Atlantic Sapphire seeks to raise another £10.3m

Land-based salmon farmer Atlantic Sapphire plans to raise NOK 140 million (£10.34m) by issuing 100 million new shares.

The shares are a Subsequent Offering that follows a private placement of new shares in September which netted the company NOK 702m. The subsequent offering will be directed at existing shareholders who missed out on the September placement.

The shares will be offered at NOK 1.40 each, which is the same price as the shares placed in September.

The subscription period in the Subsequent Offering commenced today at 09:00 CEST and will close on Friday next week (November 3) at 16:30 CET.

Allocation of the Offer Shares is expected to take place on 6 November 2023.

Temperature increases

Atlantic Sapphire, which operates a recirculating aquaculture system (RAS) facility in Maimi-Dade County, Florida, has an annual production capacity of approximately 9,500 gutted weight tonnes of Atlantic salmon in the first phase of its development but has not yet achieved that volume due to successive, separate problems.

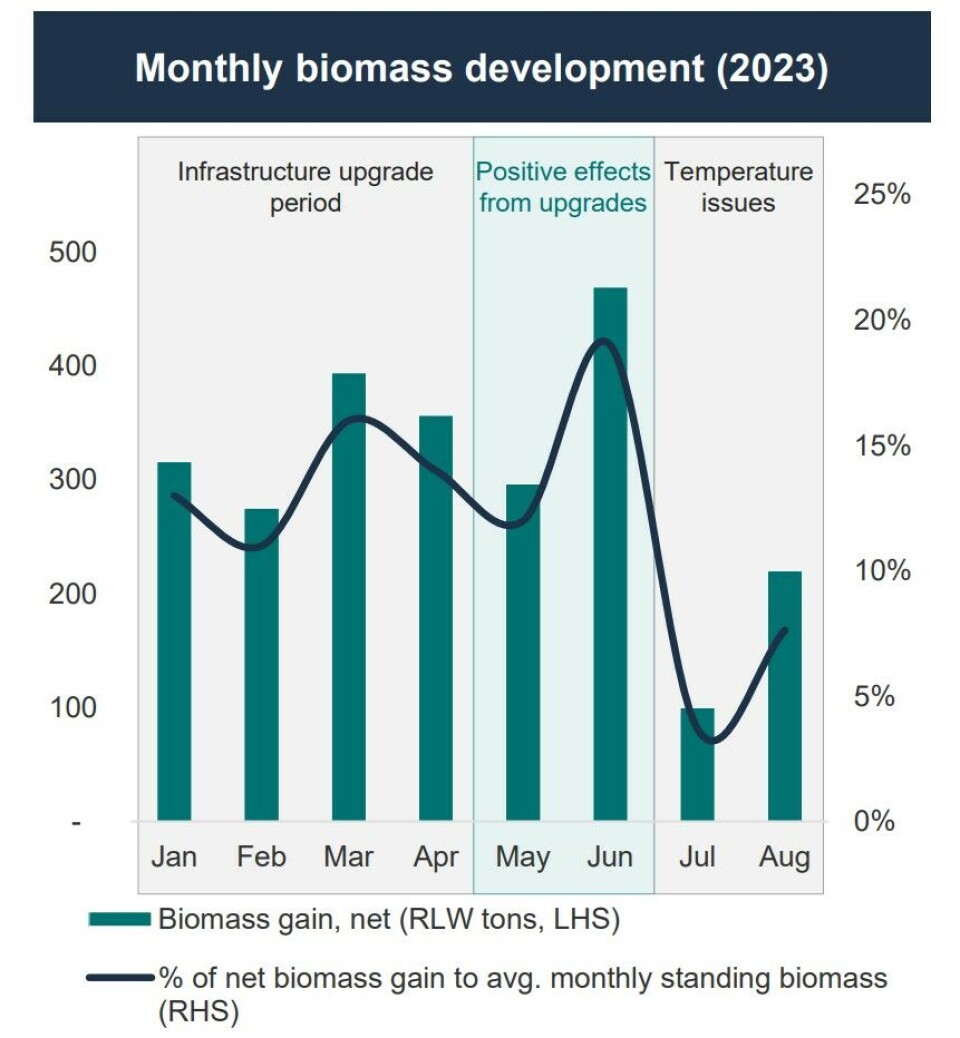

The most recent issue was higher-than-anticipated downtime for maintenance and repairs of rented chillers that resulted in water temperature increases that impacted production.

That problem has been resolved but the knock-on effect is that Atlantic Sapphire was expecting a harvest volume of just 400 gwt in Q3, and between 1,000 and 2,000 gwt for the second half of 2023.