

Jacobsen said Bakkafrost had seen very good biological performance in the Faroes, evident in strong growth, low mortality, and increased harvest weights. “Our hatcheries have also delivered excellent operational results, enabling us to increase our smolt transfer expectations for this year, with further increases planned for next year.”

De-risking Scotland

The CEO said Bakkafrost Scotland’s de-risking strategy of harvesting around 75% of the year’s volume in the first six months, to avoid biological challenges that occur in late summer, had worked.

“Exceptional mortalities have reduced by more than 80% compared to last year, harvest weights have increased, and sea lice levels are all-time low — just like in the Faroes. We are making steady progress in ramping up production at the Applecross hatchery to produce large high-quality smolt and expect start transfer of 200g smolt in Q4. Hereafter, we expect to only transfer high-quality smolt above 200g.”

Jacobsen said Bakkafrost was prioritising cost management and aligning its capacity with operational needs. Cost-saving measures and capacity adjustments in Scotland include the closure of the processing facility at Marybank, Stornoway, in July 2024. The full effects of these measures were not visible in Q3, he said.

Higher prices in 2025

“The salmon market has been weaker in this quarter with low salmon prices throughout the quarter, but we look forward to a more favourable price environment – especially in H1 2025, where the supply will be weaker of high-quality salmon. Our expected harvest next year is 100,000 tonnes, of which we plan to allocate around 15% for VAP contracts,” concluded Jacobsen.

Bakkafrost expects to harvest a total of 89,600 gwt (63,500 tonnes in the Faroe Islands and 26,100 tonnes in Scotland) this year. All of the extra volume next year will come from the Faroes, where Bakkafrost expects to harvest 77,000 gwt. The company expects 23,000 gwt from Scotland.